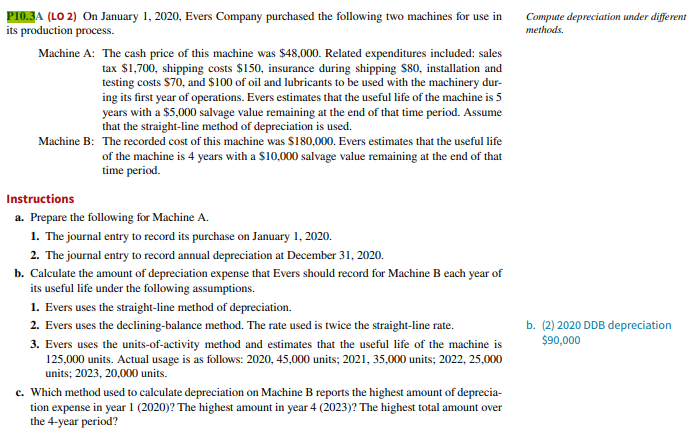

P10.3A (LO 2) On January 1, 2020, Evers Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shipping $80, installation and testing costs $70, and $100 of oil and lubricants to be used with the machinery dur- ing its first year of operations. Evers estimates that the useful life of the machine is 5 years with a $5,000 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. Machine B: The recorded cost of this machine was $180,000. Evers estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period. Instructions a. Prepare the following for Machine A. 1. The journal entry to record its purchase on January 1, 2020. 2. The journal entry to record annual depreciation at December 31, 2020. b. Calculate the amount of depreciation expense that Evers should record for Machine B each year of its useful life under the following assumptions. 1. Evers uses the straight-line method of depreciation. 2. Evers uses the declining-balance method. The rate used is twice the straight-line rate. 3. Evers uses the units-of-activity method and estimates that the useful life of the machine is 125,000 units. Actual usage is as follows: 2020, 45,000 units; 2021, 35,000 units; 2022, 25,000 units; 2023, 20,000 units. c. Which method used to calculate depreciation on Machine B reports the highest amount of deprecia- tion expense in year 1 (2020)? The highest amount in year 4 (2023)? The highest total amount over the 4-year period? Compute depreciation under different methods. b. (2) 2020 DDB depreciation $90,000

P10.3A (LO 2) On January 1, 2020, Evers Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shipping $80, installation and testing costs $70, and $100 of oil and lubricants to be used with the machinery dur- ing its first year of operations. Evers estimates that the useful life of the machine is 5 years with a $5,000 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. Machine B: The recorded cost of this machine was $180,000. Evers estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period. Instructions a. Prepare the following for Machine A. 1. The journal entry to record its purchase on January 1, 2020. 2. The journal entry to record annual depreciation at December 31, 2020. b. Calculate the amount of depreciation expense that Evers should record for Machine B each year of its useful life under the following assumptions. 1. Evers uses the straight-line method of depreciation. 2. Evers uses the declining-balance method. The rate used is twice the straight-line rate. 3. Evers uses the units-of-activity method and estimates that the useful life of the machine is 125,000 units. Actual usage is as follows: 2020, 45,000 units; 2021, 35,000 units; 2022, 25,000 units; 2023, 20,000 units. c. Which method used to calculate depreciation on Machine B reports the highest amount of deprecia- tion expense in year 1 (2020)? The highest amount in year 4 (2023)? The highest total amount over the 4-year period? Compute depreciation under different methods. b. (2) 2020 DDB depreciation $90,000

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 4PROB

Related questions

Question

P10.3

Transcribed Image Text:P10.3A (LO 2) On January 1, 2020, Evers Company purchased the following two machines for use in

its production process.

Machine A: The cash price of this machine was $48,000. Related expenditures included: sales

tax $1,700, shipping costs $150, insurance during shipping $80, installation and

testing costs $70, and $100 of oil and lubricants to be used with the machinery dur-

ing its first year of operations. Evers estimates that the useful life of the machine is 5

years with a $5,000 salvage value remaining at the end of that time period. Assume

that the straight-line method of depreciation is used.

Machine B: The recorded cost of this machine was $180,000. Evers estimates that the useful life

of the machine is 4 years with a $10,000 salvage value remaining at the end of that

time period.

Instructions

a. Prepare the following for Machine A.

1. The journal entry to record its purchase on January 1, 2020.

2. The journal entry to record annual depreciation at December 31, 2020.

b. Calculate the amount of depreciation expense that Evers should record for Machine B each year of

its useful life under the following assumptions.

1. Evers uses the straight-line method of depreciation.

2. Evers uses the declining-balance method. The rate used is twice the straight-line rate.

3. Evers uses the units-of-activity method and estimates that the useful life of the machine is

125,000 units. Actual usage is as follows: 2020, 45,000 units; 2021, 35,000 units; 2022, 25,000

units; 2023, 20,000 units.

c. Which method used to calculate depreciation on Machine B reports the highest amount of deprecia-

tion expense in year 1 (2020)? The highest amount in year 4 (2023)? The highest total amount over

the 4-year period?

Compute depreciation under different

methods.

b. (2) 2020 DDB depreciation

$90,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT