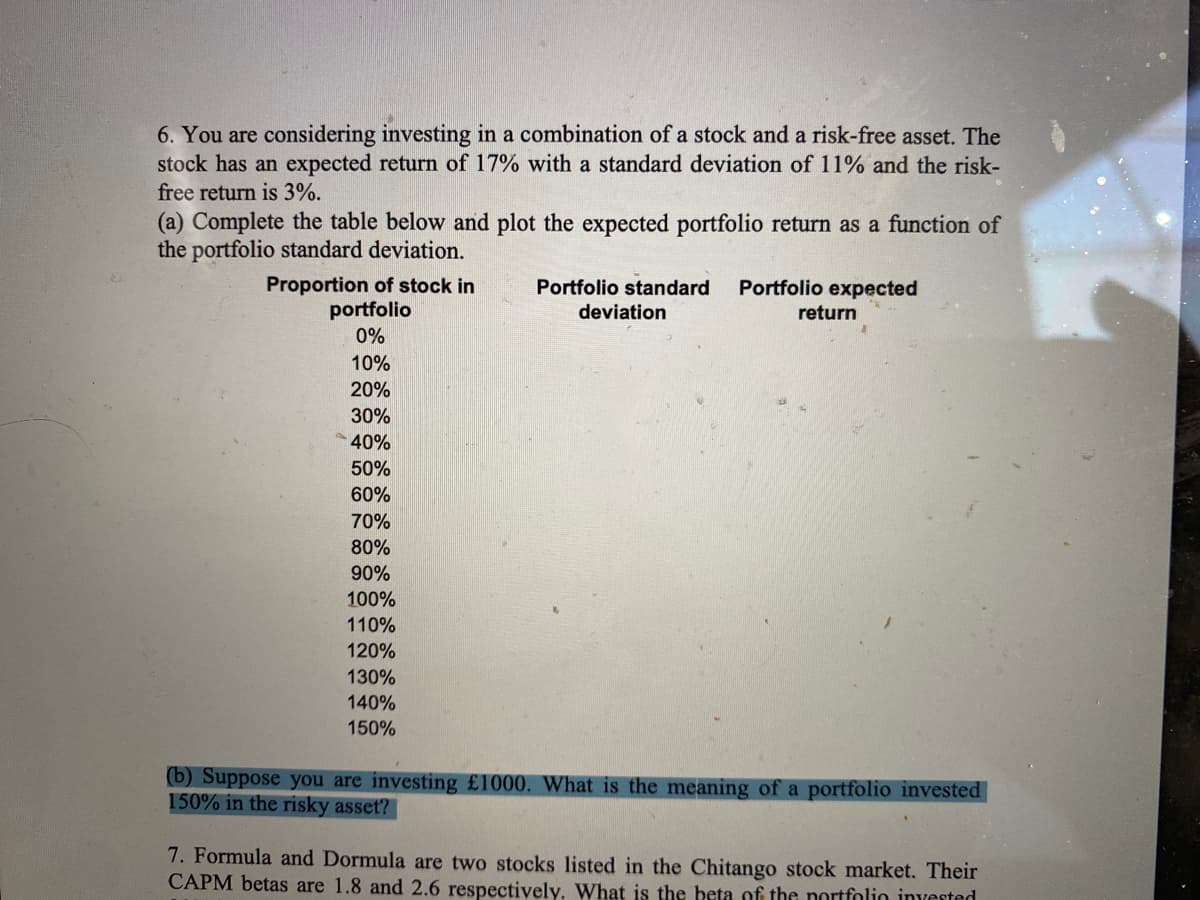

ou are considering investing in a combination of a stock and a risk-free asset. The stock has an expected return of 17% with a standard deviation of 11% and the riskfree return is 3%. (a) Complete the table below and plot the expected portfolio return as a function of the portfolio standard deviation. (b) Suppose you are investing £1000. What is the meaning of a portfolio invested 150% in the risky asset?

ou are considering investing in a combination of a stock and a risk-free asset. The stock has an expected return of 17% with a standard deviation of 11% and the riskfree return is 3%. (a) Complete the table below and plot the expected portfolio return as a function of the portfolio standard deviation. (b) Suppose you are investing £1000. What is the meaning of a portfolio invested 150% in the risky asset?

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

You are considering investing in a combination of a stock and a risk-free asset. The

stock has an expected return of 17% with a standard deviation of 11% and the riskfree return is 3%.

(a) Complete the table below and plot the expected portfolio return as a function of

the portfolio standard deviation.

(b) Suppose you are investing £1000. What is the meaning of a portfolio invested

150% in the risky asset?

Transcribed Image Text:6. You are considering investing in a combination of a stock and a risk-free asset. The

stock has an expected return of 17% with a standard deviation of 11% and the risk-

free return is 3%.

(a) Complete the table below and plot the expected portfolio return as a function of

the portfolio standard deviation.

Proportion of stock in

portfolio

Portfolio standard

deviation

Portfolio expected

return

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

110%

120%

130%

140%

150%

(b) Suppose you are investing £1000. What is the meaning of a portfolio invested

150% in the risky asset?

7. Formula and Dormula are two stocks listed in the Chitango stock market. Their

CAPM betas are 1.8 and 2.6 respectively. What is the beta of the nortfolio invested

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning