PA5. LO 13.3Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4- year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. July 1, 2018: entry to record issuing the bonds une 30, 2019: entry to record payment of interest to bondholders une 30, 2019: entry to record amortization of premium une 30, 2020: entry to record payment of interest to bondholders une 30, 2020: entry to record amortization of premium

PA5. LO 13.3Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4- year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. July 1, 2018: entry to record issuing the bonds une 30, 2019: entry to record payment of interest to bondholders une 30, 2019: entry to record amortization of premium une 30, 2020: entry to record payment of interest to bondholders une 30, 2020: entry to record amortization of premium

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10EA: Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 6,000 treats...

Related questions

Question

PA5

Transcribed Image Text:Assignment #1

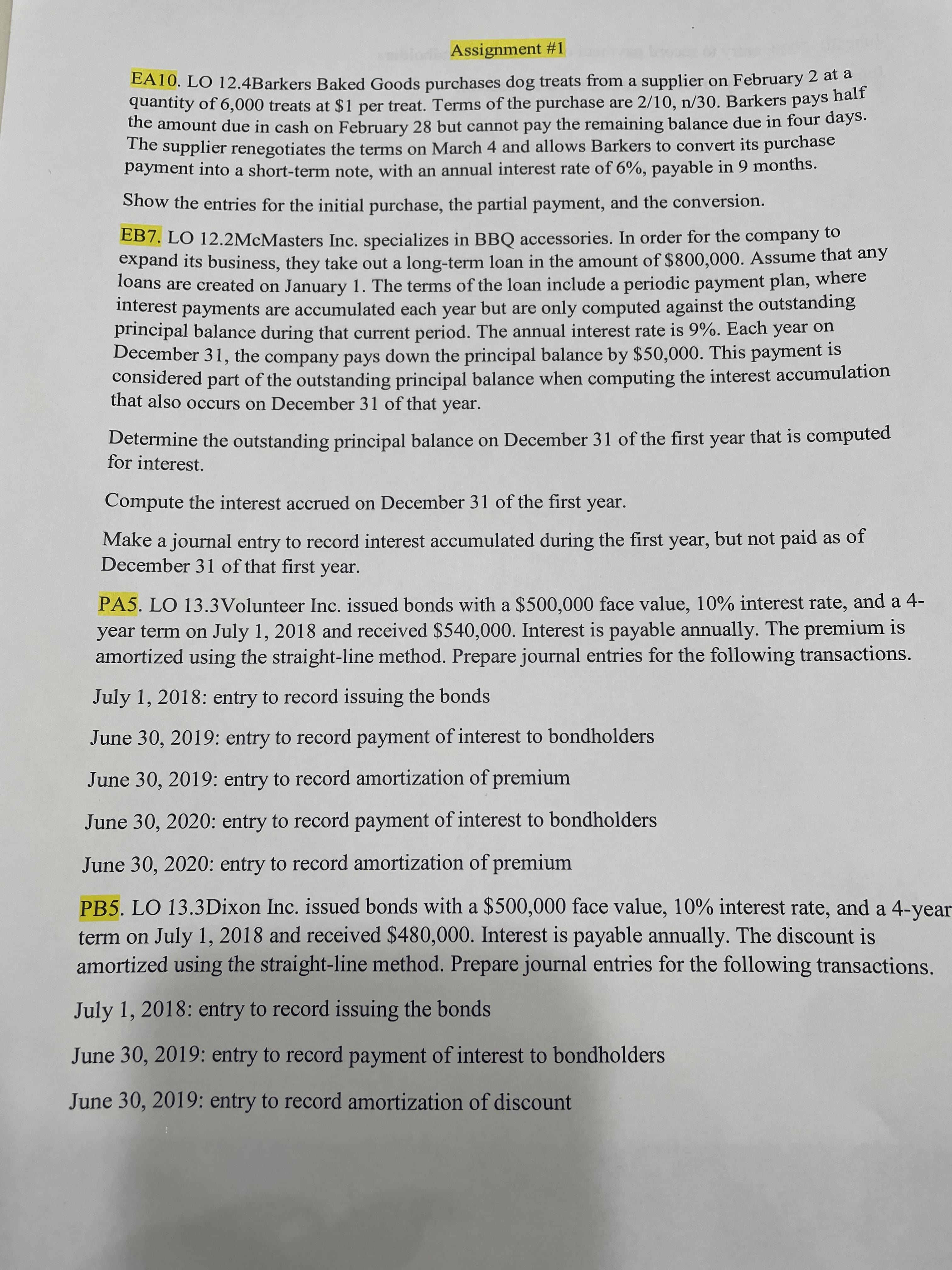

EA10. LO 12.4Barkers Baked Goods purchases dog treats from a supplier on February 2 at a

quantity of 6,000 treats at $1 per treat. Terms of the purchase are 2/10, n/30. Barkers pays half

the amount due in cash on February 28 but cannot pay the remaining balance due in four days.

The supplier renegotiates the terms on March 4 and allows Barkers to convert its purchase

payment into a short-term note, with an annual interest rate of 6%, payable in 9 months.

Show the entries for the initial purchase, the partial payment, and the conversion.

EB7, LO 12.2McMasters Inc. specializes in BBQ accessories. In order for the company to

expand its business, they take out a long-term loan in the amount of $800,000. Assume that any

loans are created on January 1. The terms of the loan include a periodic payment plan, where

interest payments are accumulated each year but are only computed against the outstanding

principal balance during that current period. The annual interest rate is 9%. Each year on

December 31, the company pays down the principal balance by $50,000. This payment is

considered part of the outstanding principal balance when computing the interest accumulation

that also occurs on December 31 of that year.

Determine the outstanding principal balance on December 31 of the first year that is computed

for interest.

Compute the interest accrued on December 31 of the first year.

Make a journal entry to record interest accumulated during the first year, but not paid as of

December 31 of that first year.

PA5. LO 13.3Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-

year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is

amortized using the straight-line method. Prepare journal entries for the following transactions.

July 1, 2018: entry to record issuing the bonds

June 30, 2019: entry to record payment of interest to bondholders

June 30, 2019: entry to record amortization of premium

June 30, 2020: entry to record payment of interest to bondholders

June 30, 2020: entry to record amortization of premium

PB5. LO 13.3Dixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year

term on July 1, 2018 and received $480,000. Interest is payable annually. The discount is

amortized using the straight-line method. Prepare journal entries for the following transactions.

July 1, 2018: entry to record issuing the bonds

June 30, 2019: entry to record payment of interest to bondholders

June 30, 2019: entry to record amortization of discount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College