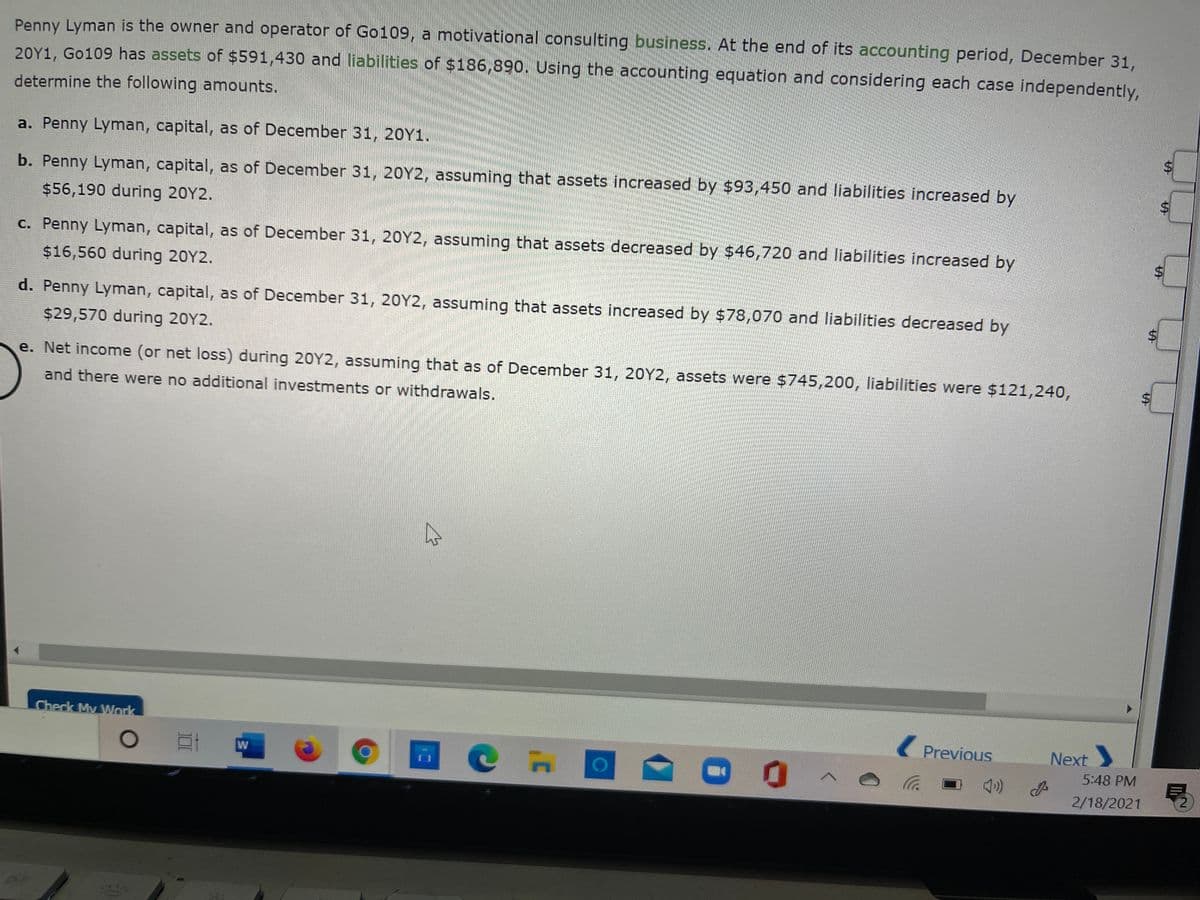

Penny Lyman is the owner and operator of Go109, a motivational consulting business. At the end of its accounting period, December 31, 20Y1, Go109 has assets of $591,430 and liabilities of $186,890. Using the accounting equation and considering each case independently, determine the following amounts. a. Penny Lyman, capital, as of December 31, 20Y1. b. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $93,450 and liabilities increased by $56,190 during 20Y2. c. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets decreased by $46,720 and liabilities increased by $16,560 during 20Y2. d. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $78,070 and liabilities decreased by %24 $29,570 during 20Y2. e. Net income (or net loss) during 20Y2, assuming that as of December 31, 20Y2, assets were $745,200, liabilities were $121,240, and there were no additional investments or withdrawals.

Penny Lyman is the owner and operator of Go109, a motivational consulting business. At the end of its accounting period, December 31, 20Y1, Go109 has assets of $591,430 and liabilities of $186,890. Using the accounting equation and considering each case independently, determine the following amounts. a. Penny Lyman, capital, as of December 31, 20Y1. b. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $93,450 and liabilities increased by $56,190 during 20Y2. c. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets decreased by $46,720 and liabilities increased by $16,560 during 20Y2. d. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $78,070 and liabilities decreased by %24 $29,570 during 20Y2. e. Net income (or net loss) during 20Y2, assuming that as of December 31, 20Y2, assets were $745,200, liabilities were $121,240, and there were no additional investments or withdrawals.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.4E: The Accounting Equation Ginger Enterprises began the year with total assets of $500,000 and total...

Related questions

Topic Video

Question

Transcribed Image Text:Penny Lyman is the owner and operator of Go109, a motivational consulting business. At the end of its accounting period, December 31,

20Y1, Go109 has assets of $591,430 and liabilities of $186,890. Using the accounting equation and considering each case independently,

determine the following amounts.

a. Penny Lyman, capital, as of December 31, 20Y1.

%$4

b. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $93,450 and liabilities increased by

$56,190 during 20Y2.

c. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets decreased by $46,720 and liabilities increased by

$4

$16,560 during 20Y2.

d. Penny Lyman, capital, as of December 31, 20Y2, assuming that assets increased by $78,070 and liabilities decreased by

$29,570 during 20Y2.

e. Net income (or net loss) during 20Y2, assuming that as of December 31, 20Y2, assets were $745,200, liabilities were $121,240,

and there were no additional investments or withdrawals.

Check My Work

Previous

Next

5:48 PM

2/18/2021

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage