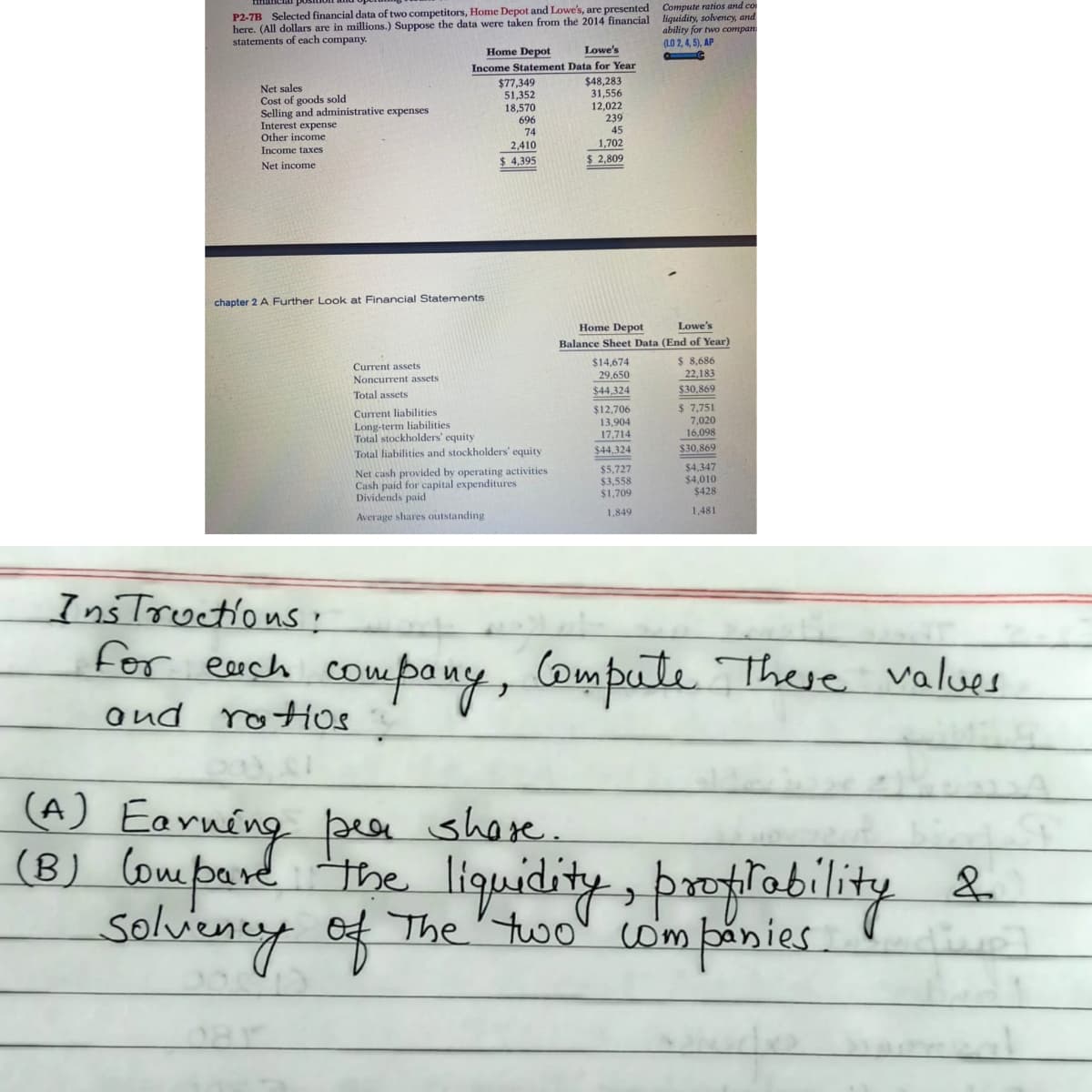

P2-7B Selected financial data of two competitors, Home Depot and Lowe's, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2014 financial liquidity, solvency, and statements of each company. Compule rafic ability for two compan (LO 2, 4, 5), AP Home Depot Lowe's Income Statement Data for Year Net sales Cost of goods sold Selling and administrative expenses $77,349 51,352 18,570 696 74 $48,283 31,556 12,022 239 45 Interest expense Other income Income taxes 2,410 1,702 Net income $4,395 $ 2,809 chapter 2 A Further Look at Financial Statements Home Depot Lowe's Balance Sheet Data (End of Year) Current assets Noncurrent assets $14,674 29,650 $ 8,686 22,183 %2430,869 Total assets $44,324 Current liabilities Long-term liabiliti Total stockholders' equity Total liabilities and stockholders' equity $12,706 13,904 17,714 $ 7,751 7,020 16.098 $44,324 $30,869 Net cash provided by operating activities Cash paid for capital expenditures Dividends paid $5,727 $3,558 $1,709 $4,347 $4,010 $428 Average shares outstanding 1,849 1,481 osTroctions! for earch compoa ny, ompute These values oud rotios Compard yese liquidity, brtlability & Earning pea shore. solvieney of The two" compănies

P2-7B Selected financial data of two competitors, Home Depot and Lowe's, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2014 financial liquidity, solvency, and statements of each company. Compule rafic ability for two compan (LO 2, 4, 5), AP Home Depot Lowe's Income Statement Data for Year Net sales Cost of goods sold Selling and administrative expenses $77,349 51,352 18,570 696 74 $48,283 31,556 12,022 239 45 Interest expense Other income Income taxes 2,410 1,702 Net income $4,395 $ 2,809 chapter 2 A Further Look at Financial Statements Home Depot Lowe's Balance Sheet Data (End of Year) Current assets Noncurrent assets $14,674 29,650 $ 8,686 22,183 %2430,869 Total assets $44,324 Current liabilities Long-term liabiliti Total stockholders' equity Total liabilities and stockholders' equity $12,706 13,904 17,714 $ 7,751 7,020 16.098 $44,324 $30,869 Net cash provided by operating activities Cash paid for capital expenditures Dividends paid $5,727 $3,558 $1,709 $4,347 $4,010 $428 Average shares outstanding 1,849 1,481 osTroctions! for earch compoa ny, ompute These values oud rotios Compard yese liquidity, brtlability & Earning pea shore. solvieney of The two" compănies

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 27E

Related questions

Question

Transcribed Image Text:P2-7B Selected financial data of two competitors, Home Depot and Lowe's, are presented

here. (All dollars are in millions.) Suppose the data were taken from the 2014 financial liquidity, solvency, and

statements of each company.

Compute ratios and co

ability for two compan

(LO 2, 4, 5), AP

Home Depot

Lowe's

Income Statement Data for Year

$48,283

31,556

$77,349

51,352

18,570

696

Net sales

Cost of goods sold

Selling and administrative expenses

12,022

239

Interest expense

Other income

Income taxes

74

45

2,410

1,702

$4,395

$ 2,809

Net income

chapter 2 A Further Look at Financial Statements

Home Depot

Lowe's

Balance Sheet Data (End of Year)

$ 8,686

22,183

$14,674

Current assets

29,650

Noncurrent assets

$44,324

$30,869

Total assets

$ 7,751

7,020

16,098

Current liabilities

$12,706

Long-term liabilities

Total stockholders' equity

13,904

17,714

$44,324

$30,869

Total liabilities and stockholders' equity

Net cash provided by operating activities

Cash paid for capital expenditures

Dividends paid

$5,727

$3,558

$1,709

$4,347

$4,010

$428

1,849

1,481

Average shares outstanding

Instructions!

for each Compute These values

aud rotios

compony,

(A) Earning

pea share.

(8) Coue pard tese liquidity, brlobility &

The' two" com þanies

solvieny

.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning