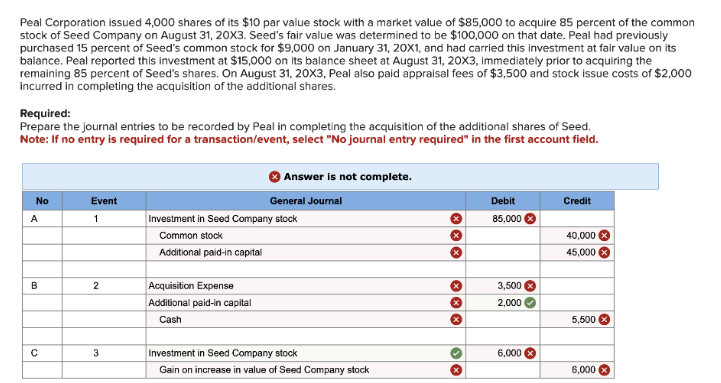

Peal Corporation issued 4,000 shares of its $10 par value stock with a market value of $85,000 to acquire 85 percent of the commor stock of Seed Company on August 31, 20X3. Seed's fair value was determined to be $100,000 on that date. Peal had previously purchased 15 percent of Seed's common stock for $9,000 on January 31, 20X1, and had carried this investment at fair value on its balance. Peal reported this investment at $15,000 on its balance sheet at August 31, 20X3, immediately prior to acquiring the remaining 85 percent of Seed's shares. On August 31, 20X3, Peal also paid appraisal fees of $3,500 and stock issue costs of $2,000 incurred in completing the acquisition of the additional shares. Required: Prepare the journal entries to be recorded by Peal in completing the acquisition of the additional shares of Seed. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Peal Corporation issued 4,000 shares of its $10 par value stock with a market value of $85,000 to acquire 85 percent of the commor stock of Seed Company on August 31, 20X3. Seed's fair value was determined to be $100,000 on that date. Peal had previously purchased 15 percent of Seed's common stock for $9,000 on January 31, 20X1, and had carried this investment at fair value on its balance. Peal reported this investment at $15,000 on its balance sheet at August 31, 20X3, immediately prior to acquiring the remaining 85 percent of Seed's shares. On August 31, 20X3, Peal also paid appraisal fees of $3,500 and stock issue costs of $2,000 incurred in completing the acquisition of the additional shares. Required: Prepare the journal entries to be recorded by Peal in completing the acquisition of the additional shares of Seed. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 27P

Related questions

Question

Transcribed Image Text:Peal Corporation issued 4,000 shares of its $10 par value stock with a market value of $85,000 to acquire 85 percent of the common

stock of Seed Company on August 31, 20X3. Seed's fair value was determined to be $100,000 on that date. Peal had previously

purchased 15 percent of Seed's common stock for $9,000 on January 31, 20X1, and had carried this investment at fair value on its

balance. Peal reported this investment at $15,000 on its balance sheet at August 31, 20X3, immediately prior to acquiring the

remaining 85 percent of Seed's shares. On August 31, 20X3, Peal also paid appraisal fees of $3,500 and stock issue costs of $2,000

incurred in completing the acquisition of the additional shares.

Required:

Prepare the journal entries to be recorded by Peal in completing the acquisition of the additional shares of Seed.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

A

B

C

Event

1

2

3

Answer is not complete.

General Journal

Investment in Seed Company stock

Common stock

Additional paid-in capital

Acquisition Expense

Additional paid-in capital

Cash

Investment in Seed Company stock

Gain on increase in value of Seed Company stock

XXX

***

X

X

››

Debit

85,000

3,500 x

2,000

6,000

Credit

40,000 X

45,000 x

5,500

6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning