Pelota Company recently acquired several businesses and recognized goodwill in each acquisition. Pelota allocated the resulting goodwill to its three reporting units: R-one, R-two, and R-three. Pelota opts to skip the qualitative assessment and therefore performs a quantitative goodwill impairment review annually. In its current-year assessment of goodwill, Pelota provides the following individual asset and liability carrying amounts for each of its reporting units: Items Carrying Amounts R-one R-two R-three Tangible assets $241,000 $219,000 $159,000 Trademark 199,000 - - Computer software 148,500 - - Unpatented technology - 232,000 - Licenses - 97,500 - Copyrights - - 57,250 Goodwill 150,200 202,850 118,000 Liabilities (32,250) - - The total fair values for each reporting unit (including goodwill) are $682,350 for R-one, $709,300 for R-two, and $653,650 for R-three. To date, Pelota has reported no goodwill impairments. Required: How much goodwill impairment should Pelota report this year for each of its reporting units?

Pelota Company recently acquired several businesses and recognized

In its current-year assessment of goodwill, Pelota provides the following individual asset and liability carrying amounts for each of its reporting units:

| Items | Carrying Amounts | ||

|---|---|---|---|

| R-one | R-two | R-three | |

| Tangible assets | $241,000 | $219,000 | $159,000 |

| Trademark | 199,000 | - | - |

| Computer software | 148,500 | - | - |

| Unpatented technology | - | 232,000 | - |

| Licenses | - | 97,500 | - |

| Copyrights | - | - | 57,250 |

| Goodwill | 150,200 | 202,850 | 118,000 |

| Liabilities | (32,250) | - | - |

The total fair values for each reporting unit (including goodwill) are $682,350 for R-one, $709,300 for R-two, and $653,650 for R-three. To date, Pelota has reported no goodwill impairments.

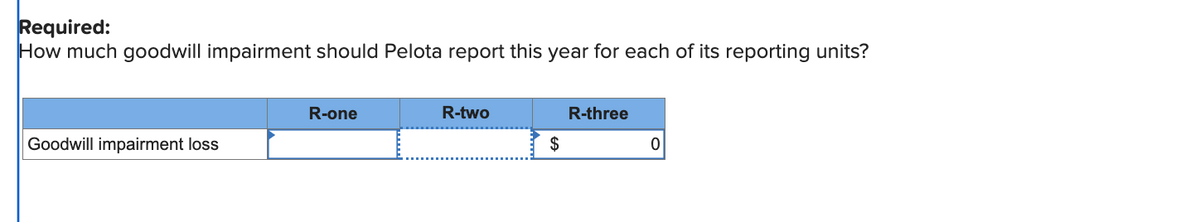

Required:

How much goodwill impairment should Pelota report this year for each of its reporting units?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps