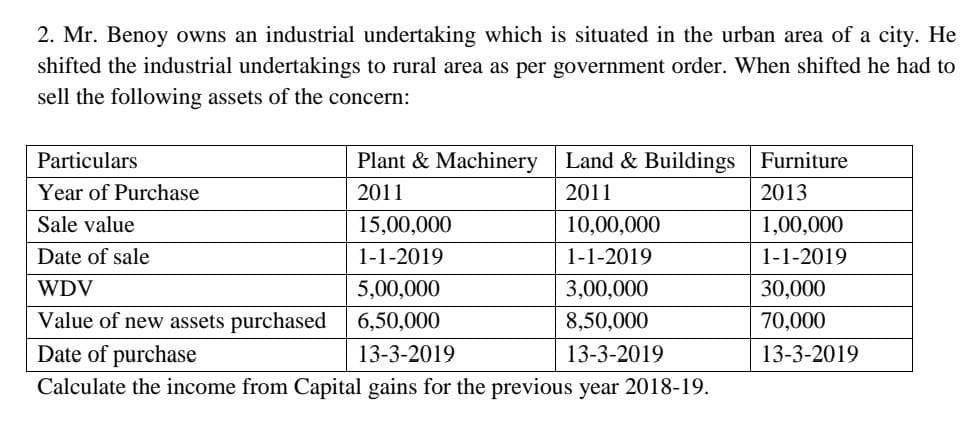

Particulars Year of Purchase Sale value Date of sale WDV 5,00,000 Value of new assets purchased 6,50,000 Date of purchase 13-3-2019 Calculate the income from Capital gains for the previous year 2018-19. Plant & Machinery Land & Buildings 2011 2011 15,00,000 1-1-2019 10,00,000 1-1-2019 3,00,000 8,50,000 13-3-2019

Q: Fill in the blanks for each independent situation. A B $350,000 $ Sales Variable expense Fixed…

A: Cost volume profit analysis is the one which is prepared by the entity in order to determine the…

Q: Question 1 of 7 View Policies Current Attempt in Progress Bramble Corporation reported net cash…

A: FREE CASH FLOW Free Cash Flow are the Amount which is Available in the hand of Owner after…

Q: 2021, the Westgate Construction Company entered into a contract to construct a road for Santa…

A: The percentage of completion method is one of the methods used in costing for contract costing, in…

Q: The following costs result from the production and sale of 4,050 drum sets manufactured by Tight…

A: Answer:- Formula:- 1. Contribution margin per unit = Contribution margin / Units sold 2.…

Q: Depreciation continues to be one of the most controversial, difficult and important areas of…

A: In general terms, depreciation is the normal wear and tear of assets over their useful life.…

Q: The investigative methodology known as OSCAR, translates to a. Obtain Information, Strategize,…

A: The OSCAR methodology is commonly used in investigations by law enforcement agencies, private…

Q: Calculating the Total Overhead Variance Standish Company manufactures consumer products and provided…

A: The variable overhead efficiency variance, on the other hand, measures the impact of the actual…

Q: Explain when an accounting period starts for corporation tax purposes.

A: “Since you have posted multiple questions, we will provide the solution only to the first question…

Q: How does corporate restructuring impact a company's financial statements?

A: A company's financial statements are documents that show how much money a company made, how much…

Q: Matthew (48 at year-end) develops cutting-edge techno

A: A money purchase plan refers to the form of a retirement plan under which the employer…

Q: inning inventory 10 30 1-Apr Purchase 30 32 16-Jun Purchase 40 35 28-Nov Purchase 20 36 There…

A: Answer :FIFO Method : Date Purchase Cost of good sold Ending inventory Unit Unit…

Q: The condensed product-line income statement for Dish N' Dat Company for the month of May is as…

A: The differential analysis is used to analyze the cost and benefit of the two alternatives. It helps…

Q: Overhead Variances, Four-Variance Analysis Oerstman, Inc., uses a standard costing system and…

A: The question is based on the concept of Cost Accounting. The difference between the actual amount of…

Q: Dr. Newel uses the straight-line method of depreciation for his sing the right procedure.

A: The selection of depreciation method by an entity depends on the nature of the asset, management…

Q: Which one of the following are NOT period costs? a) Advertising costs. b) Indirect…

A: Product costs are those costs which are incurred in the making of the product. Eg. Direct Material,…

Q: Manna Company is a processor of cereals. The company purchased new equipment that will process…

A: In the case of Manna Company purchasing new equipment, the economic benefit of increased annual…

Q: ials it sales Plastic Frames $10.00 2.00 3.00 100,000 Glass Frames $15.00 3.00 5.00 300,000

A: a. Computation of sales mix between Plastic Frame and Glass Frame Budgeted unit sales for Plastic…

Q: Good Night, Inc. Cost of Goods Sold Budget For the Year Ending December 31

A: Cost of goods sold (COGS) refers to the direct costs associated with producing or acquiring the…

Q: Madison Company sells its product for $6 a unit. Next year, fixed expenses are expected to be…

A: Break-even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: Mr. Ray, a Certified Public Accountant (CPA) was the auditor of a Registered Public Accounting Firm.…

A: The employment of Mr. Ray as the Chief Financial Controller of Bay Company after being the lead…

Q: Please help with the adjustment section. Mini Practice set 2 The Fashion Rack is a retail…

A: An adjusting journal entry is a type of financial record that may be used to keep track of…

Q: Joe Electronics recently interrupted its policy of paying cash dividends quarterly to its…

A: Dividends are a way for a company to distribute its profits to its shareholders. When a company…

Q: Faith Manufacturing Inc began business five years ago producing “Kneepal”, a new type of medical…

A: The acquisition cost of the asset is a capitalized cost as it is depreciated and recorded as an…

Q: Red Rose Manufacturers Inc. is approached by a potential customer to fulfill a one-time-only special…

A: Contribution Margin per unit = Sales price per unit - Variable cost per unit

Q: You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door…

A: Flexible budget is the statement which is prepared by the entity to estimate the fixed and the…

Q: The unqualified quarterly statement of income issued by Bailey Corporation to its stockholders are…

A: Financial statements are those statements which are being prepared by the business at the end of the…

Q: Your grandmother just gave you a building and land that you will use in your business. She paid…

A: (Note: “Since you have posted multiple questions, we will provide the solution only to the first…

Q: Adjustment Uald. 1. Supplies on hand are valued at $4,480. Accrued salaries payable are $1,400.…

A: Adjusting entries mainly helps to ensure that the principle of revenue recognition and matching are…

Q: The Anderson Company started its business on August 1st. On August 15th it paid wages for the first…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Pittsfield Sound Center pays $290,000 for a group purchase of land, building, and equipment. At the…

A: Commercial organizations used journal entries to record their financial transactions in their…

Q: Eckert Company uses the absorption costing approach to cost-plus pricing to set prices for its…

A: Desired Profit :— It is calculated by multiplying investment with % return on investment. Target…

Q: Please provide an example journal entry: At the beginning of this year your company issued stock. At…

A: Companies generally raise fund through issue of stock, whereby the sell the shares of the company…

Q: Flint Steel Corporation has a precredit U.S. tax of $188,000 on $518,000 of taxable income in 2016.…

A: A tax credit is a provision that, dollar for dollar, decreases a taxpayer's ultimate tax obligation.…

Q: The following journal entry: Salaries Expense Salaries Payable O A. Increases net income OB.…

A: Journal entries are used to record business transactions in chronological order under double entry…

Q: Oriole Company purchased a new van for floral deliveries on January 1, 2022. The van cost $60000…

A: The double declining balance method is a commonly used depreciation method in accounting. It is an…

Q: Brock Company makes candy. During the most recent accounting period Brock paid $3,000 for direct…

A: The Cost of goods sold is simply the cost of the inventory to the firm that is being sold to the…

Q: Use these factors to answer questions (ROUND ANSWERS TO NEAREST DOLLAR) n PV$1 0.73503 1 FV$1 PVA…

A: Loans are paid by equal fixed monthly payments and these carry the payment for loan and payment for…

Q: Pharoah Company buys merchandise on account from Shamrock Company. The selling price of the goods is…

A: Journal entry are basic record of any transaction and has two effects - Debit and credit. These…

Q: Question 1: Explain and give examples of the use of a fraud theory. Question 2: Outline the Fraud…

A: Fraud is an intentional act of deception or misrepresentation perpetrated by an individual or a…

Q: When Patey Pontoons issued 6% bonds on January 1, 2024, with a face amount of $840,000, the market…

A: Bonds payable is a long term liability and by issuing bonds payable organizations collect money for…

Q: Milloy Furniture purchased land, paying $75,000 cash and signing a $250,000 note payable. In…

A: Cost of assets means the amount at which the asset is bought. It is the cost at which the assets are…

Q: The Drillup Company has been in the business of oil exploration for the past 10 years. In 2021.…

A: Introduction:- This question presents a scenario involving a company called Drillup, which has been…

Q: of equipment) 1.00 0.40 2.70 $7.50

A: Selling price = $25 Per unit Direct material = $3.40 Per unit Direct labor = $1.00Per unit Variable…

Q: Is it better to save $100 every month or $1,200 every year if you can eam 6% interest every year for…

A: Time value of money is a financial concept which is used to calculate the value of money in present…

Q: Down Under Products, Limited, of Australla has budgeted sales of its popular boomerang for the next…

A: Production Budget :— This budget is prepared to estimate the budgeted units to be produced during…

Q: Timber Company imports and sells a product produced in Canada. In the summer of 2019, a natural…

A: LIFO is a costing method used to find out the cost of inventory, in which the latest purchase is…

Q: Wells Company reports the following budgeted sales: September, $53,000; October, $63,000; and…

A: Lets understand the basics. Management prepares budget in order to estimate future profit and loss…

Q: The balance sheet of Consolidated Paper, Inc., included the following shareholders' equity accounts…

A: Shares are defined as the company’s holdings that are provided to the investors or any person who…

Q: Required: 1. Prepare a bank reconciliation as of October 31, 20Y9. 2. Journalize the necessary…

A: Bank Reconciliation is a summary that is prepared to reconcile the cash balance as per the bank and…

Q: Smith-Kline Company maintains inventory records at selling prices as well as at cost. For 2024, the…

A: Under dollar value LIFO method, inventory is adjusted with the increase or decrease in the price…

Step by step

Solved in 3 steps

- Which of the following is classified as , depreciable listed property is it equipment placed in service and dispose at the same year or inventory consisting of finished goods available for sale in taxpayers business, Or a small pick up truck used by the taxpayers for predominantly For business purposes but also use occasionally for personal purposes or is it a vacant piece of land held for investmentThe following expenditures were incurred by an entity during 2021. A piece of land with a dilapidated building was acquired and immediately construction of a new building began. Upon completion of the building, the entity acquired several pieces of machinery for use in its operations.Cash paid on purchase of land-P4,500,000Mortgage assumed on the land bought-P5,000,000Legal fees and title verification expenses-P50,000Payment to squatters on the property to vacate the premises -P100,000Demolition costs incurred-P80,000 Proceeds from sale of salvaged materials-P45,000 Paid to contractor for a building erected-P12,000,000Building permit fees-P20,000Excavation expenses-P50,000Architect’s fees-P150,000Capitalized interest cost on building constructed-P18,000 What are the costs of Land and Building, respectively? Apply the principles prior to the amendments to PAS 16 that is effective on January 1, 2022.The following expenditures were incurred by an entity during 2021. A piece of land with a dilapidated building was acquired and immediately construction of a new building began. Upon completion of the building, the entity acquired several pieces of machinery for use in its operations.Cash paid on purchase of land-P4,500,000Mortgage assumed on the land bought-P5,000,000Legal fees and title verification expenses-P50,000Payment to squatters on the property to vacate the premises -P100,000Demolition costs incurred-P80,000 Proceeds from sale of salvaged materials-P45,000 Paid to contractor for a building erected-P12,000,000Building permit fees-P20,000Excavation expenses-P50,000Architect’s fees-P150,000Capitalized interest cost on building constructed-P18,000 What are the costs of Land and Building, respectively? Apply the principles prior to the amendments to PAS 16 that is effective on January 1, 2022. a. 9,685,000 and 12,238,000 b. 9,650,000 and 12,273,000 c. 9,550,000 and…

- Zofi died on February 1, 2021 leaving a 1,000 sq.m. parcel of land in BGC, Taguig, with the following valuations:Fair Market Value as determined by the City Assessor 25,000/sq.m.Zonal Value as determined by the BIR, P18,000,000Fair Market Value by independent appraisers, P30,000,000What is the value of the piece of land in the gross estate?On April 1, Bramble Corp. purchased for $1629000 a tract of land on which a warehouse and office building was located. The following data were collected concerning the property: Current Assessed Valuation Vendor's Original Cost Land $560000 $510000 Warehouse 400000 370000 Office building 840000 672000 $1800000 $1552000 What are the appropriate amounts that Bramble should record for the land, warehouse, and office building, respectively? Land, $506800; warehouse, $362000; office building, $760200. Land, $510000; warehouse, $370000; office building, $672000. Land, $560000; warehouse, $400000; office building, $840000. Land, $516375; warehouse, $374625; office building, $680400.On April 1, Oriole Company purchased for $1548000 a tract of land on which a warehouse and office building was located. The following data were collected concerning the property: Current Assessed Valuation Vendor's Original Cost Land $610000 $560000 Warehouse 390000 360000 Office building 800000 684000 $1800000 $1604000 What are the appropriate amounts that Oriole should record for the land, warehouse, and office building, respectively?

- The following transactions involving intangible assets of Blossom Corporation occurred on or near December 31, 2020. 1. Minton paid Grand Company $360,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Blossom is in business. 2. Blossom spent $540,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. In January, 2021, Blossom's application for a patent (#2 above) was granted. Legal and registration costs incurred were $189,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. 4. Blossom incurred $144,000 in successfully defending one of its patents in an infringement suit. The patent expires during December, 2024. 5. Blossom incurred $432,000 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a…Megha Nhon Corp., a vat registered taxpayer made the following acquisition of equipment from vat registered suppliers (net of vat) during 2021 and 2022: Date Purchase price Useful life (yrs) Oct. 1, 2021 2,000,000 6 Apr. 1, 2022 2,500,000 2 The equipment acquired on Oct. 2021 was sold on Apr. 2022. How much is the creditable input vat on Apr. 2022? P216,000 P324,000 P516,000 P300,000On July 1, 2020, Martinez Ltd., a publicly listed company, acquired assets from Marigold Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: Manufacturing plant (building #1) $399,620 Storage warehouse (building #2) 209,860 Machinery (in building #1) 75,000 Machinery (in building #2) 45,000 The buildings are owned by the company, and the land that the buildings are situated on is owned by the local municipality and is provided free of charge to the owner of the buildings to encourage local employment.In exchange for the acquisition of these assets, Martinez issued 145,530 common shares. Martinez’s shares are thinly traded (that is, traded in relatively low volume leading to more volatile price changes than most public companies). In the most recent sale of Martinez’s shares on the Toronto Stock Exchange, 800 shares were sold for $5 per share. At the time of acquisition, both buildings were considered…

- On July 1, 2020, Martinez Ltd., a publicly listed company, acquired assets from Marigold Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: Manufacturing plant (building #1) $399,620 Storage warehouse (building #2) 209,860 Machinery (in building #1) 75,000 Machinery (in building #2) 45,000 The buildings are owned by the company, and the land that the buildings are situated on is owned by the local municipality and is provided free of charge to the owner of the buildings to encourage local employment.In exchange for the acquisition of these assets, Martinez issued 145,530 common shares. Martinez’s shares are thinly traded (that is, traded in relatively low volume leading to more volatile price changes than most public companies). In the most recent sale of Martinez’s shares on the Toronto Stock Exchange, 800 shares were sold for $5 per share. At the time of acquisition, both buildings were considered…On July 1, 2020, Martinez Ltd., a publicly listed company, acquired assets from Marigold Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: Manufacturing plant (building #1) $399,620 Storage warehouse (building #2) 209,860 Machinery (in building #1) 75,000 Machinery (in building #2) 45,000 The buildings are owned by the company, and the land that the buildings are situated on is owned by the local municipality and is provided free of charge to the owner of the buildings to encourage local employment.In exchange for the acquisition of these assets, Martinez issued 145,530 common shares. Martinez’s shares are thinly traded (that is, traded in relatively low volume leading to more volatile price changes than most public companies). In the most recent sale of Martinez’s shares on the Toronto Stock Exchange, 800 shares were sold for $5 per share. At the time of acquisition, both buildings were considered…On July 1, 2020, Martinez Ltd., a publicly listed company, acquired assets from Marigold Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: Manufacturing plant (building #1) $399,620 Storage warehouse (building #2) 209,860 Machinery (in building #1) 75,000 Machinery (in building #2) 45,000 The buildings are owned by the company, and the land that the buildings are situated on is owned by the local municipality and is provided free of charge to the owner of the buildings to encourage local employment.In exchange for the acquisition of these assets, Martinez issued 145,530 common shares. Martinez’s shares are thinly traded (that is, traded in relatively low volume leading to more volatile price changes than most public companies). In the most recent sale of Martinez’s shares on the Toronto Stock Exchange, 800 shares were sold for $5 per share. At the time of acquisition, both buildings were considered…