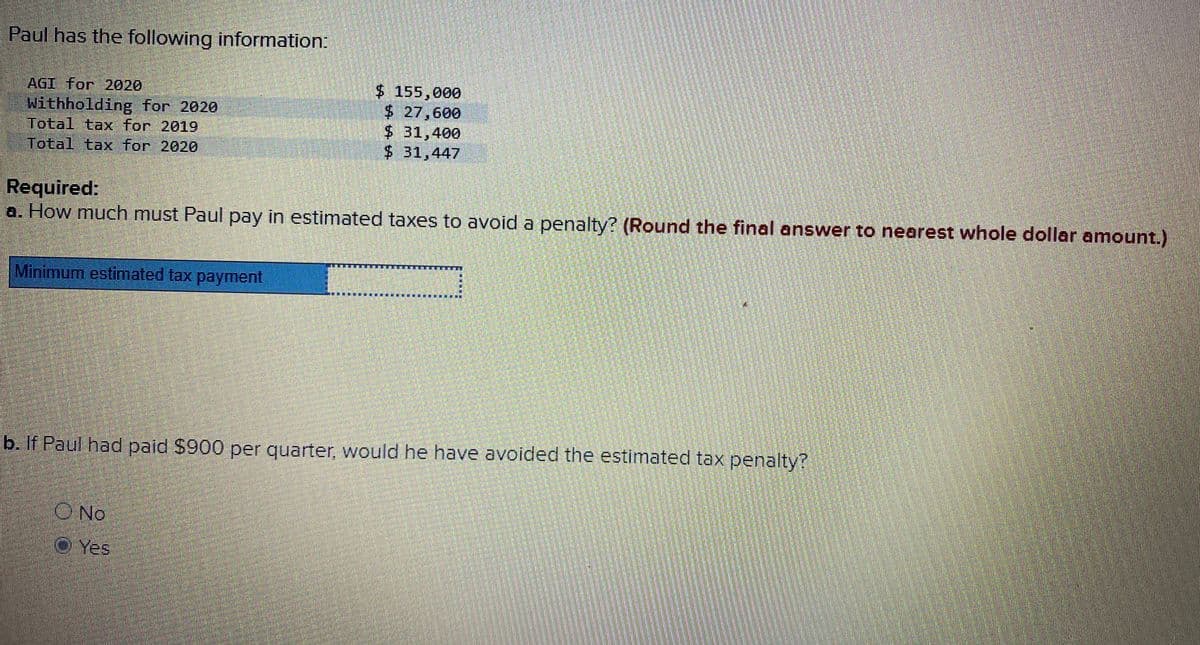

Paul has the following information: $ 155,000 $ 27,600 $ 31,400 $ 31,447 AGI for 2020 Withholding for 2020 Total tax for 2019 Total tax for 2020 Required: a. How much must Paul pay in estimated taxes to avoid a penalty? (Round the final answer to nearest whole dollar amount.) Minimum estimated tax payment b. If Paul had paid $900 per quarter, would he have avoided the estimated tax penalty? O No O Yes

Paul has the following information: $ 155,000 $ 27,600 $ 31,400 $ 31,447 AGI for 2020 Withholding for 2020 Total tax for 2019 Total tax for 2020 Required: a. How much must Paul pay in estimated taxes to avoid a penalty? (Round the final answer to nearest whole dollar amount.) Minimum estimated tax payment b. If Paul had paid $900 per quarter, would he have avoided the estimated tax penalty? O No O Yes

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 31P

Related questions

Question

Please help

Transcribed Image Text:Paul has the following information:

AGI for 2020

Withholding for 2020

Total tax for 2019

Total tax for 2020

$ 155,000

$ 27,600

$ 31,400

$31,447

Required:

a. How much must Paul pay in estimated taxes to avoid a penalty? (Round the final answer to nearest whole dollar amount.)

Minimum estimated tax payment

b. If Paul had paid $900 per quarter, would he have avoided the estimated tax penalty?

ONo

O Yes

Expert Solution

PART A

A. How much must Paul pay in estimated taxes to avoid a penalty?

ESTIMATED TAXES TO AVOID A PENALTY WILL BE LESSER OF

1 . 90% OF CURRENT YEAR TAX WHICH IS ($31,447 X 90 %) = $28,302

2. 100 % OF PREVIOUS YEAR'S TAX = $31,400

WITHHOLDING FOR 2020 IS = $27,600

SO , PAUL MUST PAY AT LEAST ( $28,302 - $27,600 )

MINIMUM ESTIMATED TAX PAYMENT = $702

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT