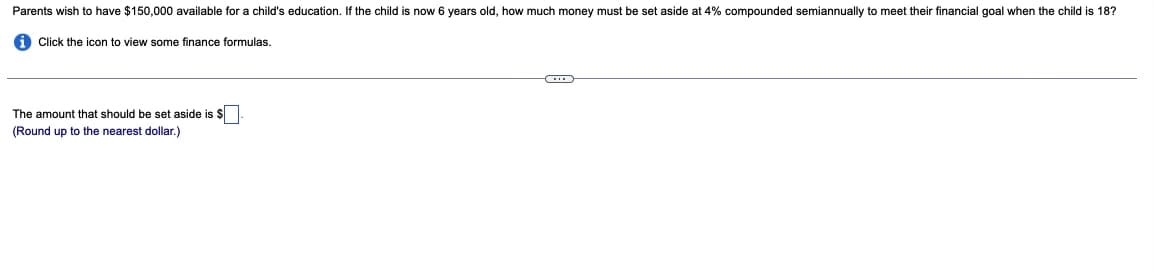

Parents wish to have $150,000 available for a child's education. If the child is now 6 years old, how much money must be set aside at 4% compounded semiannually to meet their financial goal when the child is 18? i Click the icon to view some finance formulas. The amount that should be set aside is $ (Round up to the nearest dollar.)

Parents wish to have $150,000 available for a child's education. If the child is now 6 years old, how much money must be set aside at 4% compounded semiannually to meet their financial goal when the child is 18? i Click the icon to view some finance formulas. The amount that should be set aside is $ (Round up to the nearest dollar.)

Chapter1: Equations, Inequalities, And Mathematical Modeling

Section1.6: Other Types Of Equations

Problem 9ECP: You deposit $2500 in a long-term investment in which the interest is compounded monthly. After 5...

Related questions

Question

20

Transcribed Image Text:Parents wish to have $150,000 available for a child's education. If the child is now 6 years old, how much money must be set aside at 4% compounded semiannually to meet their financial goal when the child is 18?

i Click the icon to view some finance formulas.

The amount that should be set aside is $

(Round up to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you