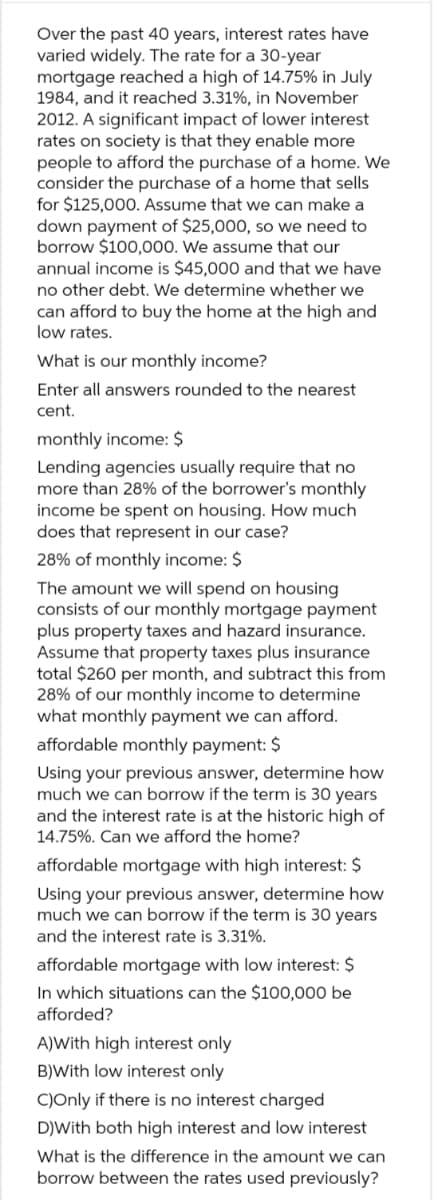

Over the past 40 years, interest rates have varied widely. The rate for a 30-year mortgage reached a high of 14.75% in July 1984, and it reached 3.31%, in November 2012. A significant impact of lower interest rates on society is that they enable more people to afford the purchase of a home. We consider the purchase of a home that sells for $125,000. Assume that we can make a down payment of $25,000, so we need to borrow $100,000. We assume that our annual income is $45,000 and that we have no other debt. We determine whether we can afford to buy the home at the high and low rates. What is our monthly income? Enter all answers rounded to the nearest cent. monthly income: $ Lending agencies usually require that no more than 28% of the borrower's monthly income be spent on housing. How much does that represent in our case? 28% of monthly income: $ The amount we will spend on housing consists of our monthly mortgage payment plus property taxes and hazard insurance. Assume that property taxes plus insurance total $260 per month, and subtract this from 28% of our monthly income to determine what monthly payment we can afford. affordable monthly payment: $ Using your previous answer, determine how much we can borrow if the term is 30 years and the interest rate is at the historic high of 14.75%. Can we afford the home? affordable mortgage with high interest: $ Using your previous answer, determine how much we can borrow if the term is 30 years and the interest rate is 3.31%. affordable mortgage with low interest: $ In which situations can the $100,000 be afforded? A)With high interest only B)With low interest only C)Only if there is no interest charged D)With both high interest and low interest What is the difference in the amount we can borrow between the rates used previously?

Over the past 40 years, interest rates have varied widely. The rate for a 30-year mortgage reached a high of 14.75% in July 1984, and it reached 3.31%, in November 2012. A significant impact of lower interest rates on society is that they enable more people to afford the purchase of a home. We consider the purchase of a home that sells for $125,000. Assume that we can make a down payment of $25,000, so we need to borrow $100,000. We assume that our annual income is $45,000 and that we have no other debt. We determine whether we can afford to buy the home at the high and low rates. What is our monthly income? Enter all answers rounded to the nearest cent. monthly income: $ Lending agencies usually require that no more than 28% of the borrower's monthly income be spent on housing. How much does that represent in our case? 28% of monthly income: $ The amount we will spend on housing consists of our monthly mortgage payment plus property taxes and hazard insurance. Assume that property taxes plus insurance total $260 per month, and subtract this from 28% of our monthly income to determine what monthly payment we can afford. affordable monthly payment: $ Using your previous answer, determine how much we can borrow if the term is 30 years and the interest rate is at the historic high of 14.75%. Can we afford the home? affordable mortgage with high interest: $ Using your previous answer, determine how much we can borrow if the term is 30 years and the interest rate is 3.31%. affordable mortgage with low interest: $ In which situations can the $100,000 be afforded? A)With high interest only B)With low interest only C)Only if there is no interest charged D)With both high interest and low interest What is the difference in the amount we can borrow between the rates used previously?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 9MC: Now assume that it is several years later. The brothers are concerned about the firm’s current...

Related questions

Question

Please send me answer of this question within 10 min i will give you like sure.send me typed answer only

Transcribed Image Text:Over the past 40 years, interest rates have

varied widely. The rate for a 30-year

mortgage reached a high of 14.75% in July

1984, and it reached 3.31%, in November

2012. A significant impact of lower interest

rates on society is that they enable more

people to afford the purchase of a home. We

consider the purchase of a home that sells

for $125,000. Assume that we can make a

down payment of $25,000, so we need to

borrow $100,000. We assume that our

annual income is $45,000 and that we have

no other debt. We determine whether we

can afford to buy the home at the high and

low rates.

What is our monthly income?

Enter all answers rounded to the nearest

cent.

monthly income: $

Lending agencies usually require that no

more than 28% of the borrower's monthly

income be spent on housing. How much

does that represent in our case?

28% of monthly income: $

The amount we will spend on housing

consists of our monthly mortgage payment

plus property taxes and hazard insurance.

Assume that property taxes plus insurance

total $260 per month, and subtract this from

28% of our monthly income to determine

what monthly payment we can afford.

affordable monthly payment: $

Using your previous answer, determine how

much we can borrow if the term is 30 years

and the interest rate is at the historic high of

14.75%. Can we afford the home?

affordable mortgage with high interest: $

Using your previous answer, determine how

much we can borrow if the term is 30 years

and the interest rate is 3.31%.

affordable mortgage with low interest: $

In which situations can the $100,000 be

afforded?

A)With high interest only

B)With low interest only

C)Only if there is no interest charged

D)With both high interest and low interest

What is the difference in the amount we can

borrow between the rates used previously?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College