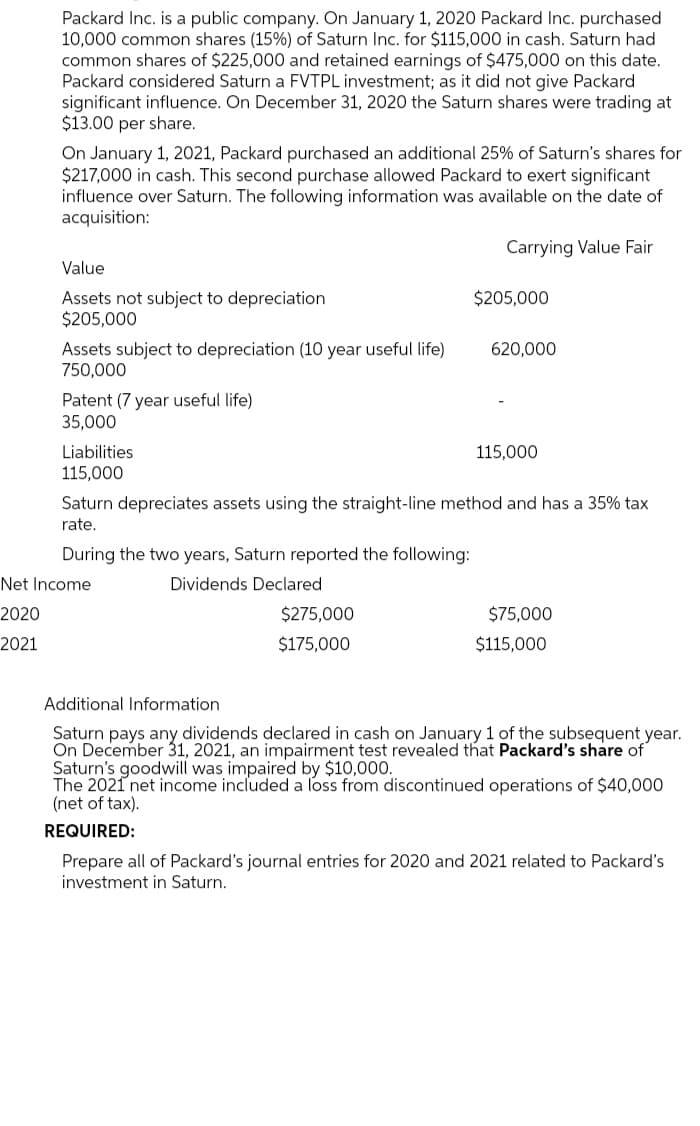

Packard Inc. is a public company. On January 1, 2020 Packard Inc. purchased 10,000 common shares (15%) of Saturn Inc. for $115,000 in cash. Saturn had common shares of $225,000 and retained earnings of $475,000 on this date. Packard considered Saturn a FVTPL investment; as it did not give Packard significant influence. On December 31, 2020 the Saturn shares were trading at $13.00 per share. On January 1, 2021, Packard purchased an additional 25% of Saturn's shares for $217,000 in cash. This second purchase allowed Packard to exert significant influence over Saturn. The following information was available on the date of acquisition: Carrying Value Fair Value Assets not subject to depreciation $205,000 Assets subject to depreciation (10 year useful life) 750,000 Patent (7 year useful life) 35,000 Liabilities 115,000 115,000 Saturn depreciates assets using the straight-line method and has a 35% tax rate. During the two years, Saturn reported the following: Dividends Declared $275,000 $75,000 $175,000 $115,000 Additional Information Saturn pays any dividends declared in cash on January 1 of the subsequent year. On December 31, 2021, an impairment test revealed that Packard's share of Saturn's goodwill was impaired by $10,000. The 2021 net income included a loss from discontinued operations of $40,000 (net of tax). REQUIRED: Prepare all of Packard's journal entries for 2020 and 2021 related to Packard's investment in Saturn. Net Income 2020 2021 $205,000 620,000

Packard Inc. is a public company. On January 1, 2020 Packard Inc. purchased 10,000 common shares (15%) of Saturn Inc. for $115,000 in cash. Saturn had common shares of $225,000 and retained earnings of $475,000 on this date. Packard considered Saturn a FVTPL investment; as it did not give Packard significant influence. On December 31, 2020 the Saturn shares were trading at $13.00 per share. On January 1, 2021, Packard purchased an additional 25% of Saturn's shares for $217,000 in cash. This second purchase allowed Packard to exert significant influence over Saturn. The following information was available on the date of acquisition: Carrying Value Fair Value Assets not subject to depreciation $205,000 Assets subject to depreciation (10 year useful life) 750,000 Patent (7 year useful life) 35,000 Liabilities 115,000 115,000 Saturn depreciates assets using the straight-line method and has a 35% tax rate. During the two years, Saturn reported the following: Dividends Declared $275,000 $75,000 $175,000 $115,000 Additional Information Saturn pays any dividends declared in cash on January 1 of the subsequent year. On December 31, 2021, an impairment test revealed that Packard's share of Saturn's goodwill was impaired by $10,000. The 2021 net income included a loss from discontinued operations of $40,000 (net of tax). REQUIRED: Prepare all of Packard's journal entries for 2020 and 2021 related to Packard's investment in Saturn. Net Income 2020 2021 $205,000 620,000

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Packard Inc. is a public company. On January 1, 2020 Packard Inc. purchased

10,000 common shares (15%) of Saturn Inc. for $115,000 in cash. Saturn had

common shares of $225,000 and retained earnings of $475,000 on this date.

Packard considered Saturn a FVTPL investment; as it did not give Packard

significant influence. On December 31, 2020 the Saturn shares were trading at

$13.00 per share.

On January 1, 2021, Packard purchased an additional 25% of Saturn's shares for

$217,000 in cash. This second purchase allowed Packard to exert significant

influence over Saturn. The following information was available on the date of

acquisition:

Carrying Value Fair

Value

Assets not subject to depreciation

$205,000

Assets subject to depreciation (10 year useful life)

750,000

Patent (7 year useful life)

35,000

Liabilities

115,000

115,000

Saturn depreciates assets using the straight-line method and has a 35% tax

rate.

During the two years, Saturn reported the following:

Dividends Declared

$275,000

$75,000

$175,000

$115,000

Additional Information

Saturn pays any dividends declared in cash on January 1 of the subsequent year.

On December 31, 2021, an impairment test revealed that Packard's share of

Saturn's goodwill was impaired by $10,000.

The 2021 net income included a loss from discontinued operations of $40,000

(net of tax).

REQUIRED:

Prepare all of Packard's journal entries for 2020 and 2021 related to Packard's

investment in Saturn.

Net Income

2020

2021

$205,000

620,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning