Overnight Publishing Company (OPC) has $4.0 million in excess cash. The firm plans to use this cash either to retire all of its outstanding debt or to repurchase equity. The firm's debt is held by one institution that is willing to sell it back to OPC for $4.0 million. The institution will not charge OPC any transaction costs. Once OPC becomes an all-equity firm, it will remain unlevered forever. If OPC does not retire the debt, the company will use the $4.0 million in cash to buy back some of its stock on the open market. Repurchasing stock also has no transaction costs. The company will generate $1,450,000 of annual earnings before interest and taxes in perpetuity regardless of its capital structure. The firm immediately pays out all earnings as dividends at the end of each year. OPC is subject to a corporate tax rate of 25 percent and the required rate of return on the firm's unlevered equity is 14 percent. The personal tax rate on interest income is 30 percent and there are no taxes on equity distribution. Assume there are no bankruptcy costs. a. What is the value of OPC if it chooses to retire all of its debt and become an unlevered firm? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the value of OPC if it decides to repurchase stock instead of retiring its debt? (Hint Use the equation for the value of a levered firm with personal tax on interest income from Problem 9 in the textbook.) (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) c. What is the value of OPC if the expected bankruptcy costs have a present value of $850,000? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) == OLD < Prev of hp

Overnight Publishing Company (OPC) has $4.0 million in excess cash. The firm plans to use this cash either to retire all of its outstanding debt or to repurchase equity. The firm's debt is held by one institution that is willing to sell it back to OPC for $4.0 million. The institution will not charge OPC any transaction costs. Once OPC becomes an all-equity firm, it will remain unlevered forever. If OPC does not retire the debt, the company will use the $4.0 million in cash to buy back some of its stock on the open market. Repurchasing stock also has no transaction costs. The company will generate $1,450,000 of annual earnings before interest and taxes in perpetuity regardless of its capital structure. The firm immediately pays out all earnings as dividends at the end of each year. OPC is subject to a corporate tax rate of 25 percent and the required rate of return on the firm's unlevered equity is 14 percent. The personal tax rate on interest income is 30 percent and there are no taxes on equity distribution. Assume there are no bankruptcy costs. a. What is the value of OPC if it chooses to retire all of its debt and become an unlevered firm? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the value of OPC if it decides to repurchase stock instead of retiring its debt? (Hint Use the equation for the value of a levered firm with personal tax on interest income from Problem 9 in the textbook.) (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) c. What is the value of OPC if the expected bankruptcy costs have a present value of $850,000? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) == OLD < Prev of hp

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 5MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

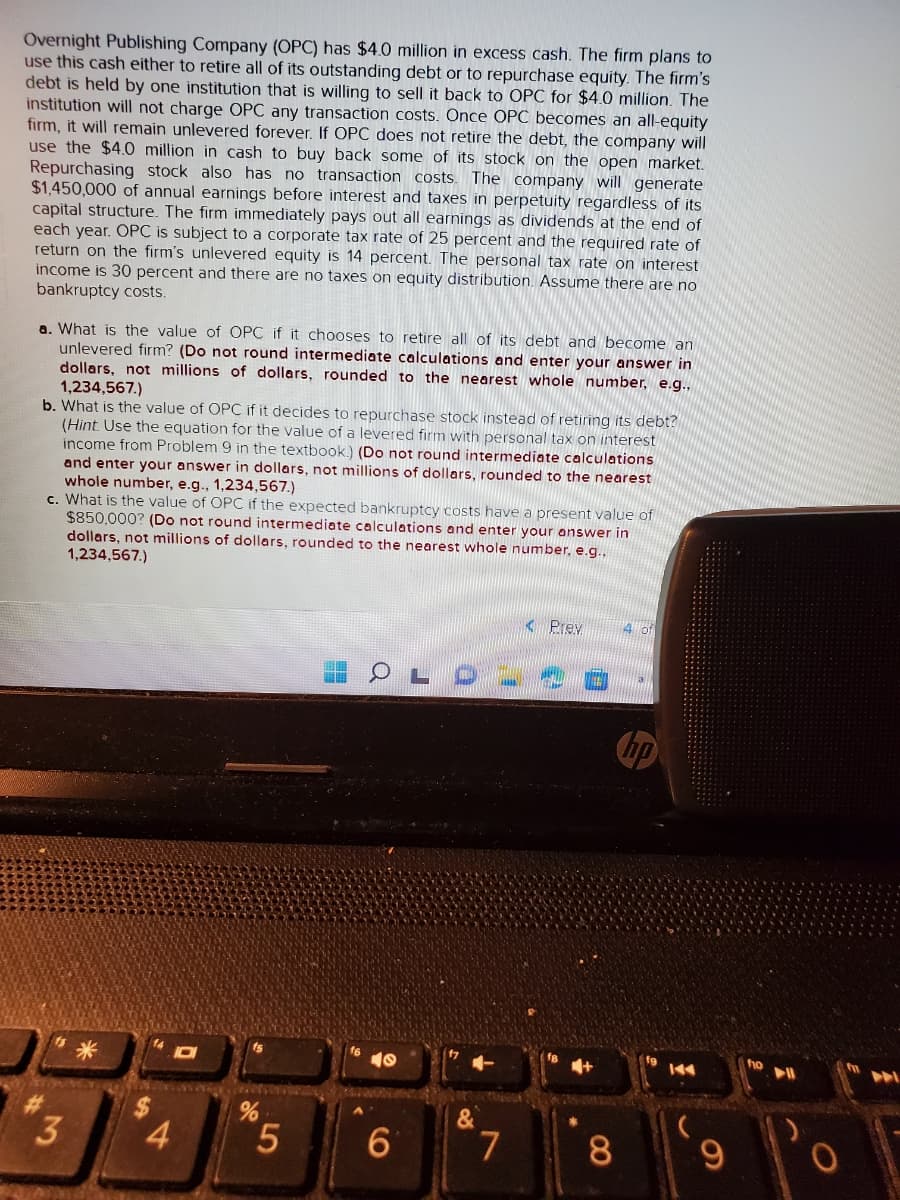

Transcribed Image Text:Overnight Publishing Company (OPC) has $4.0 million in excess cash. The firm plans to

use this cash either to retire all of its outstanding debt or to repurchase equity. The firm's

debt is held by one institution that is willing to sell it back to OPC for $4.0 million. The

institution will not charge OPC any transaction costs. Once OPC becomes an all-equity

firm, it will remain unlevered forever. If OPC does not retire the debt, the company will

use the $4.0 million in cash to buy back some of its stock on the open market.

Repurchasing stock also has no transaction costs. The company will generate

$1,450,000 of annual earnings before interest and taxes in perpetuity regardless of its

capital structure. The firm immediately pays out all earnings as dividends at the end of

each year. OPC is subject to a corporate tax rate of 25 percent and the required rate of

return on the firm's unlevered equity is 14 percent. The personal tax rate on interest

income is 30 percent and there are no taxes on equity distribution. Assume there are no

bankruptcy costs.

a. What is the value of OPC if it chooses to retire all of its debt and become an

unlevered firm? (Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to the nearest whole number, e.g.,

1,234,567.)

b. What is the value of OPC if it decides to repurchase stock instead of retiring its debt?

(Hint Use the equation for the value of a levered firm with personal tax on interest

income from Problem 9 in the textbook.) (Do not round intermediate calculations

and enter your answer in dollars, not millions of dollars, rounded to the nearest

whole number, e.g., 1,234,567.)

c. What is the value of OPC if the expected bankruptcy costs have a present value of

$850,000? (Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to the nearest whole number, e.g.,

1,234,567.)

#

13

3

*

14

4

O

5

6

&

7

< Prev

8

9

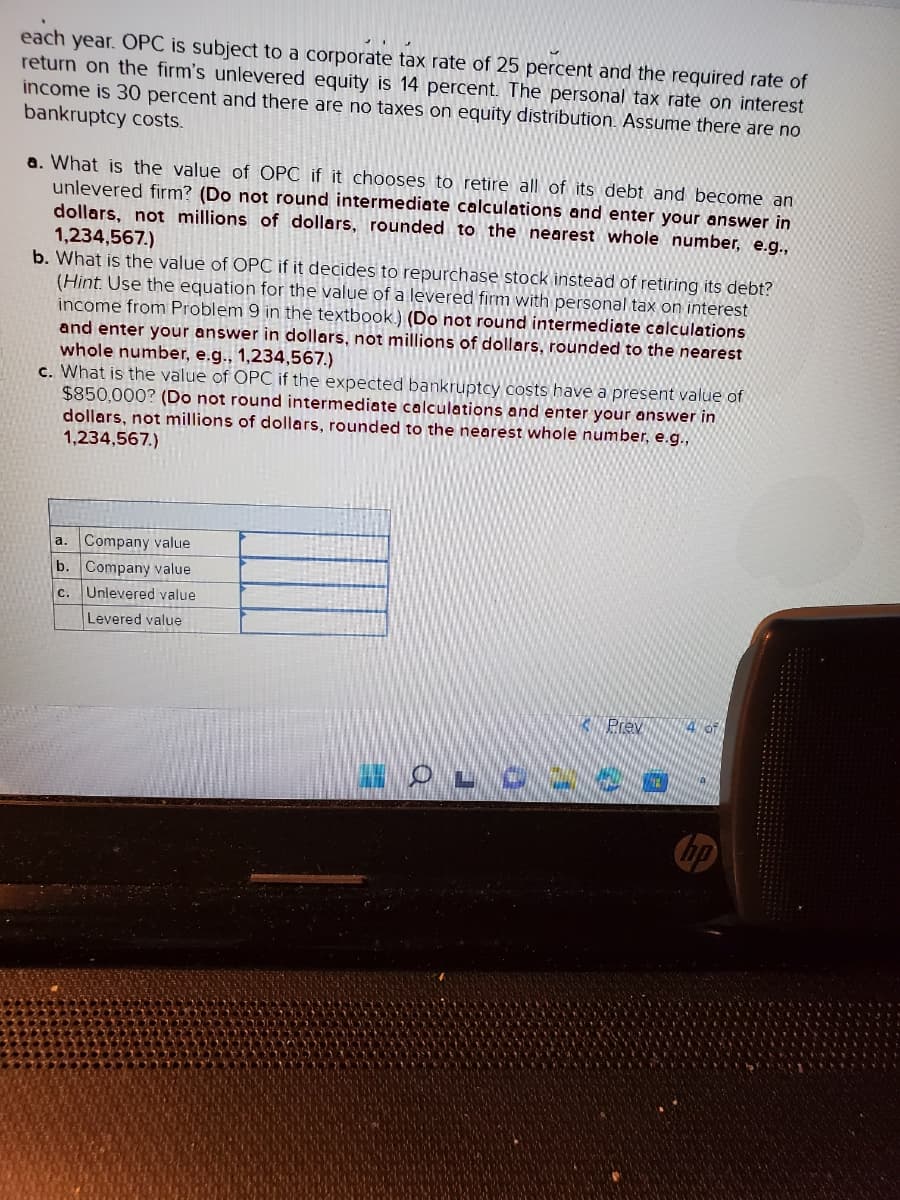

Transcribed Image Text:each year. OPC is subject to a corporate tax rate of 25 percent and the required rate of

return on the firm's unlevered equity is 14 percent. The personal tax rate on interest

income is 30 percent and there are no taxes on equity distribution. Assume there are no

bankruptcy costs.

a. What is the value of OPC if it chooses to retire all of its debt and become an

unlevered firm? (Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to the nearest whole number, e.g.,

1,234,567.)

b. What is the value of OPC if it decides to repurchase stock instead of retiring its debt?

(Hint. Use the equation for the value of a levered firm with personal tax on interest

income from Problem 9 in the textbook) (Do not round intermediate calculations

and enter your answer in dollars, not millions of dollars, rounded to the nearest

whole number, e.g., 1,234,567.)

c. What is the value of OPC if the expected bankruptcy costs have a present value of

$850,000? (Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to the nearest whole number, e.g.,

1,234,567.)

Company value

Company value

C. Unlevered value

Levered value

a.

b.

Prev

IOLO -- O

4 of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning