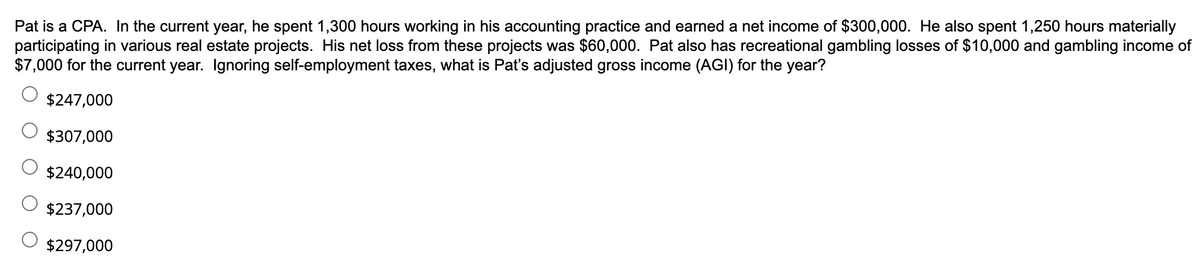

Pat is a CPA. In the current year, he spent 1,300 hours working in his accounting practice and earned a net income of $300,000. He also spent 1,250 hours materially participating in various real estate projects. His net loss from these projects was $60,000. Pat also has recreational gambling losses of $10,000 and gambling income of $7,000 for the current year. Ignoring self-employment taxes, what is Pat's adjusted gross income (AGI) for the year?

Pat is a CPA. In the current year, he spent 1,300 hours working in his accounting practice and earned a net income of $300,000. He also spent 1,250 hours materially participating in various real estate projects. His net loss from these projects was $60,000. Pat also has recreational gambling losses of $10,000 and gambling income of $7,000 for the current year. Ignoring self-employment taxes, what is Pat's adjusted gross income (AGI) for the year?

Chapter11: Invest Or Losses

Section: Chapter Questions

Problem 39P

Related questions

Question

Hw.37.

Transcribed Image Text:Pat is a CPA. In the current year, he spent 1,300 hours working in his accounting practice and earned a net income of $300,000. He also spent 1,250 hours materially

participating in various real estate projects. His net loss from these projects was $60,000. Pat also has recreational gambling losses of $10,000 and gambling income of

$7,000 for the current year. Ignoring self-employment taxes, what is Pat's adjusted gross income (AGI) for the year?

$247,000

$307,000

$240,000

$237,000

$297,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT