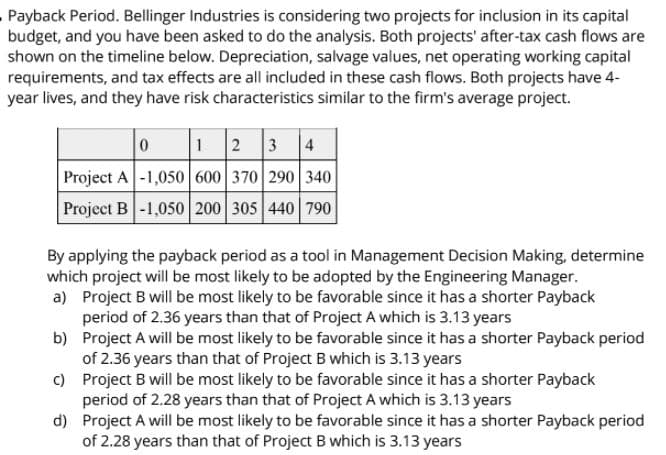

Payback Period. Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the timeline below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4- year lives, and they have risk characteristics similar to the firm's average project. |0 2 3 4 Project A-1,050 600 370 290 340 Project B -1,050 200 305 440 790 By applying the payback period as a tool in Management Decision Making, determine which project will be most likely to be adopted by the Engineering Manager. a) Project B will be most likely to be favorable since it has a shorter Payback period of 2.36 years than that of Project A which is 3.13 years b) Project A will be most likely to be favorable since it has a shorter Payback period of 2.36 years than that of Project B which is 3.13 years c) Project B will be most likely to be favorable since it has a shorter Payback period of 2.28 years than that of Project A which is 3.13 years d) Project A will be most likely to be favorable since it has a shorter Payback period of 2.28 years than that of Project B which is 3.13 years

Payback Period. Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the timeline below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4- year lives, and they have risk characteristics similar to the firm's average project. |0 2 3 4 Project A-1,050 600 370 290 340 Project B -1,050 200 305 440 790 By applying the payback period as a tool in Management Decision Making, determine which project will be most likely to be adopted by the Engineering Manager. a) Project B will be most likely to be favorable since it has a shorter Payback period of 2.36 years than that of Project A which is 3.13 years b) Project A will be most likely to be favorable since it has a shorter Payback period of 2.36 years than that of Project B which is 3.13 years c) Project B will be most likely to be favorable since it has a shorter Payback period of 2.28 years than that of Project A which is 3.13 years d) Project A will be most likely to be favorable since it has a shorter Payback period of 2.28 years than that of Project B which is 3.13 years

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

Transcribed Image Text:Payback Period. Bellinger Industries is considering two projects for inclusion in its capital

budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are

shown on the timeline below. Depreciation, salvage values, net operating working capital

requirements, and tax effects are all included in these cash flows. Both projects have 4-

year lives, and they have risk characteristics similar to the firm's average project.

12 3 4

Project A-1,050 600 370 290 340

Project B -1,050 200 305 440 790

By applying the payback period as a tool in Management Decision Making, determine

which project will be most likely to be adopted by the Engineering Manager.

a) Project B will be most likely to be favorable since it has a shorter Payback

period of 2.36 years than that of Project A which is 3.13 years

b) Project A will be most likely to be favorable since it has a shorter Payback period

of 2.36 years than that of Project B which is 3.13 years

) Project B will be most likely to be favorable since it has a shorter Payback

period of 2.28 years than that of Project A which is 3.13 years

d) Project A will be most likely to be favorable since it has a shorter Payback period

of 2.28 years than that of Project B which is 3.13 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning