osh Ltd sold inventory to Edie Ltd for $: during the previou

Q: 2a) You have an account at Bank A. Your last balance statement, which you can see on your bank…

A: Beginning Balance = $520 Deposits = $3120 Withdrawals = $750 Bill Transfers = 2300 + 180 = $2480…

Q: The term strategic management accounting involves: Select one: O A. The identification, measurement…

A: The term strategic management accounting involves: (D) a and b above Strategic management accounting…

Q: On July 31, 2022, Sage Hill Company had a cash balance per books of $6,315. The statement from…

A:

Q: Preble Company manufactures one product manufacturing overhead is applied to production based on…

A: Flexible budget as name suggests is flexible and is prepared for the actual units and hence…

Q: The Office of the Auditor General is mandated to conduct audits of all public institutions in…

A: a. In order to fulfil its mandate and provide the Parish Council and the Jamaican government with…

Q: .Prepare a cash flow statement from the following data:…

A: Introduction: A cash flow statement is a statement that comprises the cash inflows and outflows of…

Q: Which of the following costs are NOT variable? Cost 2. 1. $100,000 $300,000 3. 10,000 Units 4.…

A: The correct answer is: (C) only 3 i.e the cost which remains the same at both 10,000 units and…

Q: Arkansas Corporation manufactures liquid chemicals A and B from a joint process. It allocates joint…

A: A split-off point is the moment in the manufacturing process at which goods that were previously…

Q: A fixed asset with a cost of $53,325 and accumulated depreciation of $45,326.25 is traded for a…

A: Fixed assets are those assets which are used by the entity for more than one year and expected to…

Q: On November 1, 2022, Nelson Corp. purchased land and a building for a combined cost of $2,000,000.…

A: Acqusition of Assets A corporation is acquired through an asset acquisition if its assets rather…

Q: X the column involved in the journal entry. Debit Cash Account You put $10,000 cash in your 1…

A: The question is related to Journal Entries in the Books of X. In Journal transactions are recorded…

Q: By investing in a particular stock, a person can make a profit in one year of $3900 with…

A: Solution: Expected gain from stock = (Amount of profit * Probability of gain) - (Amount of loss *…

Q: The equation which reflects a CVP income statement is a. Sales - Variable costs - Fixed costs = Net…

A: Introduction:- CVP analysis is used to identify the changes in costs and volume affect a company's…

Q: Grade of Walnuts Number 1 Number 2 Number 3 Total Sales $ 490, 500 381, 500 218,000 $ 1,090,000 The…

A: Joint costs are the costs that are incurred jointly on production of several products that are…

Q: Beginning inventory, purchases, and sales for an inventory item are as follows: Sept. 1 Beginning…

A: Ans. In last-in,first-out method of valuation of inventory, the inventory stock which is produced…

Q: Tully Sales uses a periodic inventory system with the weighted average method of cost assignment.…

A: Under the weighted average inventory method, total cost of goods purchased is divided by the total…

Q: Cullumber Manufacturing Company had a $300 credit balance in Allowance for Doubtful Accounts at…

A: Bad debts expense: Bad debts expense is recognized in the books of the company when a debtor is…

Q: Given the following data: Fixed overheads Selling price Variable cost per unit £40 000 Select one:…

A: Break-even units = Fixed overheads / Contribution margin per unit

Q: Year 2 and 3 for Fair Value at the end of the year are still incorrect and I do not understand why?

A: The AFS securities in the form of bonds and notes are recorded at its fair value at the end of the…

Q: The following information relates to a joint production process for three products, with a total…

A: The approach of allocating joint costs based on each product's proportional part of the market or…

Q: TB Problem 7-170 (Algo) Cordova, Incorporated, reported the following... Cordova, Incorporated,…

A: Bad Debts Expense - Bad Debt Expense are the expense charged to income statement. It is the amount…

Q: What type of account (classification) is Accumulated Depreciation?

A: Account is the kind of ledger which represents an item in the book keeping. This could be asset,…

Q: Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the…

A: Debt securities refer to the financial assets that are being repaid the principal amount to the…

Q: Taxable income differs from financial accounting income in that It requires a change in the…

A: Taxable Income The base income used to calculate taxes is known as taxable income. It may include…

Q: J&J Limited Needlecraft makes hand embroidered sweat shirts to customer specifications. The…

A: Budget means the expected value of future. Budget is not affected by the actual value as it is…

Q: On June 1, FDN Trading purchased goods with an invoice price of P249,000 on terms 2/15, n/30, FOB…

A: Note: 2/15, n/30: Here, 2 represents the discount rate if payment is made within 15 days. And if…

Q: s no beginning inventory. Other information for the year included: Direct manufacturing labor…

A: Under Absorption costing, product cost include direct material, direct labor and variable…

Q: Determination of appropriate accounting for complex financial instruments by competent personnel.…

A: Ans. Financial statements are prepared on the basis of principles and concepts on accounting. It…

Q: Cunningham, Inc. sells bikes for $60 each. Variable costs are $40 per unit, and fixed costs total…

A: Break-even point = Fixed cost / Contribution margin per unit Contribution margin per unit = Selling…

Q: borrowings

A: Loans and borrowings help a business to scale amid financial crunch. However, any borrowing comes…

Q: Assume Organic Ice Cream Company, Inc., bought a new ice cream production kit…

A: Units-of-production method is a technique based on the output of a given asset during the year. It…

Q: Which comes the EARLIEST in valuation procedures? a. Determine the premise of value b. Analyze the…

A: Solution: Following is the order of valuation procedures: 1. Understand the client's use of the…

Q: Direct material: 4 pounds at $9.00 per pound Direct labor: 3 hours at $15 per hour Variable…

A: Variable manufacturing overhead cost in flexible budget is based on actual level of activity.…

Q: Swifty Corporation has two divisions; Sporting Goods and Sports Gear. The sales mix is 70% for…

A: Break-even point is the point at which the Total sales revenue of the company is equal to its total…

Q: Assume that no reversing entries are made by the entity. How would the entity record the transaction…

A: Solution: Accrued salaries and wages are recorded through Salaries payable. In next period, when…

Q: What entry for income taxes should be recorded in 2020? (Credit account titles are automatically…

A: A tax loss carryforward seems to be a provision that permits a taxpayer to carry a tax loss forward…

Q: The lawrence company has a ratio of long term debt to long term debt plus equity of .25 and a…

A: Accounting Equation The entire resources of a corporation are equivalent to the total of its…

Q: BEI-4 Swenson Company has the following payroll procedures. (a) Supervisor approves overtime work.…

A: Payroll is broadly define as the salary and wages paid to the employees and workers of the company.…

Q: Below is the payroll register of a business for one month. What are the missing vall Payroll…

A: The in hand pay is much less than what is given by the company because there many deduction…

Q: The accounting system should provide information for:

A: The accounting system should provide information for: D. All of the above. The accounting system…

Q: At the end of September 2005, Burgess Ltd. Had a bank balance of $275,000. Cash budgeting is…

A: Cash Budget A cash budget is a forecast of a company's free cash flow over a given time frame. The…

Q: Select one: O A. Future orientated focus O B. Stewardship orientation focus O C. Focus on detailed…

A: Management accounting is one of new branch of accounting and now has become very important now days…

Q: Employee 8 $75.000.00 $1.121.000.00 Total Calculate the Employer Health Tax premium. There are no…

A: Workmen compensation insurance is the amount provided by the employer as a compensation on the…

Q: The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming…

A:

Q: On June 12, 2022, FDNACCT Services issued a 90-day, 12%, P430,000 note for money borrowed which was…

A: Note payable: Note payable is an instrument through which the borrower obtains money from the…

Q: Prepare the direct material budgets for the upcoming five years. The budgets should also include a…

A: Direct Material Budget The manufacturing budget's demands are calculated using the direct materials…

Q: Oxford Company has the following account balances: Cash, $40,000; Accounts Receivable, $28,000;…

A: Current ratio = Current assets/Current liabilities Cash, accounts receivable and inventory are…

Q: depreciated

A: Buying a new machine is a big decision, and it involves various considerations. From the existing…

Q: Lansing Company’s current-year income statement and selected balance sheet data at December 31 of…

A: The cash flow statement is the one prepareed to determine the cash movement form and the company to…

Q: Which of the following is a cost objective? Select one: O A. The cost of educating a student O B.…

A: Cost object is anything to which costs are assigned. It could be product line, customers, department…

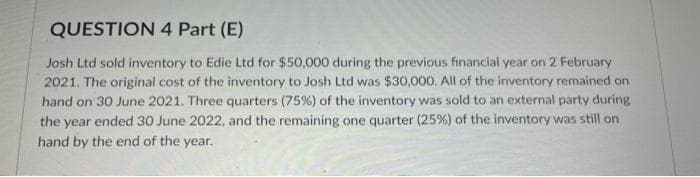

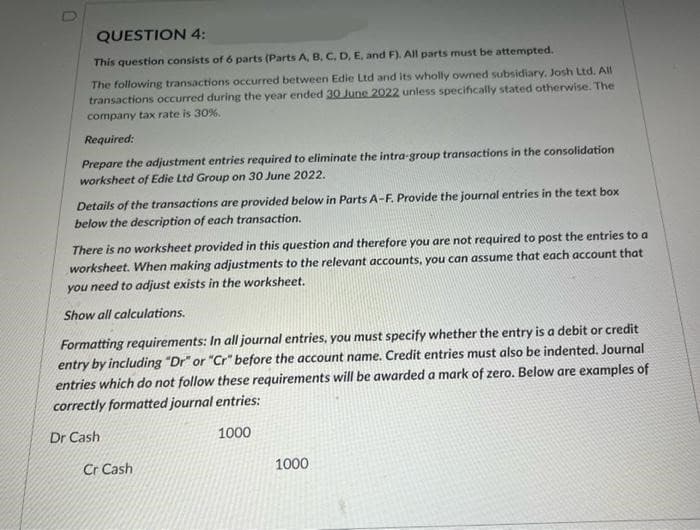

PLEASE SOLVE PART E

Step by step

Solved in 2 steps

- LIFO Liquidation Profit Hammond Company adopted LIFO when it was formed on January 1, 2017. Since then, the company has had the following purchases and sales of its single inventory item: In December 2020, the controller realized that because of an unexpected increase in demand, the company had sold 22,000 units but had purchased only 19,000 units during the year. In 2020, each unit had been sold for 19, and each unit purchased had cost 10. The income tax rate is 21%. Required: 1. Next Level If Hammond makes no additional purchases in 2020, how much LIFO liquidation profit will it report? 2. Prepare the appropriate annual report disclosures for 2020. 3. Next Level if Hammond purchases an additional 7,000 units in December 2020, how much income tax will the company save? 4. Next Level If Hammond purchases the additional 7,000 units, how much income tax has the company saved over the 4-year period by using LIFO instead of the FIFO cost flow assumption?Question 1 On 1 April 20X4 Triangle sold maturing inventory that had a carrying value of R3 million (at cost) to Factor all, a finance house, for R5 million. Its estimated market value at this date was in excess of R5 million and is expected to be R8.5 million as of 31 March 20X8. The inventory will not be ready for sale until 31 March 20X8 and will remain on Triangle's premises until this date. The sale contract includes a clause allowing Triangle to repurchase the inventory at any time up to 31 March 20X8 at a price of R5 million plus interest at 10% per annum compounded from 1 April 20X4. The proceeds of the sale have been debited to the bank and the sale (and associated profit) have been recognised in Triangle's statement of profit or loss. Required: (a) Discuss how the sale of inventory should be accounted for in accordance with the principles of IAS 18 Revenue and the IASB's Conceptual Framework for Financial Reporting. (b) Prepare any accounting adjustments required to…PROBLEM 6: XXX Company is preparing its 2021 financial statements. Prior to any adjustments, inventory is valued at P1,605,000. The following information has been found relating to certaininventory transactions from your cut-off test: A. Goods valued at P110,000 are on consignment with a customer. These goods werenot included in the ending inventory figure. B.Goods costing P87,000 were received from a vendor on January 5, 2022. The relatedinvoice was received and recorded on January 12, 2022. The goods were shippedonDecember 31, 2021, terms FOB shipping point. C. Goods costing P85,000, sold for P102,000, were shipped on December 31, 2021, andwere delivered to the customer on January 2, 2022. The terms of the invoice wereFOBshipping point. The goods were included in the ending inventory for 2021 and thesalewas recorded in 2022. D. A P35,000 shipment of goods to a customer on December 31, terms FOB destinationwas not included in the year-end inventory. The goods cost P26,000…

- Intermediate Accounting ll ch 16 On January 1, 2021, Ameen Company purchased major pieces of manufacturing equipment for a total of $54 million. Ameen uses straight-line depreciation for financial statement reporting and deducted 100% of the equipment’s cost for income tax reporting in 2021. At December 31, 2023, the book value of the equipment was $45 million. At December 31, 2024, the book value of the equipment was $42 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2024 was $72 million. Required: Prepare the appropriate journal entry to record Ameen’s 2024 income taxes. Assume an income tax rate of 20%. What is Ameen’s 2024 net income?owns 70% of Queen Ltd. (Queen). Parker and Queen both have December 31St year ends. On January 1. 2022, Queen had inventory in its warehouse which was purchased from Parker for $12,000 in 2021. This inventory was sold to an outside party during 2022. During 2022, Parker sold inventory to Queen for $50,000. 40% remained in Queen's warehouse at year end. Also, during 2022. Queen sold inventory to Parker for $25,000. 70% of this inventory remained in Parker's warehouse at year end. Both companies are subject to a tax rate of 40%. The gross profit percentage on sales is 30% for both companies. Parker uses the cost method to account for its Investment in Queen. The inventories of both companies as at December 31, 2022 were all sold to outsiders during 2023. There were no intercompany transactions during 2023. Prepare a schedule showing the realized and unrealized profits resulting from upstream transactions (i.e.. Queen selling to Parker) for 2022 and 2023. Your schedule should include both…Question 5 Week 9 (a) Jessica Ltd sold inventory during the current period to its wholly owned subsidiary, Amelie Ltd, for $15 000. These items previously cost Jessica Ltd $12 000. Amelie Ltd subsequently sold half the items to Ningbo Ltd for $8000. The tax rate is 30%. The group accountant for Jessica Ltd, Li Chen, maintains that the appropriate consolidation adjustment entries are as follows: Sales Dr. 15000 Cost of Sales Cr.13000 Inventory Cr. 2000 Deferred Tax asset Dr.300 Income Tax Expenses Cr.300 Required (i) Discuss whether the entries suggested by Li Chen are correct, explaining on a line-by-line basis the correct adjustment entry. (ii) Determine the consolidation worksheet entries in the following year, assuming the inventory has been –sold, and explain the adjustments on a line-by-line basis.

- Q2. Sky Ltd acquired all the issued shares of Jupiter Ltd on 1 January 2019. The following transactions occurred between the two entities: On 1 June 2020, Sky Ltd sold inventory to Jupiter Ltd for $12 000; By 30 June 2020, Jupiter Ltd had sold 20% of this inventory to other entities for $3000. The other 80% was all sold to external entities by 30 June 2021 for $13 000. During the 2020–21 period, Jupiter Ltd sold inventory to Sky Ltd for $6000 at cost plus 20% markup. Of this inventory, 20% remained on hand in Sky Ltd at 30 June 2021. The tax rate is 30%. Required: A).Prepare the consolidation worksheet entries for Sky Ltd at 30 June 2021 concerning the intragroup inventory transfers. B).Compute the cost of goods sold to be reported in the consolidated income statement for 2021 relating to this intra-group sale.Question 54 On December 31, 2021 Dean Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2021 beginning inventory to increase by $960,000. The cumulative effect of this accounting change to be reported for the year ended 12/31/21, assuming a 20% tax rate, is $192,000. $960,000. $0. $768,000.Intermediate Accounting ll ch 16 5. On January 1, 2021, Ameen Company purchased major pieces of manufacturing equipment for a total of $48 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2023, the book value of the equipment was $42 million and its tax basis was $32 million. At December 31, 2024, the book value of the equipment was $40 million and its tax basis was $25 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2024 was $30 million. Required: Prepare the appropriate journal entry to record Ameen’s 2024 income taxes. Assume an income tax rate of 25%. What is Ameen’s 2024 net income?

- Question 5 During 2021 Carla Vista Company purchased 9500 shares of Metlock Inc. for $25 per share. During the year Carla Vista Company sold 2250 shares of Metlock, Inc. for $30 per share. At December 31, 2021 the market price of Metlock, Inc.’s stock was $23 per share. What is the total amount of gain/(loss) that Carla Vista Company will report in its income statement for the year ended December 31, 2021 related to its investment in Metlock, Inc. stock? $-7750 $11250 $-19000 $-3250PROBLEM 18: San Jose Corporation was organized on January 1, 2020. On December 31, 2021, the corporation lost most of its inventory in a warehouse fire just before the year end count of inventory was to take place. Data records disclosed the following: 2020 2021 Beginning inventory P 0 P 1,020,000 Purchases 4,300,000 3,460,000 Purchase returns and allowances 230,600 323,000 Sales 3,940,00 4,180,000 Sales returns and allowances 80,000 100,000 On January 1, 2021, the corporation’s pricing policy was changed so that the gross profit rate would be 3% points higher than the one earned in 2020. Salvaged undamaged merchandise was marked to sell at P120,000 while damaged merchandise marked to sell at P80,000 had an estimated realizable value of P18,000. 23. How much is the inventory loss due to fire?CASE 2 On April 2, 2020 Happy Company purchased MDSE from Enjoy Corporation with a list price of P450,000; less:10% 2/10, n/30. Terms is FOB shipping point freight prepaid. Amount of freight paid by Enjoy Corporation is P6,500. Happy Company returned to Enjoy Corporation damaged MDSE worth P10,000 at list price. On April 12, Happy Company paid in full the account with Enjoy Corporation. Prepare the correct entries to record the above transaction in the books of Happy Company. Happy uses the periodic system of recording inventory. Prepare: Journal entry Note: Happy uses the periodic system of recording inventory.