owing information applles the questions displayed be Trey has two dependents, his daughters, ages 14 and 18, at year-end. Tre What amount of child tax credit (either as a child or a qualifying depende daughters under each of the following alternative situations? Use Exhibit

owing information applles the questions displayed be Trey has two dependents, his daughters, ages 14 and 18, at year-end. Tre What amount of child tax credit (either as a child or a qualifying depende daughters under each of the following alternative situations? Use Exhibit

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 28P

Related questions

Question

![!

Required information

[The following information applies to the questions displayed below.]

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his

daughters under each of the following alternative situations? Use Exhibit 8-8.

a. His AGI is $100,000.

Amount of child tax credit](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F9d921497-5a53-442a-a059-66fc6bff7335%2F36729b91-540e-4645-ad75-c5d284ff501d%2Fz1m7p0f_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his

daughters under each of the following alternative situations? Use Exhibit 8-8.

a. His AGI is $100,000.

Amount of child tax credit

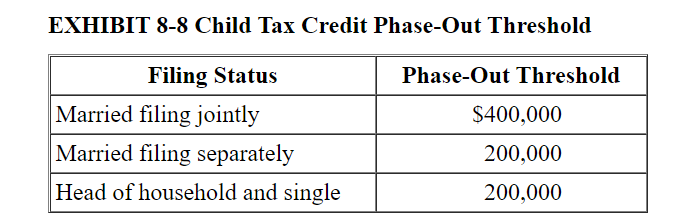

Transcribed Image Text:EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold

Filing Status

Phase-Out Threshold

Married filing jointly

$400,000

Married filing separately

200,000

Head of household and single

200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you