(ou are applying for a conventional mortgage from the Americana Bank. Your nonthly gross income is $3,500, and the bank uses the 28% housing expense atio guideline. a. What is the highest PITI you can qualify for? Hint: Solve the housing expense ratio formula for PITI. (Remember, this is an application of the percentage formula, Portion = Rate x Base, where PITI is the portion, the expense ratio is the rate, and your monthly gross income is the base.) O Based on vour answer from part a if vouare applving for a 30-vear 9% mortgage

(ou are applying for a conventional mortgage from the Americana Bank. Your nonthly gross income is $3,500, and the bank uses the 28% housing expense atio guideline. a. What is the highest PITI you can qualify for? Hint: Solve the housing expense ratio formula for PITI. (Remember, this is an application of the percentage formula, Portion = Rate x Base, where PITI is the portion, the expense ratio is the rate, and your monthly gross income is the base.) O Based on vour answer from part a if vouare applving for a 30-vear 9% mortgage

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 15P

Related questions

Question

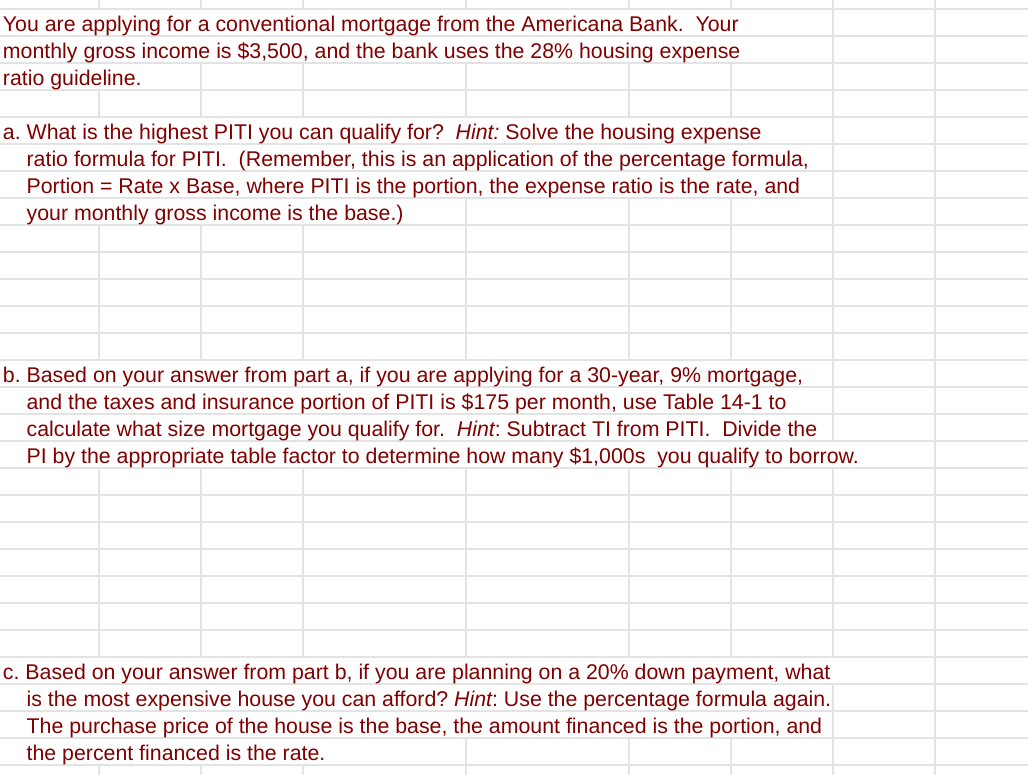

Transcribed Image Text:You are applying for a conventional mortgage from the Americana Bank. Your

monthly gross income is $3,500, and the bank uses the 28% housing expense

ratio guideline.

a. What is the highest PITI you can qualify for? Hint: Solve the housing expense

ratio formula for PITI. (Remember, this is an application of the percentage formula,

Portion = Rate x Base, where PITI is the portion, the expense ratio is the rate, and

your monthly gross income is the base.)

b. Based on your answer from part a, if you are applying for a 30-year, 9% mortgage,

and the taxes and insurance portion of PITI is $175 per month, use Table 14-1 to

calculate what size mortgage you qualify for. Hint: Subtract TI from PITI. Divide the

PI by the appropriate table factor to determine how many $1,000s you qualify to borrow.

c. Based on your answer from part b, if you are planning on a 20% down payment, what

is the most expensive house you can afford? Hint: Use the percentage formula again.

The purchase price of the house is the base, the amount financed is the portion, and

the percent financed is the rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning