Pepper Corporation owns 75 percent of Salt Company's voting shares. During 20X8, Pepper produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to Salt for $90 each. Salt sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems. Based on the information given above, what amount of cost of goods sold must be reported in the consolidated income statement for 20X8? Multiple Choice A. $1,422,000 B. $2,963,000 C. $1,620,000 D. $2,765,000

Pepper Corporation owns 75 percent of Salt Company's voting shares. During 20X8, Pepper produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to Salt for $90 each. Salt sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems. Based on the information given above, what amount of cost of goods sold must be reported in the consolidated income statement for 20X8? Multiple Choice A. $1,422,000 B. $2,963,000 C. $1,620,000 D. $2,765,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Pepper Corporation owns 75 percent of Salt Company's voting shares. During 20X8, Pepper produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to Salt for $90 each. Salt sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems. Based on the information given above, what amount of cost of goods sold must be reported in the consolidated income statement for 20X8?

Multiple Choice

A. $1,422,000

B. $2,963,000

C. $1,620,000

D. $2,765,000

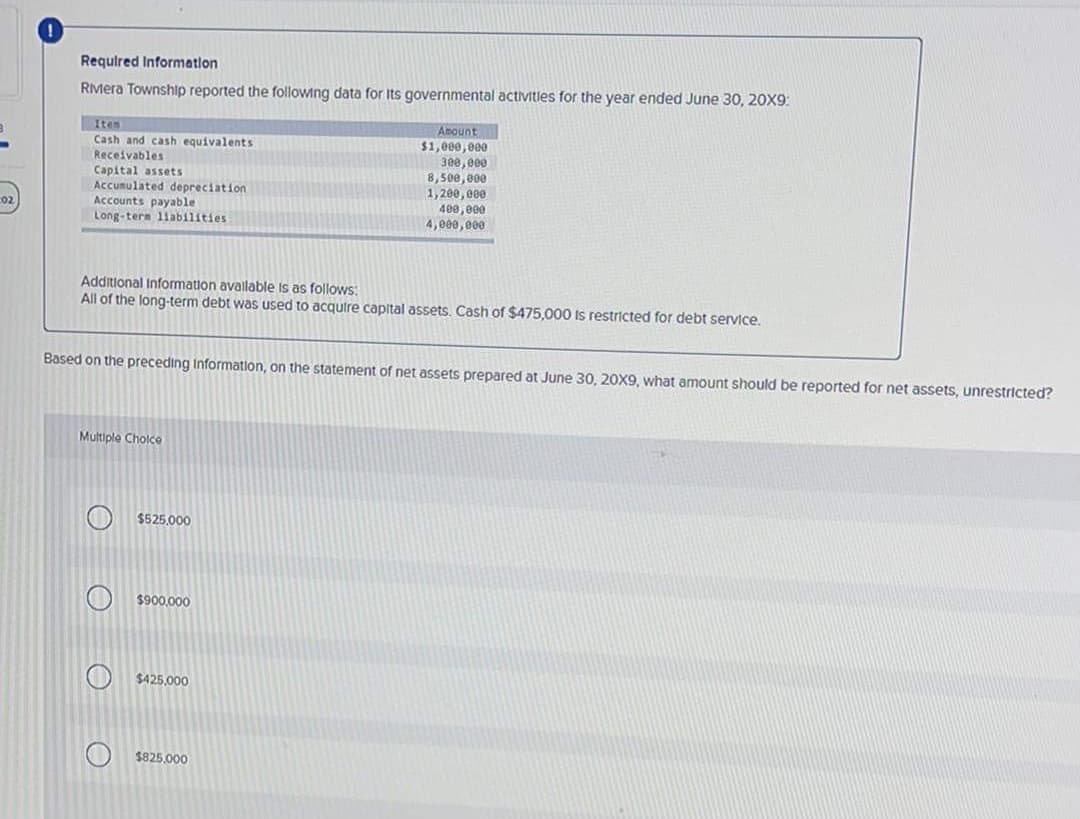

Transcribed Image Text:Requlred Information

RMera Township reported the following data for Its governmental activitles for the year ended June 30, 20X9:

Amount

$1,000,ee0

300, ee0

Item

Cash and cash equivalentS

Receivables

Capital assets

Accumulated depreciation

Accounts payable

Long-tern 1iabilities

8,500,800

1,200, eee

400, eee

02

4,000,000

Additional Information avallable is as follows:

All of the long-term debt was used to acquire capital assets. Cash of $475,000 Is restricted for debt service.

Based on the preceding Information, on the statement of net assets prepared at June 30, 20X9, what amount should be reported for net assets, unrestricted?

Multiple Cholce

$525,000

$900,000

$425,000

$825,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education