P10-22-B

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 6E: Investment Premium Amortization Schedule On January 1, 2019, Lynch Company acquired 13% bonds with a...

Related questions

Question

Question P10-22-B

Transcribed Image Text:Problems Group B

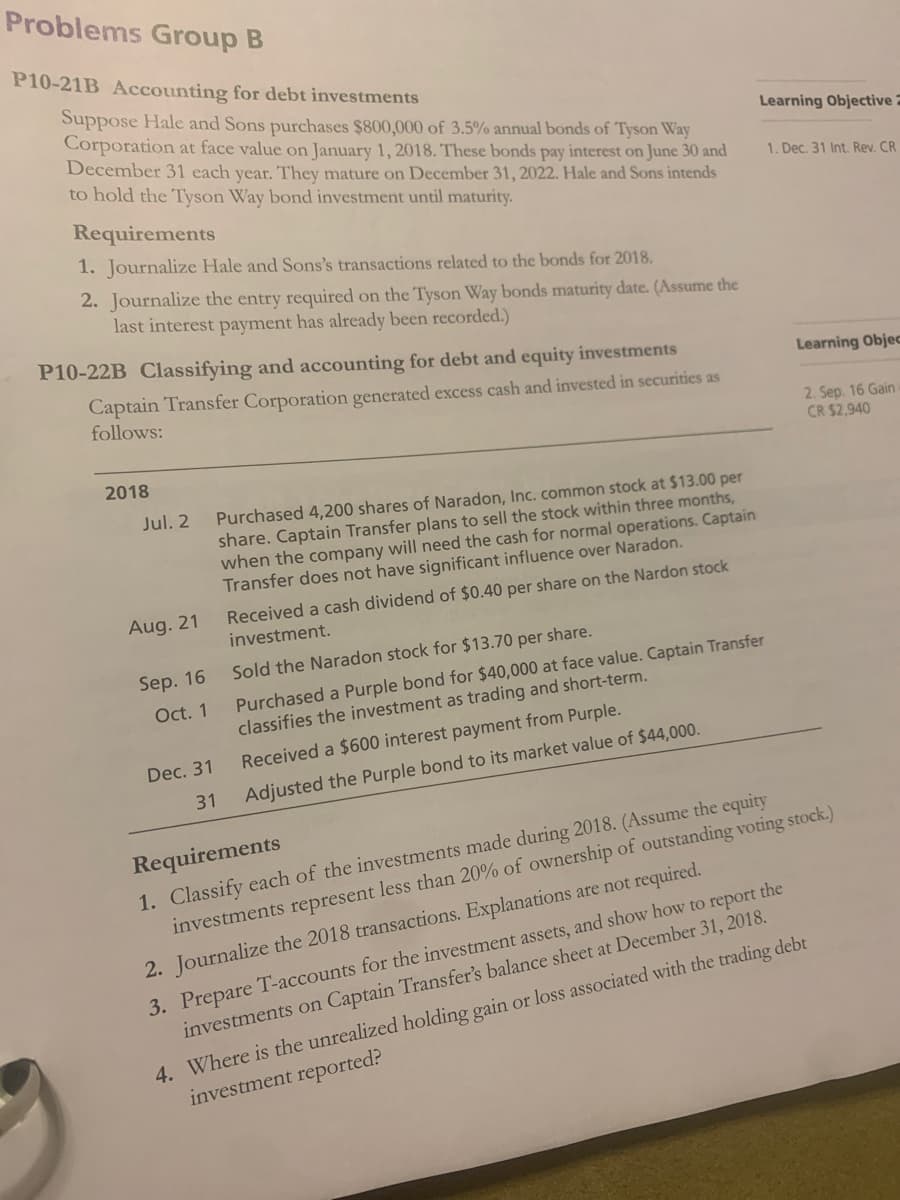

P10-21B Accounting for debt investments

Suppose Hale and Sons purchases $800,000 of 3.5% annual bonds of Tyson Way

Corporation at face value on January 1, 2018. These bonds pay interest on June 30 and

December 31 each year. They mature on December 31, 2022. Hale and Sons intends

to hold the Tyson Way bond investment until maturity.

Learning Objective 2

1. Dec. 31 Int. Rev. CR

Requirements

1. Journalize Hale and Sons's transactions related to the bonds for 2018.

2. Journalize the entry required on the Tyson Way bonds maturity date. (Assume the

last interest payment has already been recorded.)

P10-22B Classifying and accounting for debt and equity investments

Learning Objec

Captain Transfer Corporation generated excess cash and invested in securities as

follows:

2. Sep. 16 Gain

CR $2,940

2018

Jul. 2

Purchased 4,200 shares of Naradon, Inc. common stock at $13.00 per

share. Captain Transfer plans to sell the stock within three months,

when the company will need the cash for normal operations. Captain

Transfer does not have significant influence over Naradon.

Received a cash dividend of $0.40 per share on the Nardon stock

investment.

Aug. 21

Sep. 16

Sold the Naradon stock for $13.70 per share.

Purchased a Purple bond for $40,000 at face value. Captain Transfer

classifies the investment as trading and short-term.

Oct. 1

Dec. 31

Received a $600 interest payment from Purple.

31

Adjusted the Purple bond to its market value of $44,000.

1. Classify each of the investments made during 2018. (Assume the equity

investments represent less than 20% of ownership of outstanding voting stock.)

Requirements

3. Prepare T-accounts for the investment assets, and show how to report the

investments on Captain Transfer's balance sheet at December 31, 2018.

2. Journalize the 2018 transactions. Explanations are not required.

4. Where is the unrealized holding gain or loss associated with the trading debt

investment reported?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning