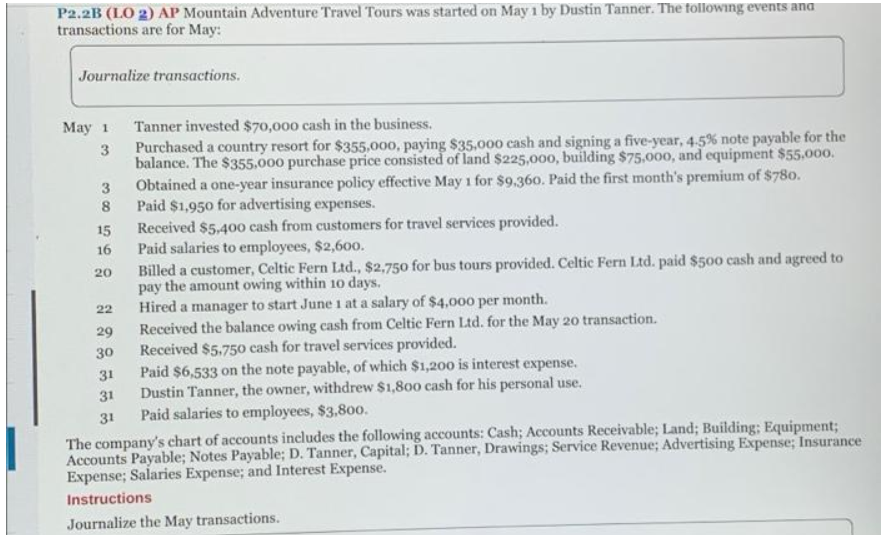

P2.2B (LO 2) AP Mountain Adventure Travel Tours was started on May 1 by Dustin Tanner. The following events and transactions are for May: Journalize transactions. May 1 Tanner invested $70,000 cash in the business. 3 Purchased a country resort for $355,000, paying $35,000 cash and signing a five-year, 4.5% note payable for the balance. The $355,000 purchase price consisted of land $225,000, building $75,000, and equipment $55,000. 3 Obtained a one-year insurance policy effective May 1 for $9,360. Paid the first month's premium of $780. Paid $1,950 for advertising expenses. 8 15 Received $5,400 cash from customers for travel services provided. 16 Paid salaries to employees, $2,600. 20 Billed a customer, Celtic Fern Ltd., $2,750 for bus tours provided. Celtic Fern Ltd. paid $500 cash and agreed to pay the amount owing within 10 days. 22 Hired a manager to start June 1 at a salary of $4,000 per month. 29 Received the balance owing cash from Celtic Fern Ltd. for the May 20 transaction. 30 Received $5.750 cash for travel services provided. 31 Paid $6,533 on the note payable, of which $1,200 is interest expense. 31 Dustin Tanner, the owner, withdrew $1,800 cash for his personal use. 31 Paid salaries to employees, $3,800. The company's chart of accounts includes the following accounts: Cash; Accounts Receivable; Land; Building; Equipment; Accounts Payable; Notes Payable; D. Tanner, Capital; D. Tanner, Drawings; Service Revenue; Advertising Expense; Insurance Expense; Salaries Expense; and Interest Expense. Instructions Journalize the May transactions.

P2.2B (LO 2) AP Mountain Adventure Travel Tours was started on May 1 by Dustin Tanner. The following events and transactions are for May: Journalize transactions. May 1 Tanner invested $70,000 cash in the business. 3 Purchased a country resort for $355,000, paying $35,000 cash and signing a five-year, 4.5% note payable for the balance. The $355,000 purchase price consisted of land $225,000, building $75,000, and equipment $55,000. 3 Obtained a one-year insurance policy effective May 1 for $9,360. Paid the first month's premium of $780. Paid $1,950 for advertising expenses. 8 15 Received $5,400 cash from customers for travel services provided. 16 Paid salaries to employees, $2,600. 20 Billed a customer, Celtic Fern Ltd., $2,750 for bus tours provided. Celtic Fern Ltd. paid $500 cash and agreed to pay the amount owing within 10 days. 22 Hired a manager to start June 1 at a salary of $4,000 per month. 29 Received the balance owing cash from Celtic Fern Ltd. for the May 20 transaction. 30 Received $5.750 cash for travel services provided. 31 Paid $6,533 on the note payable, of which $1,200 is interest expense. 31 Dustin Tanner, the owner, withdrew $1,800 cash for his personal use. 31 Paid salaries to employees, $3,800. The company's chart of accounts includes the following accounts: Cash; Accounts Receivable; Land; Building; Equipment; Accounts Payable; Notes Payable; D. Tanner, Capital; D. Tanner, Drawings; Service Revenue; Advertising Expense; Insurance Expense; Salaries Expense; and Interest Expense. Instructions Journalize the May transactions.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 10DQ

Related questions

Question

Transcribed Image Text:P2.2B (LO 2) AP Mountain Adventure Travel Tours was started on May 1 by Dustin Tanner. The following events and

transactions are for May:

Journalize transactions.

May 1

Tanner invested $70,000 cash in the business.

3

Purchased a country resort for $355,000, paying $35,000 cash and signing a five-year, 4.5% note payable for the

balance. The $355,000 purchase price consisted of land $225,000, building $75,000, and equipment $55,000.

Obtained a one-year insurance policy effective May 1 for $9,360. Paid the first month's premium of $780.

Paid $1,950 for advertising expenses.

3

8

15

Received $5,400 cash from customers for travel services provided.

16

Paid salaries to employees, $2,600.

20

Billed a customer, Celtic Fern Ltd., $2,750 for bus tours provided. Celtic Fern Ltd. paid $500 cash and agreed to

pay the amount owing within 10 days.

22

Hired a manager to start June 1 at a salary of $4,000 per month.

29

Received the balance owing cash from Celtic Fern Ltd. for the May 20 transaction.

30

Received $5,750 cash for travel services provided.

31

Paid $6,533 on the note payable, of which $1,200 is interest expense.

31

Dustin Tanner, the owner, withdrew $1,800 cash for his personal use.

31

Paid salaries to employees, $3,800.

The company's chart of accounts includes the following accounts: Cash; Accounts Receivable; Land; Building; Equipment;

Accounts Payable; Notes Payable; D. Tanner, Capital; D. Tanner, Drawings; Service Revenue; Advertising Expense; Insurance

Expense; Salaries Expense; and Interest Expense.

Instructions

Journalize the May transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT