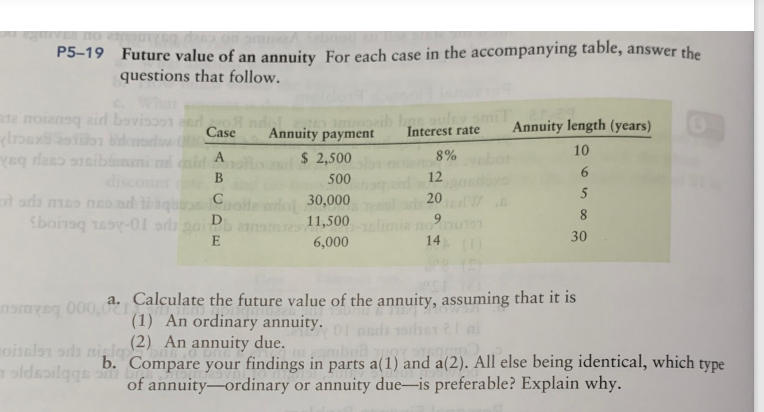

P5-19 Future value of an annuity For each case in the accompanying table, answer the questions that follow. roiensq aid bevisson and oft dolorib ban suley smit Case Annuity payment Interest rate Annuity length (years) 10 8% dass ssiblmani m $ 2,500 B 500 12 5 20. da mes neo ad hi 30,000 8 Sboisq 1697-01 od goib amat 11,500 E 6,000 30 14 (1) a. Calculate the future value of the annuity, assuming that it is yq 000,0 Cal (1) An ordinary annuity. 1561 2.1 mi (2) An annuity due. slon oda nielq soilggs ou b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity due-is preferable? Explain why.

P5-19 Future value of an annuity For each case in the accompanying table, answer the questions that follow. roiensq aid bevisson and oft dolorib ban suley smit Case Annuity payment Interest rate Annuity length (years) 10 8% dass ssiblmani m $ 2,500 B 500 12 5 20. da mes neo ad hi 30,000 8 Sboisq 1697-01 od goib amat 11,500 E 6,000 30 14 (1) a. Calculate the future value of the annuity, assuming that it is yq 000,0 Cal (1) An ordinary annuity. 1561 2.1 mi (2) An annuity due. slon oda nielq soilggs ou b. Compare your findings in parts a(1) and a(2). All else being identical, which type of annuity-ordinary or annuity due-is preferable? Explain why.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 7P: Value of an Annuity Using the appropriate tables, solve each of the following. Required: 1....

Related questions

Question

Transcribed Image Text:P5-19 Future value of an annuity For each case in the accompanying table, answer the

questions that follow.

ndo

Case

Annuity length (years)

ste noiensq aid bevisson do

(bax 2011 Binodw 000

yaq dass sicibanim id A

17 mozib bat suley smit

Annuity payment

Interest rate

10

$ 2,500

8%

B

500

12

с

otada mes nesal ti

30,000

20

D

Sboisq 1854-01 od goib ans

11,500-li

6,000

E

30

14 (1)

a. Calculate the future value of the annuity, assuming that it is

smysq 000,0

(1) An ordinary annuity.

(2) An annuity due.

moisel1 sdi nila

type

oldspilggs b. Compare your findings in parts a(1) and a(2). All else being identical, which

of annuity-ordinary or annuity due-is preferable? Explain why.

6

5

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning