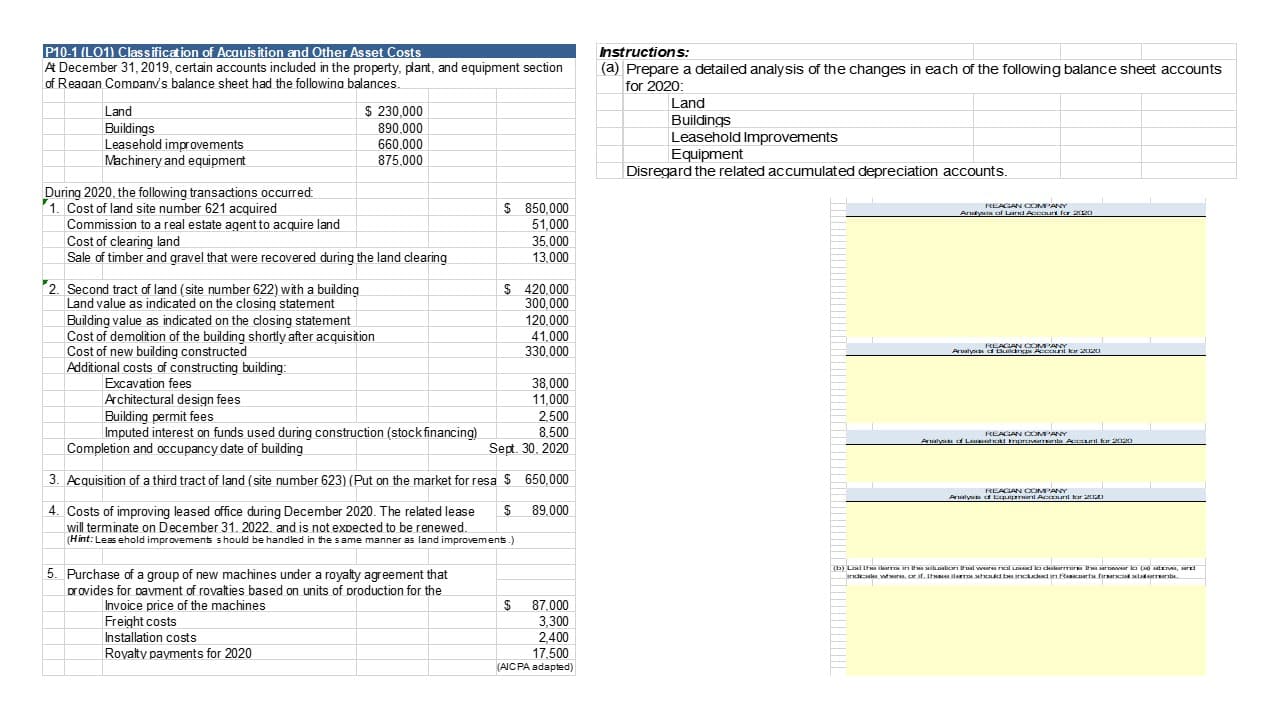

P10-1 (LO1) Classification of Acquis ition and Other Asset Costs A December 31, 2019, certain accounts included in the property, plant, and equipment section of Reagan Company's balance sheet had the followina balances. Instructions: (a) Prepare a detailed analysis of the changes in each of the following balance sheet accounts for 2020 Land Land $ 230,000 Buildings Leasehold improvements Machinery and equipment 890.000 660,000 875.000 Buildings Leasehold Improvements Equipment Disregard the related accumulated depreciation accounts. During 2020. the following transactions occurred 1. Cost of land site number 621 acquired Commission to a real estate agent to acquire land Cost of clearing land Sale of timber and gravel that were recovered during the land dearing $ 850,000 REAGANCOMPANY Aruty l r Acct f 20 51,000 35.000 13,000 2. Second tract of land (site number 622) with a buiding Land value as indicated on the closing statement Buiding value Cost of demolition of the building shortly after acquisition Cost of new bulding constructed Additional costs of constructing building: $ 420.000 300.000 eas indicated on the dosing statement 120.000 41,000 330.000 38,000 11.000 Excavation fees Achitectural design fees Building permit fees Imputed interest on funds used during construction (stock financing) Completion and occupancy date of building 2,500 8,500 Set. 30, 2020 FREACAN OOMPANY Aru d Le t mr t Accant kr 220 3. Acquisition of a third tract of land (site number 623) (Put on the market for resa S 650,000 REAGAN COMPANY Auy c L AcEu r $ 89,000 4. Costs of improving leased office during December 2020. The related lease will terminate on December 31. 2022. and is not expected to be renewed. (Hint: Leas ehold improvements should be handled in thesame manner as land improvemens.) b L n iacn wer l d kacrr r r (et , wr f.Ita it ta i in F rta fir latern 5. Purchase of a group of new machines under a royaty agreement that provides for pavment of rovaties based on units of production for the Invoice price of the machines 87,000 3,300 Freight costs Installation costs Royaty payments for 2020 2,400 17,500 (AICPA adapted)

P10-1 (LO1) Classification of Acquis ition and Other Asset Costs A December 31, 2019, certain accounts included in the property, plant, and equipment section of Reagan Company's balance sheet had the followina balances. Instructions: (a) Prepare a detailed analysis of the changes in each of the following balance sheet accounts for 2020 Land Land $ 230,000 Buildings Leasehold improvements Machinery and equipment 890.000 660,000 875.000 Buildings Leasehold Improvements Equipment Disregard the related accumulated depreciation accounts. During 2020. the following transactions occurred 1. Cost of land site number 621 acquired Commission to a real estate agent to acquire land Cost of clearing land Sale of timber and gravel that were recovered during the land dearing $ 850,000 REAGANCOMPANY Aruty l r Acct f 20 51,000 35.000 13,000 2. Second tract of land (site number 622) with a buiding Land value as indicated on the closing statement Buiding value Cost of demolition of the building shortly after acquisition Cost of new bulding constructed Additional costs of constructing building: $ 420.000 300.000 eas indicated on the dosing statement 120.000 41,000 330.000 38,000 11.000 Excavation fees Achitectural design fees Building permit fees Imputed interest on funds used during construction (stock financing) Completion and occupancy date of building 2,500 8,500 Set. 30, 2020 FREACAN OOMPANY Aru d Le t mr t Accant kr 220 3. Acquisition of a third tract of land (site number 623) (Put on the market for resa S 650,000 REAGAN COMPANY Auy c L AcEu r $ 89,000 4. Costs of improving leased office during December 2020. The related lease will terminate on December 31. 2022. and is not expected to be renewed. (Hint: Leas ehold improvements should be handled in thesame manner as land improvemens.) b L n iacn wer l d kacrr r r (et , wr f.Ita it ta i in F rta fir latern 5. Purchase of a group of new machines under a royaty agreement that provides for pavment of rovaties based on units of production for the Invoice price of the machines 87,000 3,300 Freight costs Installation costs Royaty payments for 2020 2,400 17,500 (AICPA adapted)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 8P

Related questions

Question

Good morning

Transcribed Image Text:P10-1 (LO1) Classification of Acquis ition and Other Asset Costs

A December 31, 2019, certain accounts included in the property, plant, and equipment section

of Reagan Company's balance sheet had the followina balances.

Instructions:

(a) Prepare a detailed analysis of the changes in each of the following balance sheet accounts

for 2020

Land

Land

$ 230,000

Buildings

Leasehold improvements

Machinery and equipment

890.000

660,000

875.000

Buildings

Leasehold Improvements

Equipment

Disregard the related accumulated depreciation accounts.

During 2020. the following transactions occurred

1. Cost of land site number 621 acquired

Commission to a real estate agent to acquire land

Cost of clearing land

Sale of timber and gravel that were recovered during the land dearing

$ 850,000

REAGANCOMPANY

Aruty l r Acct f 20

51,000

35.000

13,000

2. Second tract of land (site number 622) with a buiding

Land value as indicated on the closing statement

Buiding value

Cost of demolition of the building shortly after acquisition

Cost of new bulding constructed

Additional costs of constructing building:

$ 420.000

300.000

eas indicated on the dosing statement

120.000

41,000

330.000

38,000

11.000

Excavation fees

Achitectural design fees

Building permit fees

Imputed interest on funds used during construction (stock financing)

Completion and occupancy date of building

2,500

8,500

Set. 30, 2020

FREACAN OOMPANY

Aru d Le t mr t Accant kr 220

3. Acquisition of a third tract of land (site number 623) (Put on the market for resa S 650,000

REAGAN COMPANY

Auy c L AcEu r

$ 89,000

4. Costs of improving leased office during December 2020. The related lease

will terminate on December 31. 2022. and is not expected to be renewed.

(Hint: Leas ehold improvements should be handled in thesame manner as land improvemens.)

b L n iacn wer l d kacrr r r (et ,

wr f.Ita it ta i in F rta fir latern

5. Purchase of a group of new machines under a royaty agreement that

provides for pavment of rovaties based on units of production for the

Invoice price of the machines

87,000

3,300

Freight costs

Installation costs

Royaty payments for 2020

2,400

17,500

(AICPA adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning