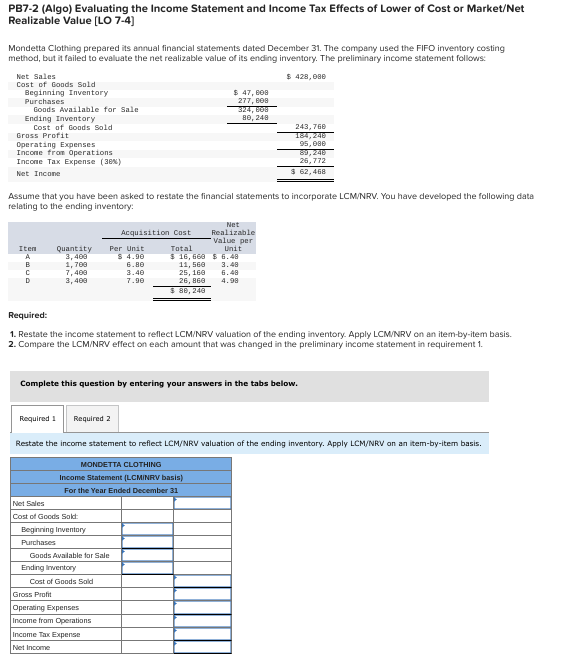

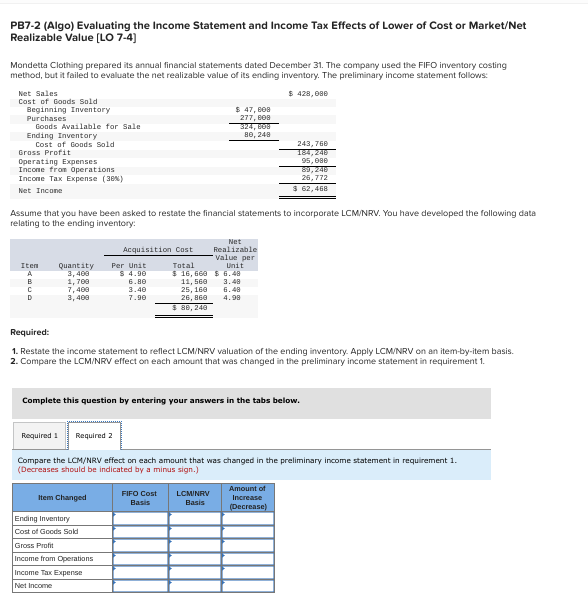

PB7-2 (Algo) Evaluating the Income Statement and Income Tax Effects of Lower of Cost or Market/Net Realizable Value (LO 7-4) Mondetta Clothing prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to evaluate the net realizable value of its ending inventory. The preliminary income statement follows: Net Sales Cost of Goods Sold $ 428, 000 $ 47, 608 277, B08 324, BO ве, 248 Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold 243, 768 184,248 95, 000 Gross Profit Operating Expenses Incone from Operations Incone Tax Expense (3N) 26,772 Net Incone S 62,468 Assume that you have been asked to restate the financial statements to incorporate LCMNRV. You have developed the following data relating to the ending inventory: Net Realizable Value per Unit S 16, 660 S 6.48 3.4 25, 160 6.48 Acquisition Cost Quantsty 3,400 1, 700 7, 400 3, 400 Total Item A Per Unit S 4.90 6.80 3.40 7.90 11, 560 26, 860 4.98 S 88, 248 Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

PB7-2 (Algo) Evaluating the Income Statement and Income Tax Effects of Lower of Cost or Market/Net Realizable Value [LO 7-4]

| Net Sales | $ 428,000 | |

|---|---|---|

| Cost of Goods Sold | ||

| Beginning Inventory | $ 47,000 | |

| Purchases | 277,000 | |

| Goods Available for Sale | 324,000 | |

| Ending Inventory | 80,240 | |

| Cost of Goods Sold | 243,760 | |

| Gross Profit | 184,240 | |

| Operating Expenses | 95,000 | |

| Income from Operations | 89,240 | |

| Income Tax Expense (30%) | 26,772 | |

| Net Income | $ 62,468 |

Assume that you have been asked to restate the financial statements to incorporate LCM/NRV. You have developed the following data relating to the ending inventory:

Required:

- Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis.

- Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images