Parents wish to have $140,000 available for a child's education. If the child is now 2 years old, how much money must be set aside at 8% compounded semiannually to meet their financial goal when the child is 18? Click the icon to view some finance formulas. The amount that should be set aside is $ (Round up to the nearest dollar.) Formulas In the provided formulas, A is the balance in the account after t years, P is the principal investment, r is the annual interest rate in decimal form, n is the number of compounding periods per year, and Y is the investment's effective annual yield in decimal form. nt A A = P + P = A = Pert nt Y = (1+ ±)-1 - ×

Parents wish to have $140,000 available for a child's education. If the child is now 2 years old, how much money must be set aside at 8% compounded semiannually to meet their financial goal when the child is 18? Click the icon to view some finance formulas. The amount that should be set aside is $ (Round up to the nearest dollar.) Formulas In the provided formulas, A is the balance in the account after t years, P is the principal investment, r is the annual interest rate in decimal form, n is the number of compounding periods per year, and Y is the investment's effective annual yield in decimal form. nt A A = P + P = A = Pert nt Y = (1+ ±)-1 - ×

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 56SE: To get the best loan rates available, the Riches want to save enough money to place 20% down on a...

Related questions

Question

100%

The amount that should be set aside is $

enter your response here.

(Round up to the nearest dollar.)

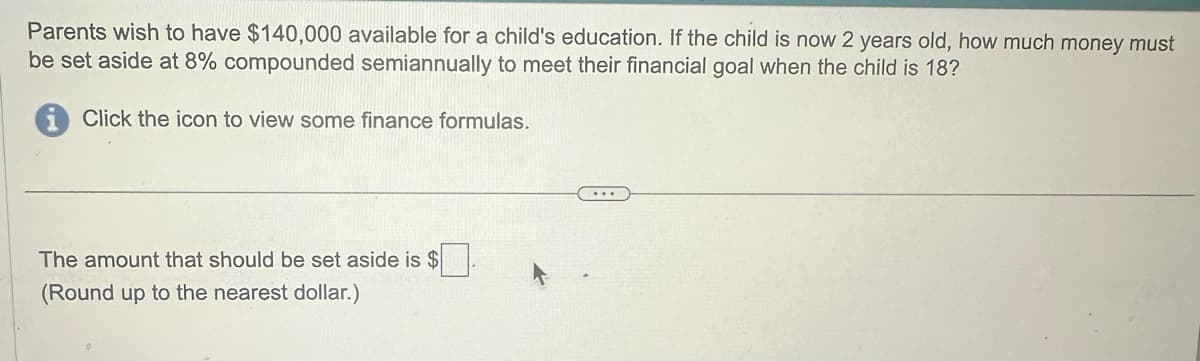

Transcribed Image Text:Parents wish to have $140,000 available for a child's education. If the child is now 2 years old, how much money must

be set aside at 8% compounded semiannually to meet their financial goal when the child is 18?

Click the icon to view some finance formulas.

The amount that should be set aside is $

(Round up to the nearest dollar.)

Transcribed Image Text:Formulas

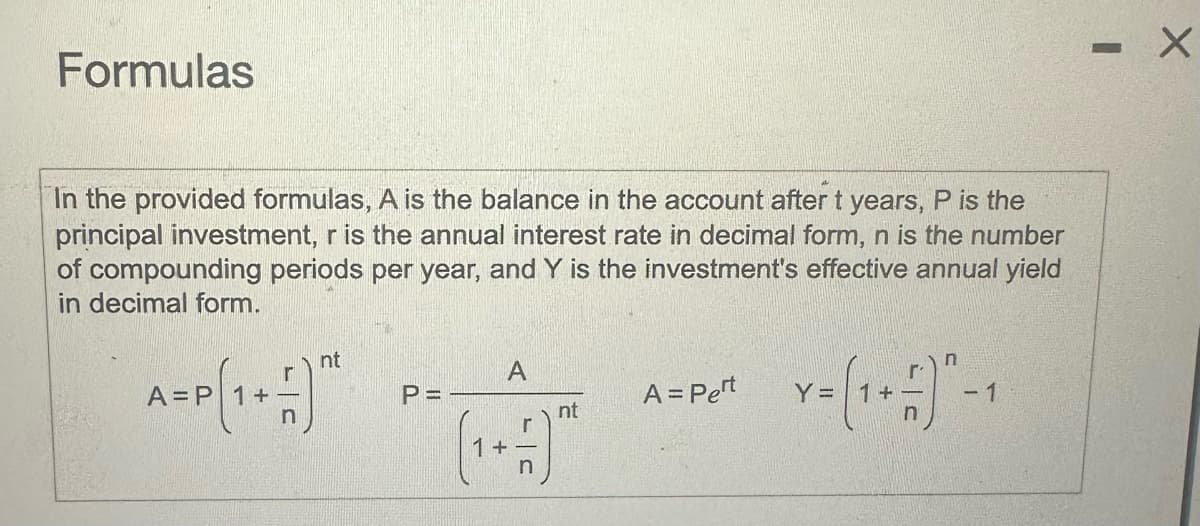

In the provided formulas, A is the balance in the account after t years, P is the

principal investment, r is the annual interest rate in decimal form, n is the number

of compounding periods per year, and Y is the investment's effective annual yield

in decimal form.

nt

A

A = P

+

P =

A = Pert

nt

Y = (1+ ±)-1

-

×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you