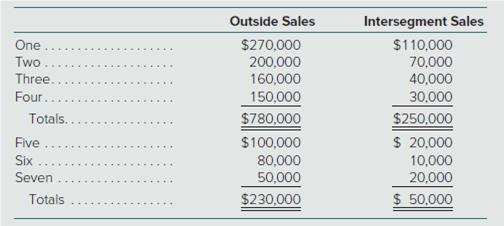

Outside Sales Intersegment Sales One . $270,000 200,000 160,000 150,000 $110,000 70,000 40,000 30,000 Two Three Four. $250,000 $ 20,000 Totals. $780,000 Five $100,000 Six 80,000 10,000 20,000 Seven 50,000 Totals $230,000 $ 50,000

Chambers Company has seven operating segments but only four (One, Two, Three, and Four) are of significant size to warrant separate disclosure. As a whole, the segments generated revenues of $1,010,000 ($780,000 + $230,000) from sales to outside customers. In addition, the segments had $300,000 in intersegment sales ($250,000 + $50,000).

Which of the following statements is true?

a. A sufficient number of segments is being reported because those segments have $1,030,000 in total sales of a total of $1,310,000 for the company as a whole.

b. Not enough segments are being reported because those segments have $780,000 in outside sales of a total of $1,010,000 for the company as a whole.

c. Not enough segments are being reported because those segments have $1,030,000 in total revenues of a total of $1,310,000 for the company as a whole.

d. A sufficient number of segments is being reported because those segments have $780,000 in outside sales of a total of $1,010,000 for the company as a whole.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps