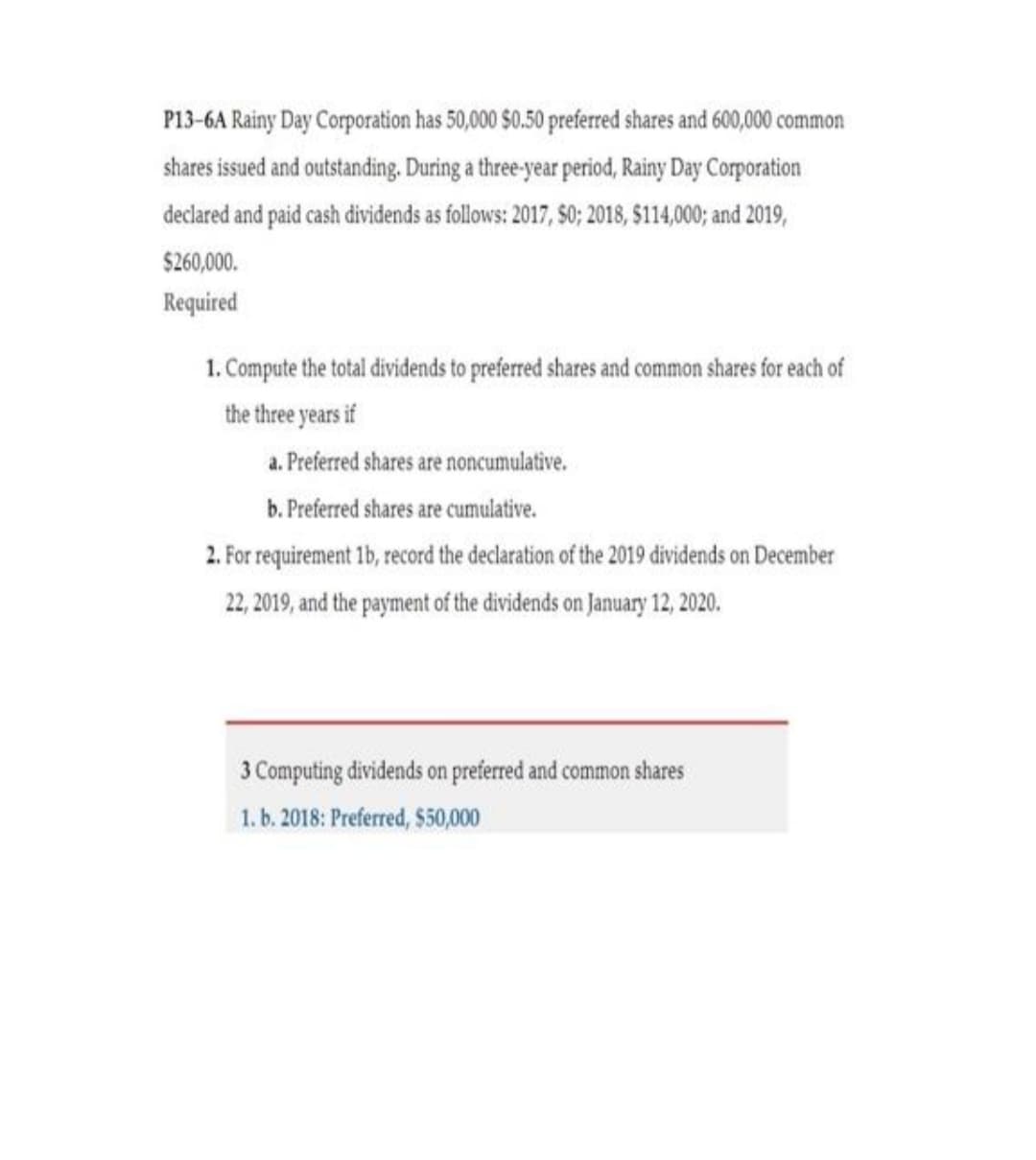

P13-6A Rainy Day Corporation has 50,000 $0.50 preferred shares and 600,000 common shares issued and outstanding. During a three-year period, Rainy Day Corporation declared and paid cash dividends as follows: 2017, $0; 2018, $114,000; and 2019, $260,000. Required 1. Compute the total dividends to preferred shares and common shares for each of the three years if a. Preferred shares are noncumulative. b. Preferred shares are cumulative.

Q: ▪ Issued 4,800 shares of $2 par value common stock for $26. It authorized 20,000 shares. • Issued…

A: The balance sheet shows the financial position of the company. It involves the assets, liabilities,…

Q: The following are the non-strategic investment transactions of Wiki Garden Tool Inc. Assume each…

A: Journal is the recording of financial transactions using dual entity concept and in chronological…

Q: Journal епхоу? a. Issued 1,000 shares of $10 par common stock at $59 for cash.

A: Introduction: Issuing common stock gives the holders, the ownership of an organization. Along with…

Q: Quatro Company issues bonds dated January 1, 2021, with a par value of $900,000. The bonds' annual…

A: When a corporation sells bonds to earn cash, bonds payable are recognized. The corporation is a…

Q: Salaries and wages payable Salaries and wages expense Utilities expense Equipment $1,700 Notes…

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: cost ratio, the conservative/conventional retail method should A. Exclude mark-up but not markdown…

A: The conservative/conventional retail method estimates the lower of cost (average) or market value…

Q: Beginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning…

A: In case of Last in first out method the latest goods will be sold first.

Q: Use the following information for Meeker Corporation to determine the amount of equity to report.…

A: >Accounting equation states that Total Assets = Total Liabilities + Total equity. >This…

Q: What is a summary of the changes in each partner's capital in a partnership that have occurred…

A: The assets and liabilities of partnership are presented in Balance sheet. The income and expenses…

Q: cash flow

A: Cash flows refer to the measurement of cash inflows and cash outflows in a company in a particular…

Q: 2. On June 4, Marie Company had cash sales rung up by cashiers totaling $119,000Cash in the drawer…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: describe book keeping in financial accounting in detail

A: The process of recording the daily company financial transaction is called Book Keeping. It is a…

Q: Torino Company has 10,000 shares of $5 par value, 4% cumulative preferred stock and 100,000 shares…

A: A shareholder, also known as a stockholder, is an individual, corporation, or institution who owns…

Q: A fire occurred in the City of Pasay and coincided with the looting of stock of plywood of a lumber…

A: Given that fire occurred which results in loss of stock of lumber Company

Q: When the total direct labor cost variance is unfavorable, the direct labor rate variance will (must)…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: What is difference between general ledger and balance sheet. If possible, can you give me an…

A: The accounting is a process to record the financial transactions on regular basis and prepare the…

Q: 4/3 Paid the Gazette $200 to place an employment advertisement for an accounting clerk. how to solve…

A: Introduction: Journal: All the business transactions are to be recorded in Journals. Journals are…

Q: A city's Parks Department has these two General Fund appropriations: Parks department salaries and…

A: The journal entries are prepared to record the transactions on regular basis. The assets and…

Q: Westwood Music uses flexible budgets to control its selling expenses. Monthly sales are expected to…

A: A flexible budget performance report evaluates actual sales and expenditures for a timeframe to…

Q: Q3. (Horngren) Inorganic Chemicals (IC) processes salt into various industrial products. In July…

A: Comment Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: capital balance of Lucky after admission?

A: WHEN A NEW PARTNER IS AADMISTED INTO THE PARNERSHIP, NEW PROFIT SHARING RATIO WILL BE CALCULATED,…

Q: Which of the following statements correctly gives the account to be debited and the account to be…

A: Cash is being reduced so cash will be credited. So first two options are incorrect. For drawings,…

Q: The forward rate is 0.8500-0.8650 euros to the 1$ What will a euro 2,000 receipt be converted to at…

A: As per forward rate, the sell rate is 0.865 If 2000 euros converted to $ at forward rate then it…

Q: Given the Actual Demand from January to June of 2021, along with the forecasts based on three (3)…

A: Forecasting is a process of predicting the future demand based on the available previous demand…

Q: You are an accountant working for a company that has recently decided to incorporate. The company…

A: The journal entries are prepared to record the transactions on the regular basis. The assets and…

Q: ABC Company uses the retail inventory method to estimate its inventory for interim financial…

A: Ending inventory refers to the stock value which remains at the end of the fiscal year or the year…

Q: What type of opinion is issued by the auditorr if he or she is unable to determine the overall…

A: Introduction: Auditing is the process of verifying, validating, and investigating all financial…

Q: Cost of goods manufactured Selling expenses Administrative expenses Sales Finished goods inventory,…

A: Formula: Cost of finished goods available for sale = Beginning finished goods - Cost of goods…

Q: Explain the significant inherent risks associated with inventory. Explain the process of physical…

A: Internal controls mean to control the internal activities of the company. the internal control is…

Q: Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim…

A: The inventory turnover ratio is the ratio that tells about the turnover of the inventory. It shows…

Q: Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the…

A: Allowance for doubtful accounts - Allowance for doubtful accounts is the provision made by the…

Q: Create simple examples to illustrate the following concepts. i. Time value of money ii. Effective…

A: i) Time Value of Money: The concept of time value of money underlines that the value of money today…

Q: a. Sampson Co. sold merchandise to Batson Co. on account, $22,200, terms 2/15, net 45. b. The cost…

A: Accounts receivable on date of sale = $22, 200 - ($22, 200 × 2%) = $22, 200 - $444 = $21, 756

Q: Describe common substantive procedures used to audit a client’s property, plant, and equipment. How…

A: The auditor’s main objective is to form an opinion on the financial statement of the company. The…

Q: BIN MANUFACTURING Current Assets Section of the Balance Sheet December 31 Total current assets $

A: The balance sheet is prepared to represent the financial position of the business with assets and…

Q: If the net realizable of an entity's inventories is less than its cost, the entry to adjust the…

A: Introduction: Under the lower of cost or net realizable value (LCNRV) method, if net selling price…

Q: What is the maximum number of shares of stock that a corporation can issue over the life of the…

A: The financial statements of the business includes the income statement and balance sheet. The…

Q: Problem (2) XYZ corporation currently practices the following system for the procurement of an item:…

A: Economic Order Quantity EOQ=2×Annual Demand×Ordering Cost per orderHolding cost per unit

Q: Assess the truth of this statement: The day-by-day transactions of a partnership are recorded in…

A: A partnership is a form of business where two or more partners are agreed to carry a business and…

Q: A bond sells at a discount when the: Multiple Choice Bond has a short-term life. Contract rate is…

A: A bond can be sold at premium, discount or at par.

Q: llocate the costs incurred by Mitzu to the appropriate columns and total each column.

A:

Q: Accounts Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation Accounts…

A: Lets understand the basics. Shareholders equity includes total of common stock issued plus retained…

Q: Feb 2-Märt established a petty cash fund recently and the following transactions affecting the fund…

A: The petty cash fund is established to maintain the cash balance for smaller cash transactions of the…

Q: This problem illustrates how costs of two corporate support departments are allocated tooperating…

A: Direct Method- The direct method is used to create a company's cash flow statement by using the…

Q: Ecker Company reports $1,950,000 of net income and declares $273,000 of cash dividends on its…

A: In order to determine the Earning per share, the Earnings available to common shareholders are…

Q: Date of issuance: June 17, 2018 Optionally redeemable beginning: June 18, 2020 Par value (gross…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Lided to propose some improvements that will affect and change their cost per category, as ow.…

A: Productivity: It is the relationship between the output and input, means production produced and…

Q: Letty Company provided the bank statement for the month of April which included the following…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: What is meant by a promissory note?

A: The amount due to be paid for loan can be promissed by customer by issuing promissory note.

Q: Coffee Co. incurred P5,000,000 on a self-created computer software, P2,100,000 of which was incurred…

A: Lets understand the basics. Ass per IAS 38 "Intangible assets", all expenditure incurred up to…

Step by step

Solved in 2 steps

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.