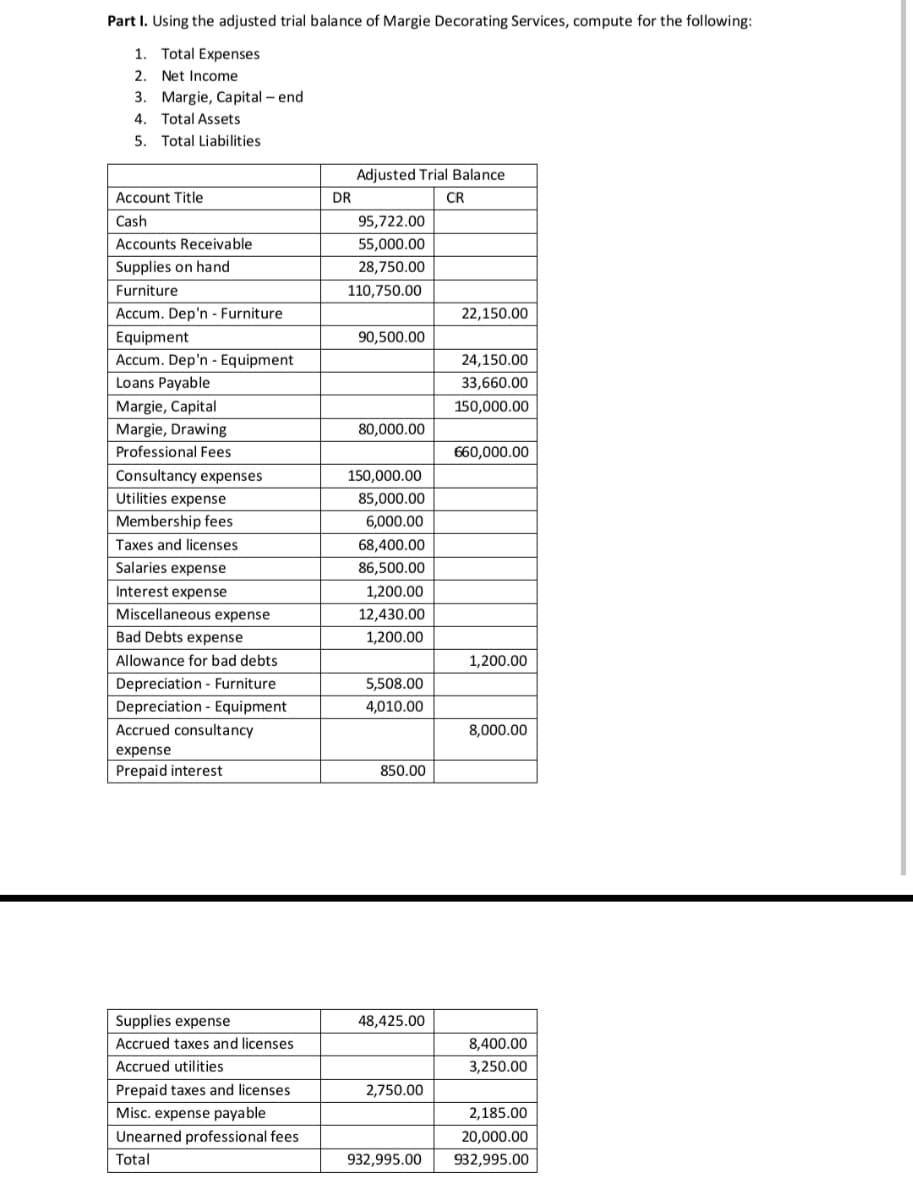

Part I. Using the adjusted trial balance of Margie Decorating Services, compute for the following: 1. Total Expenses 2. Net Income 3. Margie, Capital - end 4. Total Assets 5. Total Liabilities Adjusted Trial Balance Account Title DR CR Cash 95,722.00 Accounts Receivable 55,000.00 Supplies on hand 28,750.00 Furniture 110,750.00 Accum. Dep'n - Furniture 22,150.00 Equipment 90,500.00 Accum. Dep'n - Equipment 24,150.00 Loans Payable 33,660.00 Margie, Capital 150,000.00 Margie, Drawing 80,000.00 Professional Fees 660,000.00 Consultancy expenses 150,000.00 Utilities expense 85,000.00 Membership fees 6,000.00 Taxes and licenses 68,400.00 Salaries expense 86,500.00 1,200.00 Interest expense Miscellaneous expense 12,430.00 Bad Debts expense 1,200.00 Allowance for bad debts 1,200.00 Depreciation - Furniture 5,508.00 Depreciation - Equipment Accrued consultancy 4,010.00 8,000.00 expense Prepaid interest 850.00 Supplies expense 48,425.00 Accrued taxes and licenses 8,400.00 Accrued utilities 3,250.00 Prepaid taxes and licenses 2,750.00 Misc. expense payable Unearned professional fees 2,185.00 20,000.00 Total 932,995.00 932,995.00

Part I. Using the adjusted trial balance of Margie Decorating Services, compute for the following: 1. Total Expenses 2. Net Income 3. Margie, Capital - end 4. Total Assets 5. Total Liabilities Adjusted Trial Balance Account Title DR CR Cash 95,722.00 Accounts Receivable 55,000.00 Supplies on hand 28,750.00 Furniture 110,750.00 Accum. Dep'n - Furniture 22,150.00 Equipment 90,500.00 Accum. Dep'n - Equipment 24,150.00 Loans Payable 33,660.00 Margie, Capital 150,000.00 Margie, Drawing 80,000.00 Professional Fees 660,000.00 Consultancy expenses 150,000.00 Utilities expense 85,000.00 Membership fees 6,000.00 Taxes and licenses 68,400.00 Salaries expense 86,500.00 1,200.00 Interest expense Miscellaneous expense 12,430.00 Bad Debts expense 1,200.00 Allowance for bad debts 1,200.00 Depreciation - Furniture 5,508.00 Depreciation - Equipment Accrued consultancy 4,010.00 8,000.00 expense Prepaid interest 850.00 Supplies expense 48,425.00 Accrued taxes and licenses 8,400.00 Accrued utilities 3,250.00 Prepaid taxes and licenses 2,750.00 Misc. expense payable Unearned professional fees 2,185.00 20,000.00 Total 932,995.00 932,995.00

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 16PB: Prepare an adjusted trial balance from the following account information, and also considering the...

Related questions

Question

Answer the following.

Transcribed Image Text:Part I. Using the adjusted trial balance of Margie Decorating Services, compute for the following:

1. Total Expenses

2. Net Income

3. Margie, Capital – end

4. Total Assets

5. Total Liabilities

Adjusted Trial Balance

Account Title

DR

CR

Cash

95,722.00

Accounts Receivable

55,000.00

Supplies on hand

28,750.00

Furniture

110,750.00

Accum. Dep'n - Furniture

22,150.00

Equipment

90,500.00

Accum. Dep'n - Equipment

24,150.00

Loans Payable

33,660.00

Margie, Capital

150,000.00

Margie, Drawing

80,000.00

Professional Fees

660,000.00

Consultancy expenses

150,000.00

Utilities expense

85,000.00

Membership fees

6,000.00

Taxes and licenses

68,400.00

Salaries expense

86,500.00

Interest expense

1,200.00

Miscellaneous expense

12,430.00

Bad Debts expense

1,200.00

Allowance for bad debts

1,200.00

Depreciation - Furniture

5,508.00

Depreciation - Equipment

4,010.00

Accrued consultancy

8,000.00

expense

Prepaid interest

850.00

Supplies expense

48,425.00

Accrued taxes and licenses

8,400.00

Accrued utilities

3,250.00

Prepaid taxes and licenses

2,750.00

Misc. expense payable

2,185.00

Unearned professional fees

20,000.00

Total

932,995.00

932,995.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning