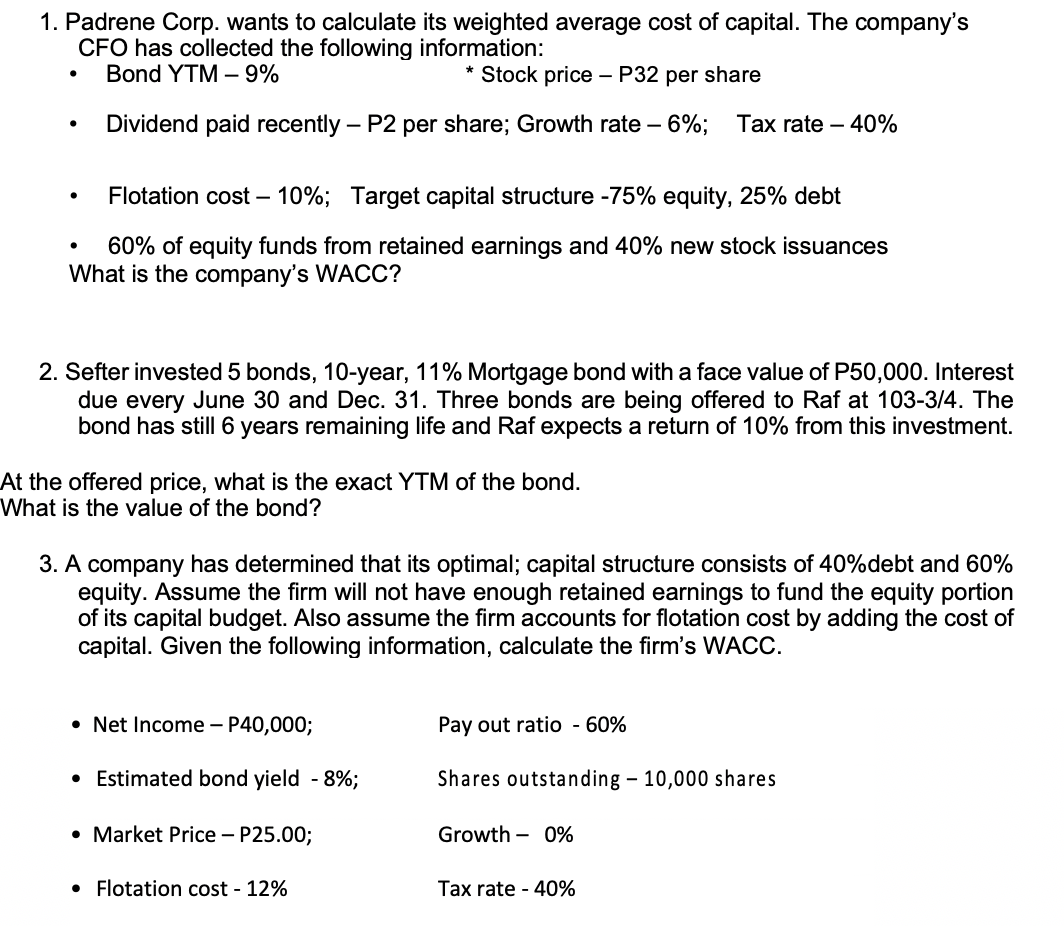

Padrene Corp. wants to calculate its weighted average cost of capital. The company's CFO has collected the following information: Bond YTM - 9% * Stock price - P32 per share Dividend paid recently - P2 per share; Growth rate - 6%; Tax rate - 40% ● Flotation cost - 10%; Target capital structure -75% equity, 25% debt 60% of equity funds from retained earnings and 40% new stock issuances What is the company's WACC? ●

Padrene Corp. wants to calculate its weighted average cost of capital. The company's CFO has collected the following information: Bond YTM - 9% * Stock price - P32 per share Dividend paid recently - P2 per share; Growth rate - 6%; Tax rate - 40% ● Flotation cost - 10%; Target capital structure -75% equity, 25% debt 60% of equity funds from retained earnings and 40% new stock issuances What is the company's WACC? ●

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

answer with solution pls numbers 123.

please answer in complete items please it will help me so much if you will answer all items. thanks

Transcribed Image Text:1. Padrene Corp. wants to calculate its weighted average cost of capital. The company's

CFO has collected the following information:

Bond YTM - 9%

* Stock price - P32 per share

Dividend paid recently - P2 per share; Growth rate - 6%; Tax rate - 40%

●

Flotation cost - 10%; Target capital structure -75% equity, 25% debt

60% of equity funds from retained earnings and 40% new stock issuances

What is the company's WACC?

●

2. Sefter invested 5 bonds, 10-year, 11% Mortgage bond with a face value of P50,000. Interest

due every June 30 and Dec. 31. Three bonds are being offered to Raf at 103-3/4. The

bond has still 6 years remaining life and Raf expects a return of 10% from this investment.

At the offered price, what is the exact YTM of the bond.

What is the value of the bond?

3. A company has determined that its optimal; capital structure consists of 40%debt and 60%

equity. Assume the firm will not have enough retained earnings to fund the equity portion

of its capital budget. Also assume the firm accounts for flotation cost by adding the cost of

capital. Given the following information, calculate the firm's WACC.

• Net Income - P40,000;

• Estimated bond yield - 8%;

• Market Price - P25.00;

• Flotation cost - 12%

Pay out ratio - 60%

Shares outstanding - 10,000 shares

Growth 0%

Tax rate - 40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning