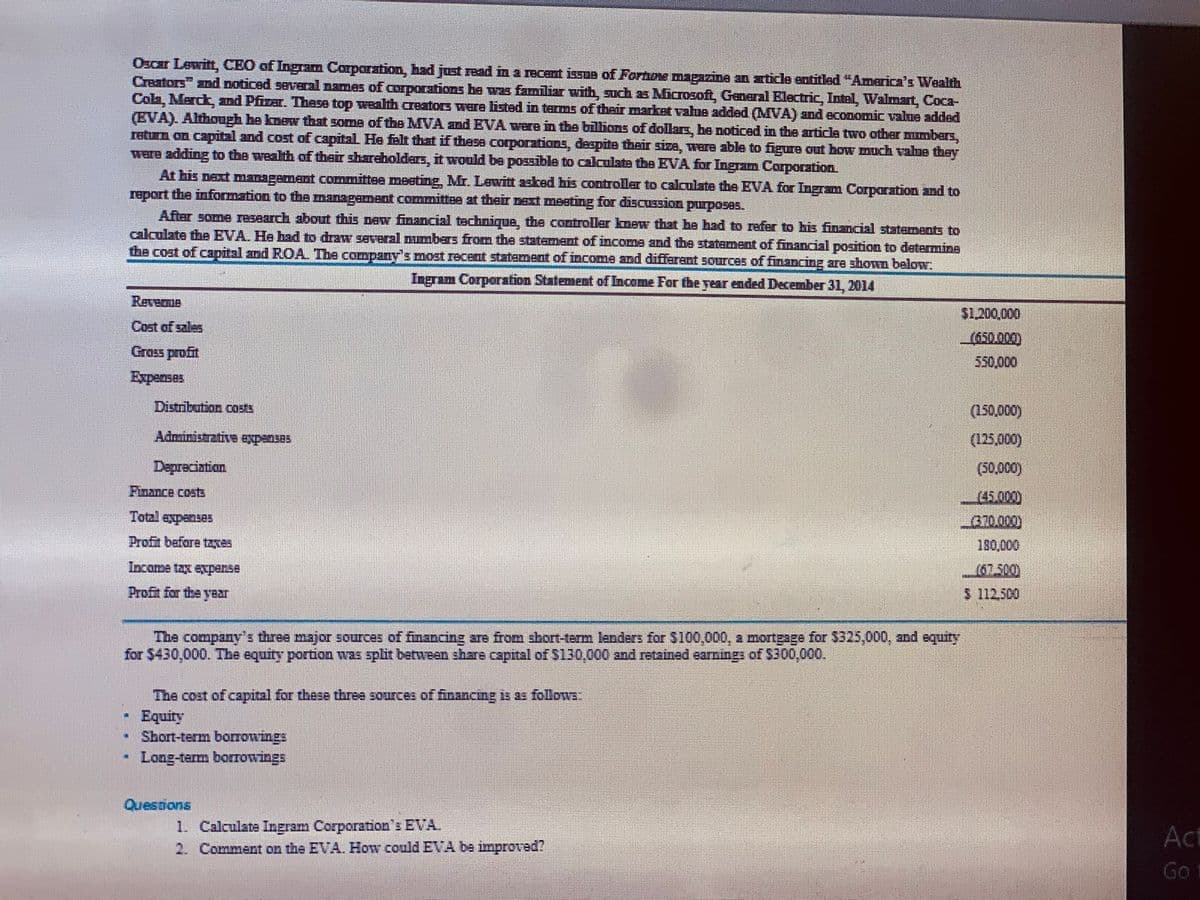

Oscar Lewitt, CEO of Ingram Carparation, had just read in a recent issue of Fortone magazine an aticle entitled "America's Wealth Creators" and noticed several names of corporations be was familiar with, such as Microsoft, General Electric, Intel, Walmart, Coca- Cola, Merck, znd Pfizar. These top wealth creators were listed in terms of their market value added (MVA) and economic value added (EVA). Although he knew that some of the MVA and EVA were in the billions of dollars, he noticed in the article two other mmbars, return on capital and cost of capital. He falt that if these corporations, despite thair size, were able to figure out how much vahne they ware adding to the wealth of their shareholders, it would be possible to calculate the EVA for Ingram Corporation. At his next management committee meeting, Mr. Lewitt asked his controller to calculate the EVA for Ingram Corparation and to report the information to the management committee at their next meeting for discussion purposes. After some research about this new financial technique, the controller knew that he had to refer to his financial statements to calculate the EVA. He had to draw several numbers from the statement of income and the statement of financial position to determine the cost of capital and ROA. The company's most recent statement of income and different sources of financing are shown below: Ingram Corporation Statement of Income For the year ended December 31, 2014

Oscar Lewitt, CEO of Ingram Carparation, had just read in a recent issue of Fortone magazine an aticle entitled "America's Wealth Creators" and noticed several names of corporations be was familiar with, such as Microsoft, General Electric, Intel, Walmart, Coca- Cola, Merck, znd Pfizar. These top wealth creators were listed in terms of their market value added (MVA) and economic value added (EVA). Although he knew that some of the MVA and EVA were in the billions of dollars, he noticed in the article two other mmbars, return on capital and cost of capital. He falt that if these corporations, despite thair size, were able to figure out how much vahne they ware adding to the wealth of their shareholders, it would be possible to calculate the EVA for Ingram Corporation. At his next management committee meeting, Mr. Lewitt asked his controller to calculate the EVA for Ingram Corparation and to report the information to the management committee at their next meeting for discussion purposes. After some research about this new financial technique, the controller knew that he had to refer to his financial statements to calculate the EVA. He had to draw several numbers from the statement of income and the statement of financial position to determine the cost of capital and ROA. The company's most recent statement of income and different sources of financing are shown below: Ingram Corporation Statement of Income For the year ended December 31, 2014

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter2: Descriptive Statistics

Section: Chapter Questions

Problem 25P: The scatter chart in the following figure was created using sample data for profits and market...

Related questions

Question

100%

Transcribed Image Text:Oscar Lewitt, CEO af Ingram Corporation, had just read in a recent issue of Fortone magazine an aticle entitled "America's Wealth

Creators" and noticed several names of corporations be was faniliar with, such as Nicrosoft, Ganeral Electric, Intal Walmart, Coca-

Cola, Marckt nd Pfizar, These top wealth aeators were listed in tems of their market vaue added (MVA) and economic value added

(EVA). Although be knew that some of the MVA and EVA were in the bilhons of dollars, he noticed in the article two other mumbers,

return on capital and cost of capital He falt that if these corporations, despite their siza, Wera able to figure out bow much valne they

ware adding to the wealth of thair shareholders, it would be possible to calculats the EVA for Ingram Corporation.

At his next management committee meeting, Mr. Lewitt asked his controllar to calculate the EVA for Ingram Corporation and to

report the information to the management committee at their naxt meating for discusBsion purposes.

After some research about this new financial technique, the controller knew that he had to refer to his financial statements to

calculate the EVA. Ha had to draw several numbers from the statement of income and the statement of financial position to determine

the cost of capital and ROA. The company's most receat statemeat of income and differant sources of financing are shown below.

Ingram Corporstion Statement of Income For the year ended December 31, 2014

Revegue

$1.200,000

Cost of sales

(650.000)

550,000

Grass profit

Experses

Distribution costs

(150,000)

Administrative expanses

(125,000)

Depreciation

(50,000)

Finance costE

(45.000)

Total expenses

370.000)

Profit before txges

Income tax expense

(67.500)

Proft for the year

$ 112.500

The company's three major sources of financing are from short-tarm landers for $100,000, a mortgage for $325,000, and equity

for 5430,000. The equity portion was split between share capital of 5130,000 and retained earnings of $300,000.

The cost of capital for these three sources offnancimg is as follows:

Equity

Short-term borrowings

Long-term borrowings

Questions

1. Calculate Ingram Corporation's EVA.

2. Comment on the EVA. How could EVA be improved?

Act

Go

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning