Paulina, Incorporated, owns 90 percent of Southport Company. On January 1, 2021, Paulina acquires half of Southport’s $560,000 outstanding 13-year bonds. These bonds had been sold on the open market on January 1, 2018, at a 12 percent effective rate. The bonds pay a cash interest rate of 10 percent every December 31 and are scheduled to come due on December 31, 2030. Southport issued this debt originally for $488,056. Paulina paid $317,576 for this investment, indicating an 8 percent effective yield Assuming that both parties use the straight-line method, what consolidation entry would be required on December 31, 2021, because of these bonds? Assume that the parent is not applying the equity method.

Paulina, Incorporated, owns 90 percent of Southport Company. On January 1, 2021, Paulina acquires half of Southport’s $560,000 outstanding 13-year bonds. These bonds had been sold on the open market on January 1, 2018, at a 12 percent effective rate. The bonds pay a cash interest rate of 10 percent every December 31 and are scheduled to come due on December 31, 2030. Southport issued this debt originally for $488,056. Paulina paid $317,576 for this investment, indicating an 8 percent effective yield Assuming that both parties use the straight-line method, what consolidation entry would be required on December 31, 2021, because of these bonds? Assume that the parent is not applying the equity method.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 1P: 11-1 After-Tax Cost of Debt

Calculate the after-tax cost of debt under each of the following...

Related questions

Question

Paulina, Incorporated, owns 90 percent of Southport Company. On January 1, 2021, Paulina acquires half of Southport’s $560,000 outstanding 13-year bonds. These bonds had been sold on the open market on January 1, 2018, at a 12 percent effective rate. The bonds pay a cash interest rate of 10 percent every December 31 and are scheduled to come due on December 31, 2030. Southport issued this debt originally for $488,056. Paulina paid $317,576 for this investment, indicating an 8 percent effective yield

-

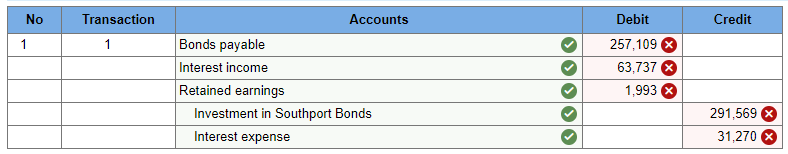

Assuming that both parties use the straight-line method, what consolidation entry would be required on December 31, 2021, because of these bonds? Assume that the parent is not applying the equity method.

Transcribed Image Text:No

1

Transaction

1

Accounts

Bonds payable

Interest income

Retained earnings

Investment in Southport Bonds

Interest expense

Debit

257,109 X

63,737 X

1,993 X

Credit

291,569 X

31,270

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,