PARTI: The following transactions occurred for Murphy Delivery Service during December 2020: Dec. 1 Murphy Delivery Service began operations by receiving $22,000 cash and a truck with a fair value of $15,000 from Russ Murphy. The business issued Murphy shares of common stock in exchange for this contribution. 1 Paid $4,080 cash for a one-year insurance policy. The policy begins on December 1. 4 Paid $1,400 cash for office supplies. 12 Performed delivery services for a customer and received $4.800 cash.

PARTI: The following transactions occurred for Murphy Delivery Service during December 2020: Dec. 1 Murphy Delivery Service began operations by receiving $22,000 cash and a truck with a fair value of $15,000 from Russ Murphy. The business issued Murphy shares of common stock in exchange for this contribution. 1 Paid $4,080 cash for a one-year insurance policy. The policy begins on December 1. 4 Paid $1,400 cash for office supplies. 12 Performed delivery services for a customer and received $4.800 cash.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PA: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

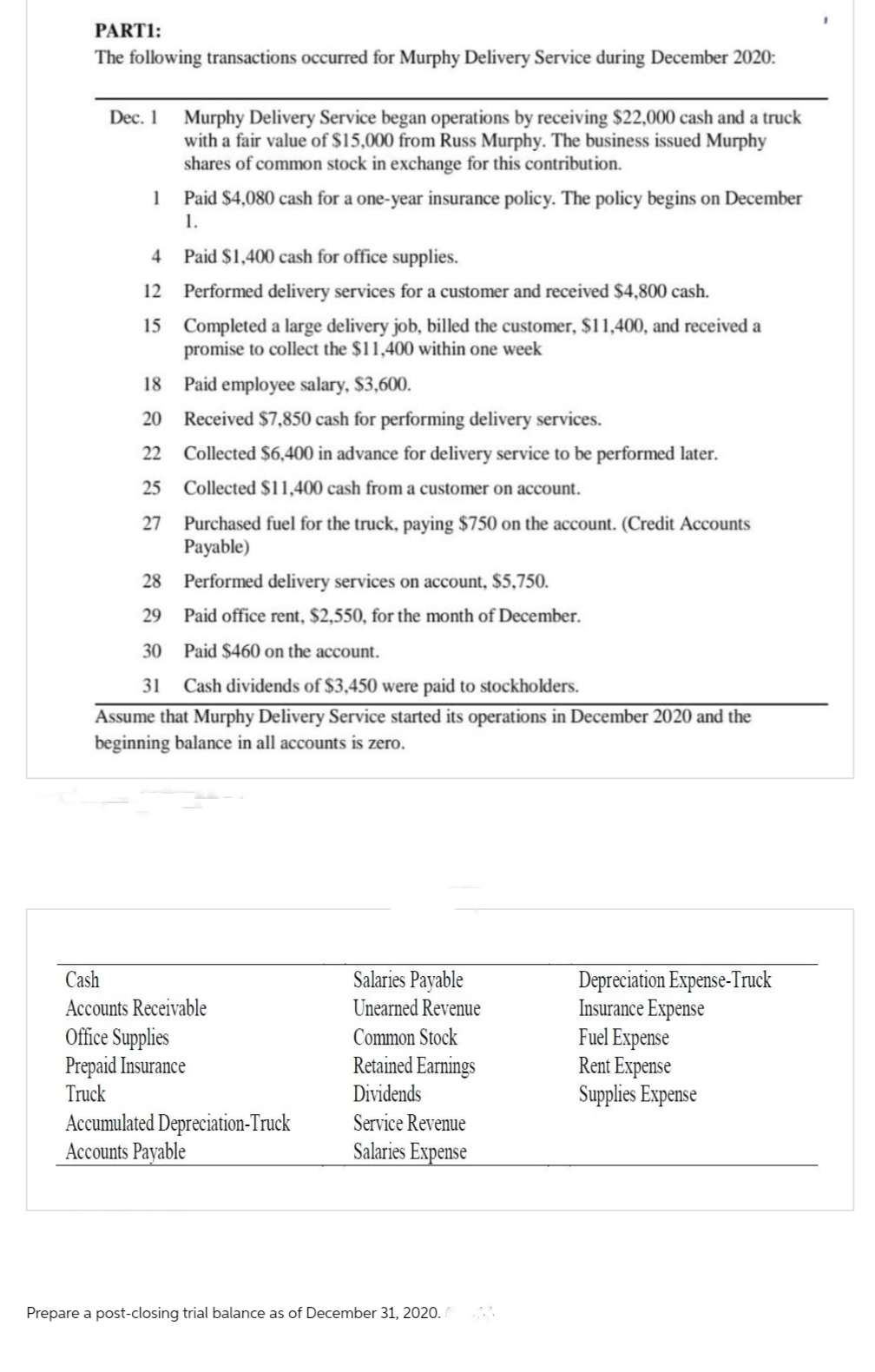

Transcribed Image Text:PARTI:

The following transactions occurred for Murphy Delivery Service during December 2020:

Dec. 1 Murphy Delivery Service began operations by receiving $22,000 cash and a truck

with a fair value of $15,000 from Russ Murphy. The business issued Murphy

shares of common stock in exchange for this contribution.

1

Paid $4,080 cash for a one-year insurance policy. The policy begins on December

1.

4

12

15

Paid $1,400 cash for office supplies.

Performed delivery services for a customer and received $4,800 cash.

Completed a large delivery job, billed the customer, $11,400, and received a

promise to collect the $11,400 within one week

18 Paid employee salary, $3,600.

20

Received $7,850 cash for performing delivery services.

22

Collected $6,400 in advance for delivery service to be performed later.

25

Collected $11,400 cash from a customer on account.

27

Purchased fuel for the truck, paying $750 on the account. (Credit Accounts

Payable)

Performed delivery services on account, $5,750.

Paid office rent, $2,550, for the month of December.

Paid $460 on the account.

28

29

30

31 Cash dividends of $3,450 were paid to stockholders.

Assume that Murphy Delivery Service started its operations in December 2020 and the

beginning balance in all accounts is zero.

Cash

Accounts Receivable

Office Supplies

Prepaid Insurance

Truck

Accumulated Depreciation-Truck

Accounts Payable

Salaries Payable

Unearned Revenue

Common Stock

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Prepare a post-closing trial balance as of December 31, 2020. (

Depreciation Expense-Truck

Insurance Expense

Fuel Expense

Rent Expense

Supplies Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning