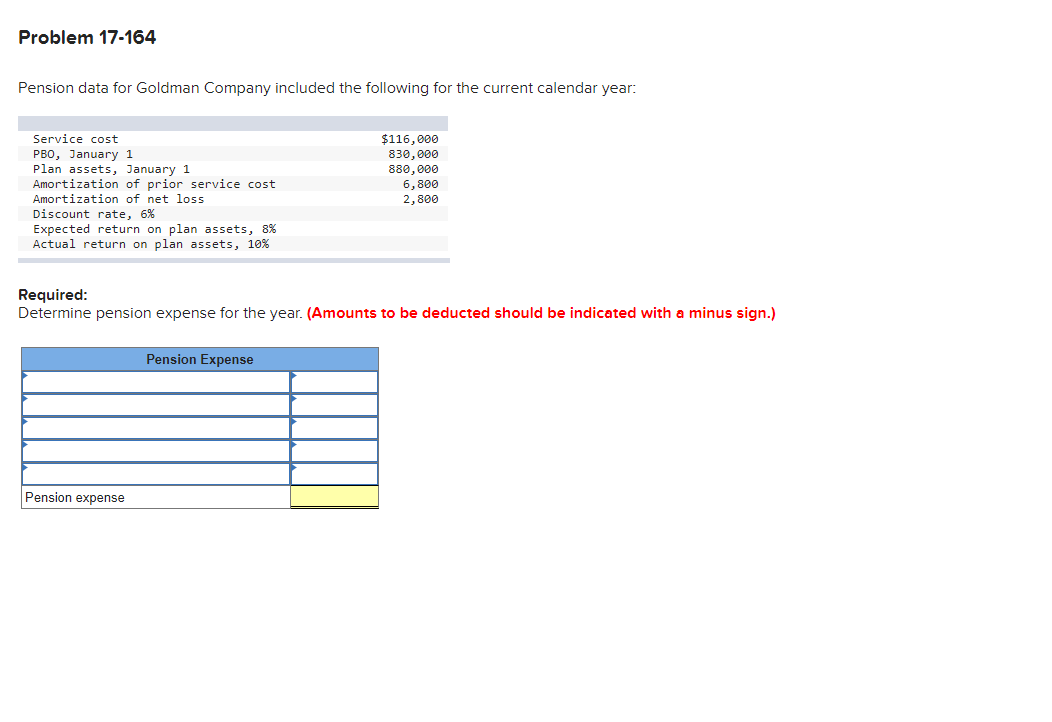

Pension data for Goldman Company included the following for the current calendar year: Service cost $116,000 PBO, January 1 Plan assets, January 1 Amortization of prior service cost Amortization of net loss 830,000 880,000 6,800 2,800 Discount rate, 6% Expected return on plan assets, 8% Actual return on plan assets, 10% Required: Determine pension expense for the year. (Amounts to be deducted should be indicated with a minus sign.) Pension Expense Pension expense

Q: Pension data for Barry Financial Services Inc. include the following: ($ in thousands) Discount…

A: Journal entry is the process of recording the business transactions in the books of accounts for the…

Q: ABC Company provided the following information for the current year: Projected Benefit Obligation,…

A: Interest costs = Projected Benefit Obligation, January 1 x discount rate = 3500000 x 10% = 350,000

Q: A company had the following information about the company's defined-benefit pension plan:…

A: SOLUTION- PENSION EXPENSE- IT IS THE AMOUNT THAT A BUSINESS CHARGES TO EXPENSE IN RELATION TO ITS…

Q: The Shasti Corporation reported the following for the year ending December 31, 20X1: Service…

A: Expected return on Plan Assets = Plan assets, January 1, 20X1 x Expected return on plan assets…

Q: On January 1, 2021, Ravetch Corporation’s projected benefit obligation was $30 million. During 2021,…

A: Interest cost = Beginning Projected benefit obligation x actuary’s discount rate = $30 million x 10%…

Q: On January 1 of the current reporting year, Pepper Corporation's projected benefit obligation was…

A: A pension benefit obligation refers to the measurement done by the company for the future purpose by…

Q: Various pension plan information of Kerem Company for 2019 and 2020 is as follows 2019 2020 Service…

A: Pension: It is a regular fixed payment that employee received after its retirement. It is kind of…

Q: U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure…

A: As posted multiple sub parts questions we are answering only first three kindly repost the…

Q: ABC Company provided the following information for the current year: · Projected Benefit…

A: Interest costs = Projected Benefit Obligation, January 1 x discount rate = 3500000 x 10% = 350,000

Q: Pension data for Barry Financial Services Inc. include the following: ($ in thousands) Discount…

A: Pension Expense: Pension Cost is a measure of the yearly cost to a business of maintaining a pension…

Q: The following information is related to the defined benefit pension plan of a company for 2021.…

A: Pension is an expense a company charges to expense for the pension amount payable to its employees.…

Q: Pension data for the Ben Franklin Company include the following for the current calendar year:…

A: Journal: Recording of a business transactions in a chronological order.

Q: Pension data for David Emerson Enterprises include the following: ($ in millions) Discount…

A: Pension plan: The pension plan is an agreement between the employer and the employee. After the…

Q: For the current year, Casimira Travel Agency provided the following information relating to the…

A: Interest cost = Beginning Defined benefit obligation x discount rate = P7,200,000 x 10% = P720,000

Q: Pension data for Barry Financial Services Inc. include the following: ($ in thousands) Discount…

A: Pension expense can be defined as the expenses related to the liabilities for pension payable to…

Q: The following information is available for the pension plan of Sunland Company for the year 2020.…

A: Interest on PBO (Pension benefit obligation)=PBO×Interest/discount rate

Q: Pension data for Carolina Consulting Company included the following for the current calendar year:…

A: Pension expenses include service cost, the Interest cost, expected return on plan assets,…

Q: A company's defined benefit pension plan had a projected benefit obligation (PBO) of $350,000 on…

A: Introduction: A projected benefit obligation (PBO) is the expected present value of an employee's…

Q: For the current year, Clark Company has the following information. Beginning plan assets was $1,000,…

A: Defined Pension Obligation Defined pension obligation which is described as implemented scheme to…

Q: vThe following data relate to the operation of Riverbed Co.s pension plan in 2021. Service cost…

A: It is a worksheet prepared to determine the pension expense be accrued for the year along with the…

Q: On January 1, 2015, Parks Co. has the following balances: Projected benefit obligation $4,200,000…

A: projected benefit obligation:- Projected Benefit obligation add: Service cost less: Benefit…

Q: A company had the following information at the end of 2021: Accumulated benefit obligation…

A: Formula: Pension liability = Projected benefit obligation - Fair value of pension plan Assets.

Q: On January 1 of the current reporting year, Coda Company's projected benefit obligation was $30.5…

A: Solution:- Calculation of the projected benefit obligation at December 31 as follows:- Basic…

Q: Bissell Company received the following reports of its defined benefit pension plan for the current…

A: PENSION EXPENSE FOR THE YEAR : = SERVICE COST + INTEREST COST -EXPECTED RATE OF RETURN ON PLAN…

Q: Pearsall Company's defined benefit pension plan had a projected benefit obligation (PBO) of $265,000…

A: A projected benefit obligation is a measurement of what the company will need currently to cover its…

Q: Scott Hobson Enterprises has a defined benefit pension plan. At the end of the reporting year, the…

A: Pension expense = Service cost + Interest cost + Expected return on plan assets

Q: The following data relate to Voltaire Company's defined benefit pension plan: ($ in millions) Plan…

A: Particulars Amount Plan assets at the beginning of the year $600 million Add: Actual…

Q: (Amortization of Accumulated OCI (G/L), Corridor Approach, Pension Expense Computation) The actuary…

A:

Q: On January 1 of the current reporting year, Hatami Company's projected benefit obligation was $29.6…

A: A PBO (Projected Benefit Obligation) is an actuarial measurement which shows the amount to cover…

Q: On January 1, 2020, Hulk Ltd. reported the following balances relating to their defined benefit…

A: The question is related to the Employees Benefit. The pension Expeses amd Journal entries are…

Q: Horizon Inc. has a defined benefit pension plan. The following pension-related data were available…

A: Journal entries are to be reported to show the primary effect of transactions on account books of an…

Q: Riko Company had the following data related to its defined benefit pension plan: 1/1 Plan Assets…

A: In this question, we have been asked to calculate the ending balance of the pension fund. For which…

Q: On January 1 of the current reporting year, Coda Company's projected benefit obligation was…

A: Particulars Amounts ($) PBO on January 1 $30,00,000 Add: Service cost during the year $8,75,000…

Q: Pension data for Millington Enterprises include the following: (S in millions) Discount rate, 10%…

A: Interest cost = Projected benefit obligation at the beginning of the year x Discount rate = $360…

Q: Ch U.S. Metallurgical Inc. reported the following balances in its financial statements and…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: The following information relates to Hatami Company's defined benefit pension plan during the…

A: Plan assets end of the year = Plan assets beginning of the year + Actual return on plan assets +…

Q: The following information regarding Buffalo Ltd.’s defined benefit pension plan was taken from the…

A: A continuity schedule report is a useful tool for tracking asset activities on a monthly basis. It…

Q: Pension data for David Emerson Enterprises include the following:…

A: Pension plan: It refers to a plan that is formulated to provide earnings to the employees during…

Q: Jolo Company provided the following data: January 1 Fair Value of plan assets 8,750,000 During the…

A: Formula: Actual return on plan Assets = Ending fair value of Assets - Beginning fair value of plan…

Q: Pension data for Coda Corporation included the following for the current calendar year: Service cost…

A: Interest cost = PBO x discount rate = 720,000 x 10% = $72000

Q: PQR Company provided the following information for the current year: · Projected Benefit…

A: The current service cost is the employee expenses incurred for the current year. Computation of…

Q: The following information is available for the pension plan of Sunland Company for the year 2020.…

A: Total pension expenses include service cost, interest cost, actual return on plan assets, and…

Q: (Pension Expense, Journal Entries for 2 Years) Gordon Company sponsors a defined benefit pension…

A: Solution:- a)Computation of pension expense for 2020 and 2021 as follows under:-

Q: On January 1 of the current reporting year, Coda Company's projected benefit obligation was $29.3…

A: Interest cost = Projected benefit obligation x actuary's discount rate = $29.3 x 10% = $2.93

Q: Pension data for the Ben Franklin Company Include the following for the current calendar year:…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: U.S. Metallurgical Incorporated reported the following balances in its financial statements and…

A: Pension expense refers to the amount of money which the business charges to the expenses against the…

Q: At January 1, 2020, Hennein Company had plan assets of $280,000 and a projected benefit obligation…

A: Interest cost: Interest Cost = Projected benefit Obligation × Settlement Discount Rate Service Cost:…

Q: Company A has a pension plan. On December 31, 2021, the following pension related data were…

A: + Service cost = 112 + Interest Cost = 43 - Expected Return on plan assets = 45 + Amortized Prior…

Q: On January 1, 20X1, Cello Co. established a defined benefit pension plan for its estimated the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 4) Exercise 17-16 (Static) Determine and record pension expense and gains and losses; funding and retiree benefits [LO17-6, 17-7] Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2021: Prior service cost at Jan. 1, 2021, from plan amendment at the beginning of 2018 (amortization: $4 million per year) $ 28 million Net loss—AOCI at Jan. 1, 2021 (previous losses exceeded previous gains) $ 80 million Average remaining service life of the active employee group 10 years Actuary's discount rate 7 % ($ in millions) Plan PBO Assets Beginning of 2021 $ 600 Beginning of 2021 $ 400 Service cost 80 Return on plan assets, 8% (10% expected) 32 Interest cost, 7% 42 Loss (gain) on PBO (14 ) Cash contributions 90 Less: Retiree benefits (38 ) Less: Retiree benefits (38 ) End of 2021 $ 670…Exercise 20-10 Shamrock Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $498,300 Projected benefit obligation 614,700 Pension asset/liability 116,400 Accumulated OCI (PSC) 96,900 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $92,500 Settlement rate, 9% Actual return on plan assets 54,200 Amortization of prior service cost 18,100 Expected return on plan assets 51,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 74,200 Contributions 97,200 Benefits paid retirees 82,600 Using the data above, compute pension expense for Shamrock Corp. for the year 2020 by preparing a pension worksheet. (Enter all amounts as…Exercise 18-36 Marigold Construction Company uses the percentage-of-completion method of accounting. In 2020, Marigold began work under contract #E2-D2, which provided for a contract price of $2,234,000. Other details follow: 2020 2021 Costs incurred during the year $615,980 $1,420,000 Estimated costs to complete, as of December 31 1,005,020 –0– Billings during the year 413,000 2,234,000 Collections during the year 351,000 1,530,000 Your answer is incorrect. Try again. What portion of the total contract price would be recognized as revenue in 2020? In 2021? Revenue recognized in 2020 $ Revenue recognized in 2021 $ SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is correct. Assuming the same facts as those above except that Marigold uses the completed-contract method…

- Exercise 20-03 (Part Level Submission) Windsor Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,400 Contribution to the plan 102,900 Prior service cost amortization 9,600 Actual and expected return on plan assets 64,900 Benefits paid 40,600 Plan assets at January 1, 2020 632,300 Projected benefit obligation at January 1, 2020 686,100 Accumulated OCI (PSC) at January 1, 2020 147,300 Interest/discount (settlement) rate 11 % A. Prepare a pension worksheet inserting January 1, 2020, balances, showing December 31, 2020.Question 21 Sage Company provides the following selected information related to its defined benefit pension plan for 2020. Pension asset/liability (January 1) $25,600 Cr. Accumulated benefit obligation (December 31) 400,600 Actual and expected return on plan assets 10,400 Contributions (funding) in 2020 148,800 Fair value of plan assets (December 31) 796,000 Settlement rate 10 % Projected benefit obligation (January 1) 698,500 Service cost 79,600 (b) Indicate the pension-related amounts that would be reported in the company’s income statement and balance sheet for 2020. Sage CompanyIncome Statement (Partial) $…14.Shirley Company obtained the following information at the beginning of the currentyear prior to the adoption of PAS 19R:Projected benefit obligation 9,000,000Fair value of plan assets 10,000,000Unrecognized actuarial loss 1,500,000During the current year, the actuary determined the current service cost at P2,500,000and the discount rate at 10%. The actual return on plan assets was P 1,200,000.Contribution to the plan amounted to P500,000. The actuarial loss due to increase in PBOduring the year was P900,000 and the average remaining service period is 10 years.What is the employee benefit expense?

- 19. Chanika Company provided the following information for the current year: Fair value of plan assets – January 1 3,500,000 Fair value of plan assets – December 31 5,250,000 Employer contribution 1,100,000 Benefits paid 850,000 What was the actual return on plan assets for the current year? Group of answer choices 1,500,000 1,750,000 2,600,000 2,000,0007. Entity A publishes quarterly interim financial reports. Entity A’s annual depreciation for items of PPE is P120,000. At the end of the first quarter, Entity A’s inventories have a cost of P600,000 and a net realizable value of P510,000. Entity A expects that the total employee bonuses (13th month pay) that will be paid at year-end will amount to P60,000. How much is the total amount of expense to be recognized from the items described above in Entity A’s first quarter statement of profit or loss?Problem 20-07 Tamarisk Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances related to this plan. Plan assets (market-related value) $474,000 Projected benefit obligation 759,000 Pension asset/liability 285,000 Cr. Prior service cost 84,000 Net gain or loss (debit) 89,000 As a result of the operation of the plan during 2020, the actuary provided the following additional data for 2020. Service cost $107,000 Settlement rate, 9%; expected return rate, 10% Actual return on plan assets 43,000 Amortization of prior service cost 25,000 Contributions 138,000 Benefits paid retirees 93,000 Average remaining service life of active employees 10 years Using the preceding data, compute pension expense for Tamarisk Corp. for the year 2020 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive.) TAMARISK…

- Question 16## Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Also please help me answer part B. (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…Question 16 Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and…Question 16# Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…