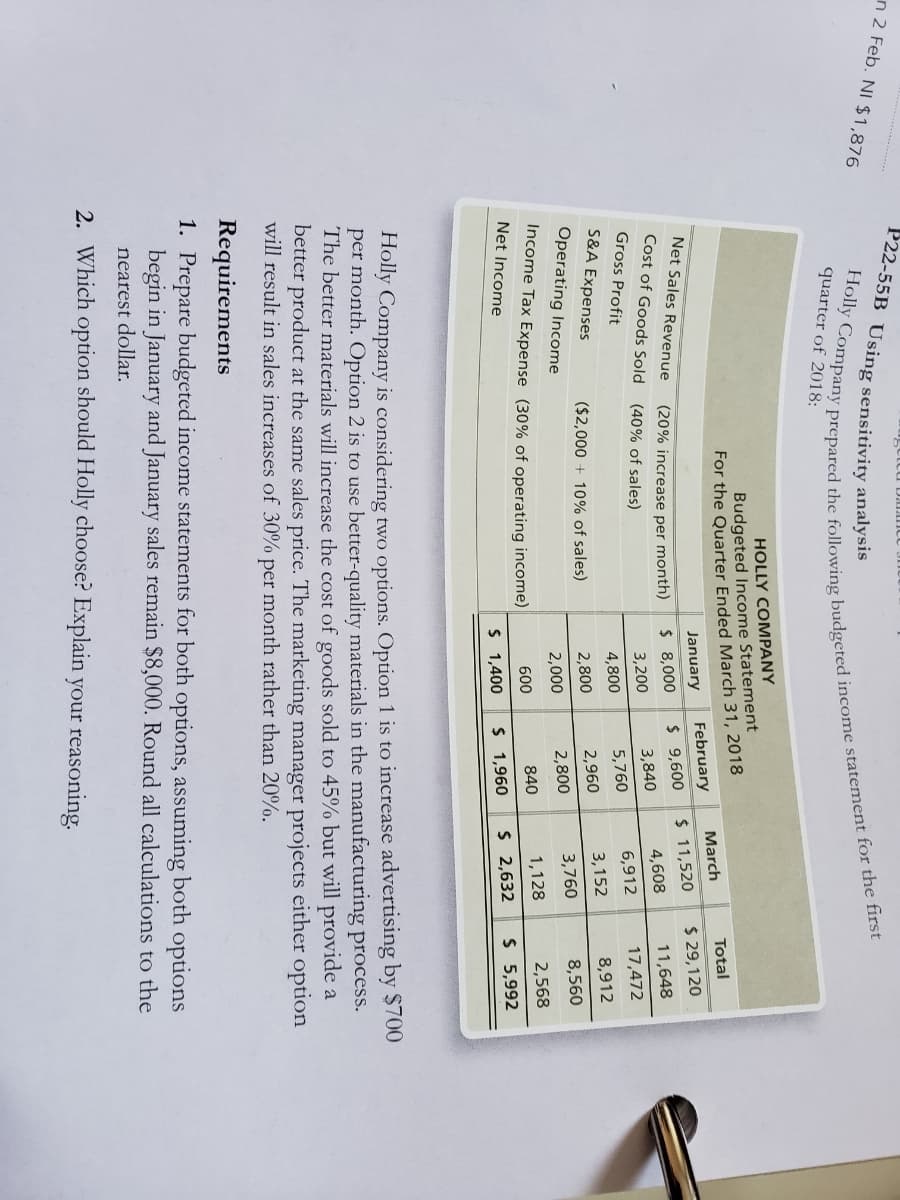

P22-55B Using sensitivity analysis Holly Company prepared the following budgeted income statement for the first quarter of 2018: HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 Total March January February Net Sales Revenue $ 11,520 $ 29,120 Cost of Goods Sold (40% of sales) (20% increase per month) $ 8,000 $ 9,600 4,608 11,648 3,200 3,840 Gross Profit 6,912 17,472 4,800 5,760 S&A Expenses ($2,000 + 10% of sales) 2,800 2,960 3,152 8,912 Operating Income 2,000 2,800 3,760 8,560 Income Tax Expense (30% of operating income) 840 1,128 2,568 600 Net Income $ 1,400 $ 1,960 $ 2,632 $ 5,992 Holly Company is considering two options. Option 1 is to increase advertising by $700 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 45% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 30% per month rather than 20%. Requirements 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. Round all calculations to the nearest dollar. 2. Which option should Holly choose? Explain your reasoning.

P22-55B Using sensitivity analysis Holly Company prepared the following budgeted income statement for the first quarter of 2018: HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 Total March January February Net Sales Revenue $ 11,520 $ 29,120 Cost of Goods Sold (40% of sales) (20% increase per month) $ 8,000 $ 9,600 4,608 11,648 3,200 3,840 Gross Profit 6,912 17,472 4,800 5,760 S&A Expenses ($2,000 + 10% of sales) 2,800 2,960 3,152 8,912 Operating Income 2,000 2,800 3,760 8,560 Income Tax Expense (30% of operating income) 840 1,128 2,568 600 Net Income $ 1,400 $ 1,960 $ 2,632 $ 5,992 Holly Company is considering two options. Option 1 is to increase advertising by $700 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 45% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 30% per month rather than 20%. Requirements 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. Round all calculations to the nearest dollar. 2. Which option should Holly choose? Explain your reasoning.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:n 2 Feb. NI $1,876

-....

quarter of 2018:

HOLLY COMPANY

Budgeted Income Statement

For the Quarter Ended March 31, 2018

Total

March

February

Net Sales Revenue

January

$ 11,520

$ 29,120

(20% increase per month)

$ 8,000

$ 9,600

Cost of Goods Sold (40% of sales)

11,648

3,840

4,608

3,200

Gross Profit

6,912

17,472

4,800

5,760

S&A Expenses

2,960

3,152

8,912

($2,000 + 10% of sales)

2,800

Operating Income

3,760

8,560

2,000

2,800

Income Tax Expense (30% of operating income)

2,568

600

840

1,128

Net Income

$ 1,400

$ 1,960

$ 2,632

$ 5,992

Holly Company is considering two options. Option 1 is to increase advertising by $700

per month. Option 2 is to use better-quality materials in the manufacturing process.

The better materials will increase the cost of goods sold to 45% but will provide a

better product at the same sales price. The marketing manager projects either option

will result in sales increases of 30% per month rather than 20%.

Requirements

1. Prepare budgeted income statements for both options, assuming both options

begin in January and January sales remain $8,000. Round all calculations to the

nearest dollar.

2. Which option should Holly choose? Explain your reasoning.

Holly for the first

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College