ORMAL BALANCE OF A LIABILITY IS A DEBIT/CREDIT THE NORMAL BALANCE OF AN INCOME ACCOUNT IS A DEBIT/CREDIT THE NORMAL BALANCE OF AN EXPENSE ACCOUNT IS DEBIT CREDIT 5 THE FOLLOWING OCCURRED DURING DEC 2014 INVESTED $20,000 TO START UP COMPANY VPAID RENT TO REALTY CO IN AMOUNT OF $5,000 PURCHASED OFFICE FURNITURE FROM FURN CO ON ACCOUNT FOR $30,000 VPERFORMED CONSULTING SERVICES FOR $200,000 V CASH RECEIPTS FROM CUSTOMER $100,000 op CASH DISBURSEMENT TO VENDORS FOR $20,000 Cash PAID WAGES IN AMOUNT OF $20,000 FROM THE ABOVE INFORMATION LISTED ABOVE PREPARE: A TRIAL BALANCE, AN INCOME STATEMENT, AND A BALANCE SHEET, AND A STATEMENT OF CASH FLOW AT DEC 31, 2014 ALSO PREPARE A TRIAL BALANCE AT JAN 1, 2015

ORMAL BALANCE OF A LIABILITY IS A DEBIT/CREDIT THE NORMAL BALANCE OF AN INCOME ACCOUNT IS A DEBIT/CREDIT THE NORMAL BALANCE OF AN EXPENSE ACCOUNT IS DEBIT CREDIT 5 THE FOLLOWING OCCURRED DURING DEC 2014 INVESTED $20,000 TO START UP COMPANY VPAID RENT TO REALTY CO IN AMOUNT OF $5,000 PURCHASED OFFICE FURNITURE FROM FURN CO ON ACCOUNT FOR $30,000 VPERFORMED CONSULTING SERVICES FOR $200,000 V CASH RECEIPTS FROM CUSTOMER $100,000 op CASH DISBURSEMENT TO VENDORS FOR $20,000 Cash PAID WAGES IN AMOUNT OF $20,000 FROM THE ABOVE INFORMATION LISTED ABOVE PREPARE: A TRIAL BALANCE, AN INCOME STATEMENT, AND A BALANCE SHEET, AND A STATEMENT OF CASH FLOW AT DEC 31, 2014 ALSO PREPARE A TRIAL BALANCE AT JAN 1, 2015

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PA: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

Hello can some please solve number 5 for me please.

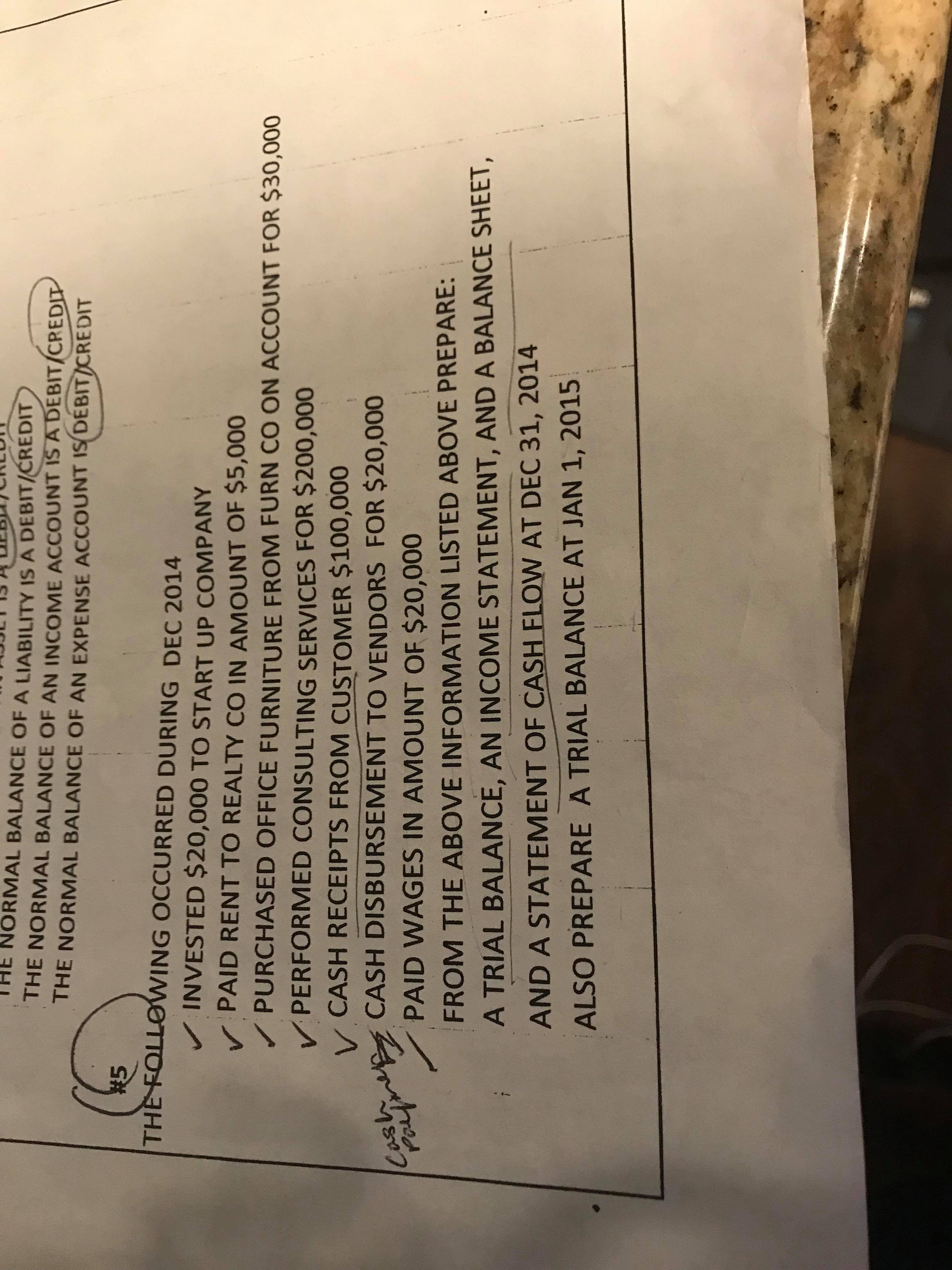

Transcribed Image Text:ORMAL BALANCE OF A LIABILITY IS A DEBIT/CREDIT

THE NORMAL BALANCE OF AN INCOME ACCOUNT IS A DEBIT/CREDIT

THE NORMAL BALANCE OF AN EXPENSE ACCOUNT IS DEBIT CREDIT

5

THE FOLLOWING OCCURRED DURING DEC 2014

INVESTED $20,000 TO START UP COMPANY

VPAID RENT TO REALTY CO IN AMOUNT OF $5,000

PURCHASED OFFICE FURNITURE FROM FURN CO ON ACCOUNT FOR $30,000

VPERFORMED CONSULTING SERVICES FOR $200,000

V CASH RECEIPTS FROM CUSTOMER $100,000

op CASH DISBURSEMENT TO VENDORS FOR $20,000

Cash

PAID WAGES IN AMOUNT OF $20,000

FROM THE ABOVE INFORMATION LISTED ABOVE PREPARE:

A TRIAL BALANCE, AN INCOME STATEMENT, AND A BALANCE SHEET,

AND A STATEMENT OF CASH FLOW AT DEC 31, 2014

ALSO PREPARE A TRIAL BALANCE AT JAN 1, 2015

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning