Perform a Dupont Analysis for Dunder Mifflin, Inc. for 2015 and 2016 Hint: Use the Product(...) function of Excel for ROE ROE = x TA Turnover x Equity Multiplier PM 2016 2015 Perform a Common Size Analysis of the balance sheets and income statements for Dunder Mifflin

Perform a Dupont Analysis for Dunder Mifflin, Inc. for 2015 and 2016 Hint: Use the Product(...) function of Excel for ROE ROE = x TA Turnover x Equity Multiplier PM 2016 2015 Perform a Common Size Analysis of the balance sheets and income statements for Dunder Mifflin

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.6.2MBA: Return on assets ExxonMobil Corporation (XOM) explores, produces, and distributes oil and natural...

Related questions

Question

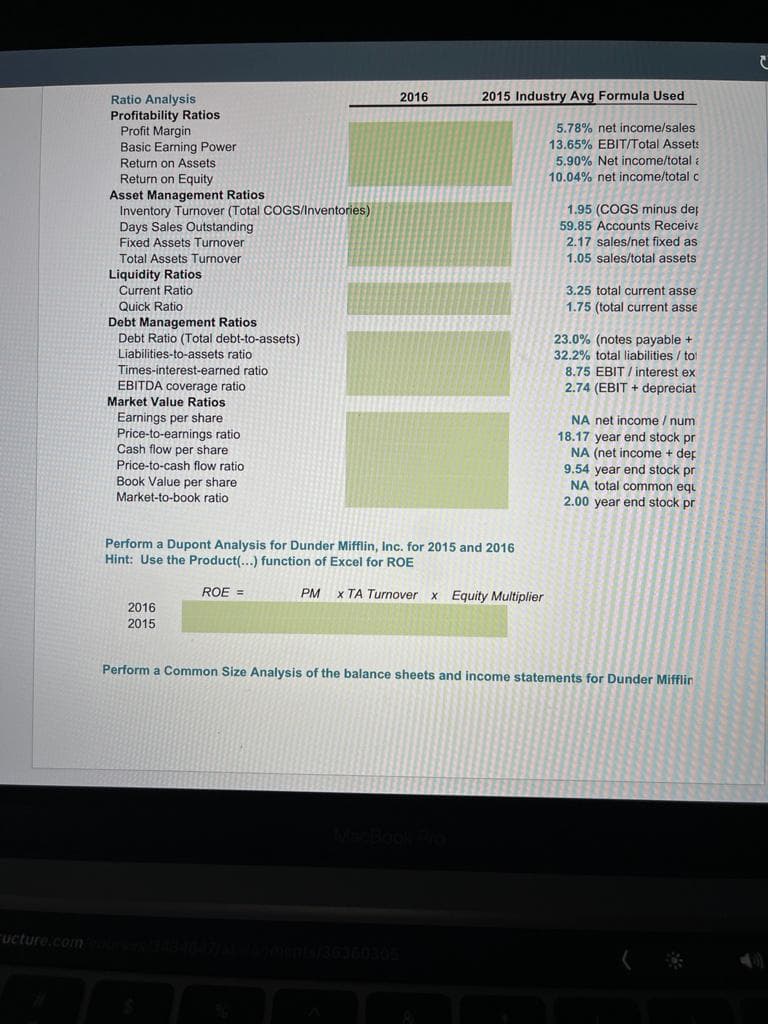

Transcribed Image Text:2016

2015 Industry Avg Formula Used

Ratio Analysis

Profitability Ratios

Profit Margin

Basic Earning Power

Return on Assets

5.78% net income/sales

13.65% EBIT/Total Asset:

5.90% Net income/total a

10.04% net income/total c

Return on Equity

Asset Management Ratios

Inventory Turnover (Total COGS/Inventories)

Days Sales Outstanding

Fixed Assets Turnover

1.95 (COGS minus dep

59.85 Accounts Receiva

2.17 sales/net fixed as

1.05 sales/total assets

Total Assets Turnover

Patie

Liquidity Ratios

Current Ratio

3.25 total current asse

Quick Ratio

1.75 (total current asse

Debt Management Ratios

Debt Ratio (Total debt-to-assets)

23.0% (notes payable +

32.2% total liabilities / tot

8.75 EBIT / interest ex

Liabilities-to-assets ratio

Times-interest-earned ratio

EBITDA coverage ratio

Market Value Ratios

2.74 (EBIT + depreciat

Ratioe

Earnings per share

Price-to-earnings ratio

Cash flow per share

NA net income / num

Price-to-cash flow ratio

Book Value per share

Market-to-book ratio

18.17 year end stock pr

NA (net income + dep

9.54 year end stock pr

NA total common eqi

2.00 year end stock pr

Perform a Dupont Analysis for Dunder Mifflin, Inc. for 2015 and 2016

Hint: Use the Product(...) function of Excel for ROE

ROE =

x TA Turnover x Equity Multiplier

PM

2016

2015

Perform a Common Size Analysis of the balance sheets and income statements for Dunder Mifflin

ucture.com

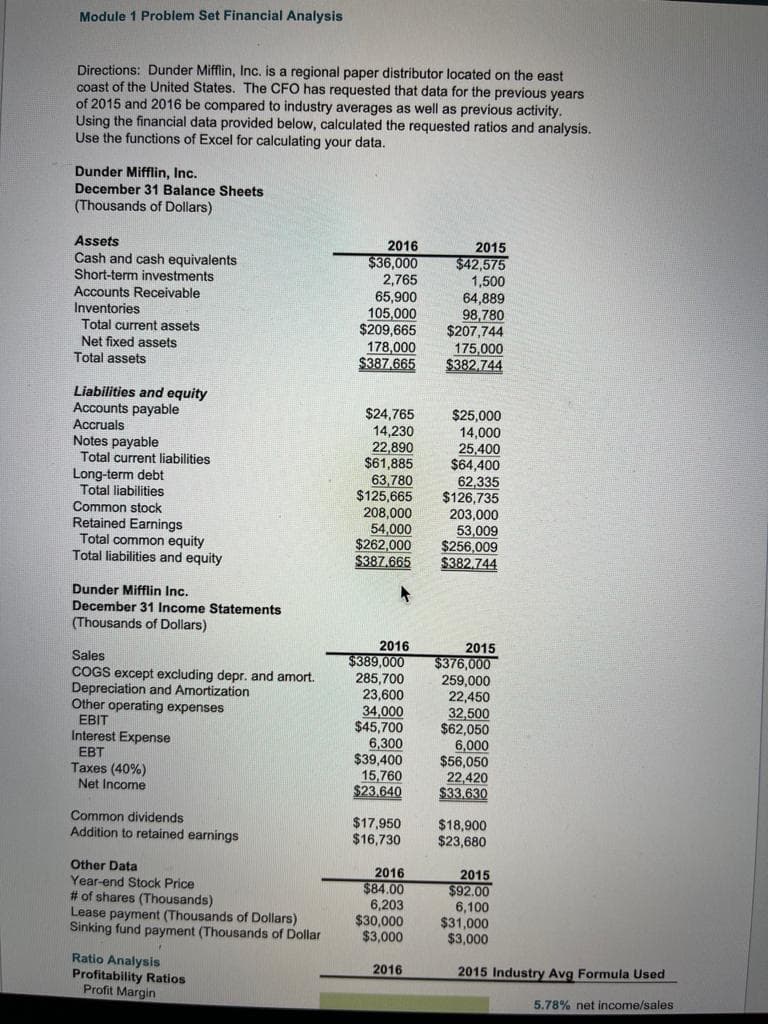

Transcribed Image Text:Module 1 Problem Set Financial Analysis

Directions: Dunder Mifflin, Inc. is a regional paper distributor located on the east

coast of the United States. The CFO has requested that data for the previous years

of 2015 and 2016 be compared to industry averages as well as previous activity.

Using the financial data provided below, calculated the requested ratios and analysis.

Use the functions of Excel for calculating your data.

Dunder Mifflin, Inc.

December 31 Balance Sheets

(Thousands of Dollars)

Assets

2016

Cash and cash equivalents

Short-term investments

Accounts Receivable

Inventories

Total current assets

Net fixed assets

Total assets

$36,000

2,765

65,900

105,000

$209,665

178,000

$387.665

2015

$42,575

1,500

64,889

98,780

$207,744

175,000

$382.744

Liabilities and equity

Accounts payable

Accruals

Notes payable

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained Earnings

Total common equity

Total liabilities and equity

$24,765

14,230

22,890

$61,885

63,780

$125,665

208,000

54,000

$262,000

$387.665

$25,000

14,000

25,400

$64,400

62,335

$126,735

203,000

53,009

$256,009

$382.744

Dunder Mifflin Inc.

December 31 Income Statements

(Thousands of Dollars)

2016

$389,000

285,700

23,600

34,000

$45,700

6,300

$39,400

15,760

$23.640

2015

$376,000

259,000

22,450

32,500

$62,050

6,000

$56,050

22,420

$33.630

Sales

COGS except excluding depr. and amort.

Depreciation and Amortization

Other operating expenses

EBIT

Interest Expense

EBT

Taxes (40%)

Net Income

Common dividends

Addition to retained earnings

$17,950

$16,730

$18,900

$23,680

Other Data

Year-end Stock Price

# of shares (Thousands)

Lease payment (Thousands of Dollars)

Sinking fund payment (Thousands of Dollar

2016

$84.00

6,203

$30,000

$3,000

2015

$92.00

6,100

$31,000

$3,000

Ratio Analysis

Profitability Ratios

Profit Margin

2016

2015 Industry Avg Formula Used

5.78% net income/sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning