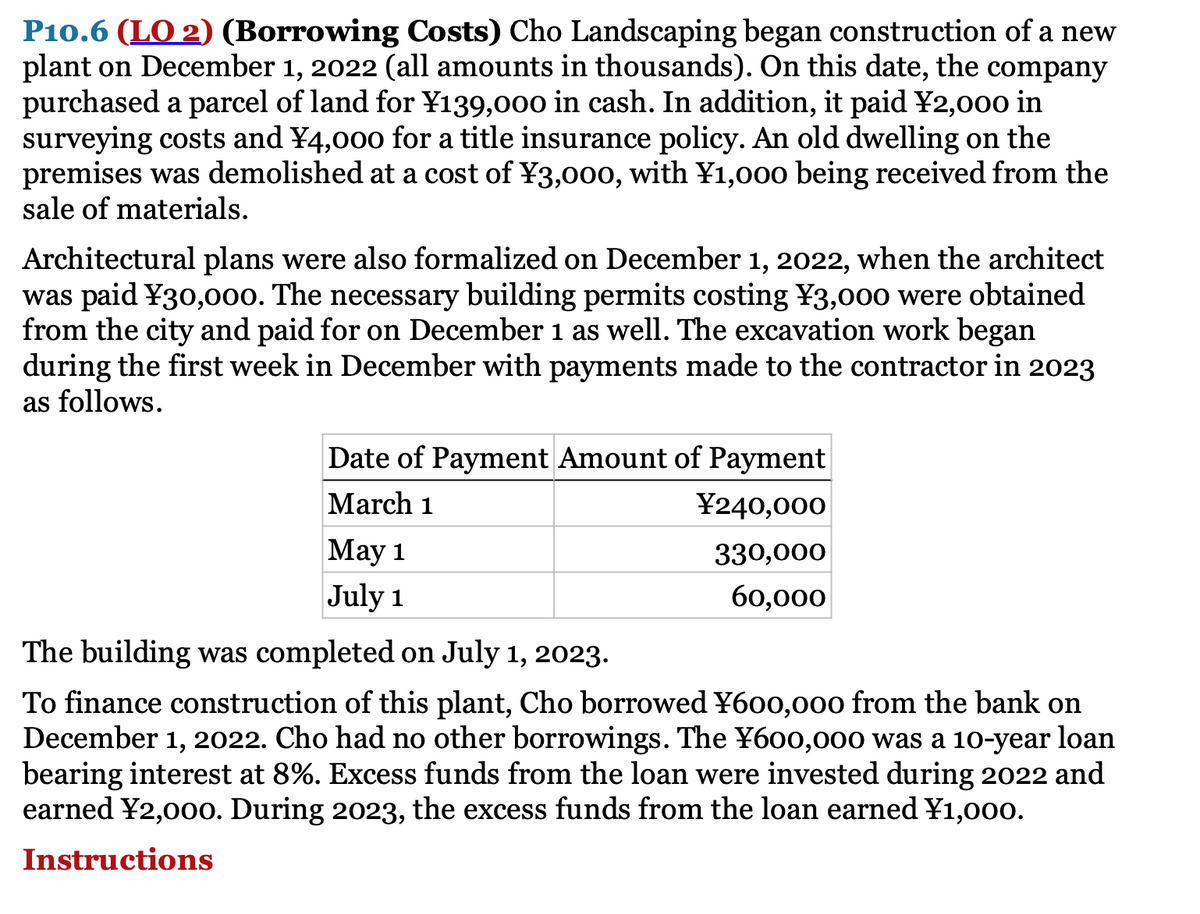

P10.6 (LO 2) (Borrowing Costs) Cho Landscaping began construction of a new plant on December 1, 2022 (all amounts in thousands). On this date, the company purchased a parcel of land for ¥139,000 in cash. In addition, it paid ¥2,000 in surveying costs and ¥4,000 for a title insurance policy. An old dwelling on the premises was demolished at a cost of ¥3,000, with ¥1,000 being received from the sale of materials. Architectural plans were also formalized on December 1, 2022, when the architect was paid ¥30,00o. The necessary building permits costing ¥3,000 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2023 as follows. Date of Payment Amount of Payment March 1 ¥240,000 Мay 1 330,000 July 1 60,000 The building was completed on July 1, 2023. To finance construction of this plant, Cho borrowed ¥600,000 from the bank on December 1, 2022. Cho had no other borrowings. The ¥600,00o was a 10-year loan bearing interest at 8%. Excess funds from the loan were invested during 2022 and earned ¥2,000. During 2023, the excess funds from the loan earned ¥1,000. Instructions

P10.6 (LO 2) (Borrowing Costs) Cho Landscaping began construction of a new plant on December 1, 2022 (all amounts in thousands). On this date, the company purchased a parcel of land for ¥139,000 in cash. In addition, it paid ¥2,000 in surveying costs and ¥4,000 for a title insurance policy. An old dwelling on the premises was demolished at a cost of ¥3,000, with ¥1,000 being received from the sale of materials. Architectural plans were also formalized on December 1, 2022, when the architect was paid ¥30,00o. The necessary building permits costing ¥3,000 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2023 as follows. Date of Payment Amount of Payment March 1 ¥240,000 Мay 1 330,000 July 1 60,000 The building was completed on July 1, 2023. To finance construction of this plant, Cho borrowed ¥600,000 from the bank on December 1, 2022. Cho had no other borrowings. The ¥600,00o was a 10-year loan bearing interest at 8%. Excess funds from the loan were invested during 2022 and earned ¥2,000. During 2023, the excess funds from the loan earned ¥1,000. Instructions

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 55P

Related questions

Question

100%

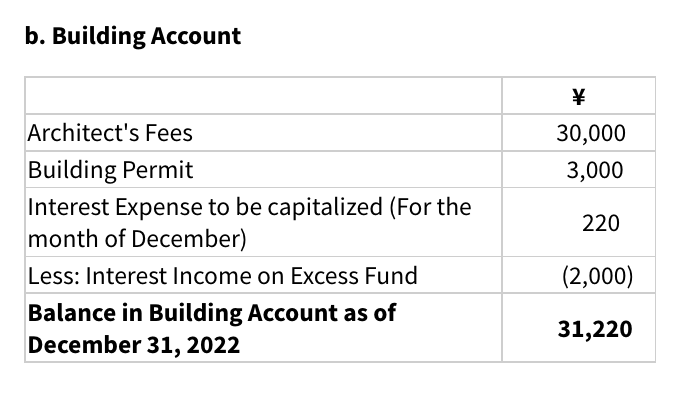

How did the tutor calculate the 'interest expense to be capitalized' (amnt. of 220) in this problem?

Transcribed Image Text:P10.6 (LO 2) (Borrowing Costs) Cho Landscaping began construction of a new

plant on December 1, 2022 (all amounts in thousands). On this date, the company

purchased a parcel of land for ¥139,000 in cash. In addition, it paid ¥2,000 in

surveying costs and ¥4,000 for a title insurance policy. An old dwelling on the

premises was demolished at a cost of ¥3,000, with ¥1,000 being received from the

sale of materials.

Architectural plans were also formalized on December 1, 2022, when the architect

was paid ¥30,00o. The necessary building permits costing ¥3,000 were obtained

from the city and paid for on December 1 as well. The excavation work began

during the first week in December with payments made to the contractor in 2023

as follows.

Date of Payment Amount of Payment

March 1

¥240,000

Маy 1

330,000

July 1

60,000

The building was completed on July 1, 2023.

To finance construction of this plant, Cho borrowed ¥600,00o from the bank on

December 1, 2022. Cho had no other borrowings. The ¥600,000 was a 10-year loan

bearing interest at 8%. Excess funds from the loan were invested during 2022 and

earned ¥2,000o. During 2023, the excess funds from the loan earned ¥1,00o.

Instructions

Transcribed Image Text:b. Building Account

Architect's Fees

30,000

Building Permit

Interest Expense to be capitalized (For the

month of December)

3,000

220

Less: Interest Income on Excess Fund

(2,000)

Balance in Building Account as of

December 31, 2022

31,220

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College