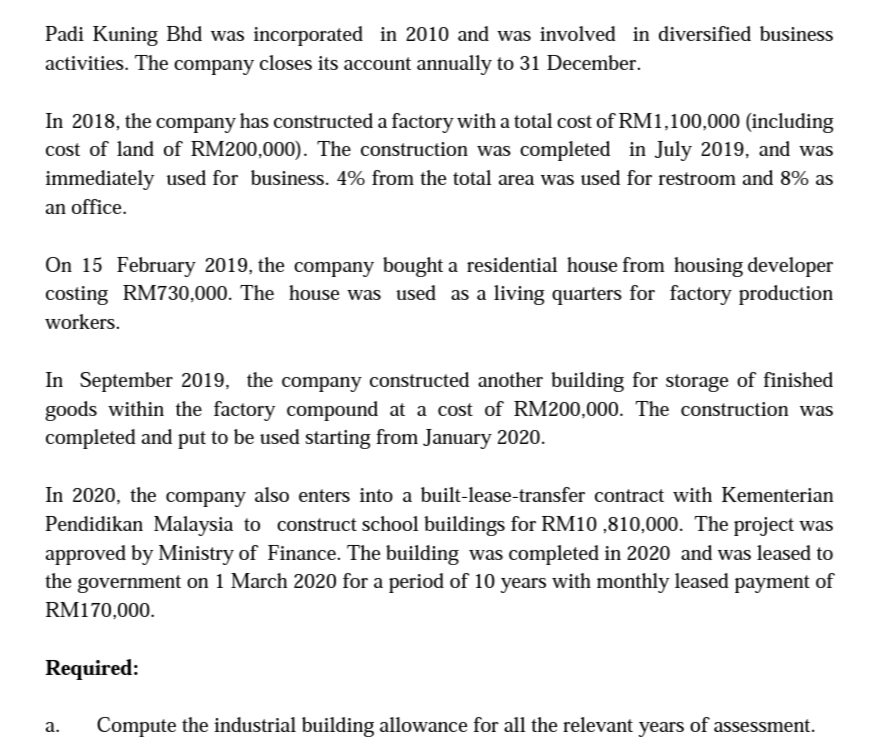

Padi Kuning Bhd was incorporated in 2010 and was involved in diversified business activities. The company closes its account annually to 31 December. In 2018, the company has constructed a factory with a total cost of RM1,100,000 (including cost of land of RM200,000). The construction was completed in July 2019, and was immediately used for business. 4% from the total area was used for restroom and 8% as an office. On 15 February 2019, the company bought a residential house from housing developer costing RM730,000. The house was used as a living quarters for factory production workers. In September 2019, the company constructed another building for storage of finished goods within the factory compound at a cost of RM200,000. The construction was completed and put to be used starting from January 2020. In 2020, the company also enters into a built-lease-transfer contract with Kementerian Pendidikan Malaysia to construct school buildings for RM10 ,810,000. The project was approved by Ministry of Finance. The building was completed in 2020 and was leased to the government on 1 March 2020 for a period of 10 years with monthly leased payment of RM170,000. Required: Compute the industrial building allowance for all the relevant years of assessment. a.

Padi Kuning Bhd was incorporated in 2010 and was involved in diversified business activities. The company closes its account annually to 31 December. In 2018, the company has constructed a factory with a total cost of RM1,100,000 (including cost of land of RM200,000). The construction was completed in July 2019, and was immediately used for business. 4% from the total area was used for restroom and 8% as an office. On 15 February 2019, the company bought a residential house from housing developer costing RM730,000. The house was used as a living quarters for factory production workers. In September 2019, the company constructed another building for storage of finished goods within the factory compound at a cost of RM200,000. The construction was completed and put to be used starting from January 2020. In 2020, the company also enters into a built-lease-transfer contract with Kementerian Pendidikan Malaysia to construct school buildings for RM10 ,810,000. The project was approved by Ministry of Finance. The building was completed in 2020 and was leased to the government on 1 March 2020 for a period of 10 years with monthly leased payment of RM170,000. Required: Compute the industrial building allowance for all the relevant years of assessment. a.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

Solve this

Transcribed Image Text:Padi Kuning Bhd was incorporated in 2010 and was involved in diversified business

activities. The company closes its account annually to 31 December.

In 2018, the company has constructed a factory with a total cost of RM1,100,000 (including

cost of land of RM200,000). The construction was completed in July 2019, and was

immediately used for business. 4% from the total area was used for restroom and 8% as

an office.

On 15 February 2019, the company bought a residential house from housing developer

costing RM730,000. The house was used as a living quarters for factory production

workers.

In September 2019, the company constructed another building for storage of finished

goods within the factory compound at a cost of RM200,000. The construction was

completed and put to be used starting from January 2020.

In 2020, the company also enters into a built-lease-transfer contract with Kementerian

Pendidikan Malaysia to construct school buildings for RM10 ,810,000. The project was

approved by Ministry of Finance. The building was completed in 2020 and was leased to

the government on 1 March 2020 for a period of 10 years with monthly leased payment of

RM170,000.

Required:

a.

Compute the industrial building allowance for all the relevant years of assessment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning