Pertaining to Cash Receipts Journal and Deposit column of the bank statement) 1. How much is the total of your Cash Receipts Journal? Answer. 2. How much is the total of your Cash Disbursement Journal? Answer: 3. How much is the General Ledger balance of your Cash in Bank account as of 30 June 20A? Answer. 4. How much is the total deposit column of Banco de Oro bank statement? Answer: 5. Comparing the total of your Cash Receipts Journal and the deposit column of the bank statement, how much is the amount of difference? Answer:

Pertaining to Cash Receipts Journal and Deposit column of the bank statement) 1. How much is the total of your Cash Receipts Journal? Answer. 2. How much is the total of your Cash Disbursement Journal? Answer: 3. How much is the General Ledger balance of your Cash in Bank account as of 30 June 20A? Answer. 4. How much is the total deposit column of Banco de Oro bank statement? Answer: 5. Comparing the total of your Cash Receipts Journal and the deposit column of the bank statement, how much is the amount of difference? Answer:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 47E

Related questions

Question

Transcribed Image Text:4. Describe the nature of a bank reconciliation statement.

5. Identify common reconciling items and describe each of them.

6. Analyze the effects of the identified reconciling items.

Reference: Quarter 1 Module 9 - Fundamentals of Accountancy, Business and Management 2

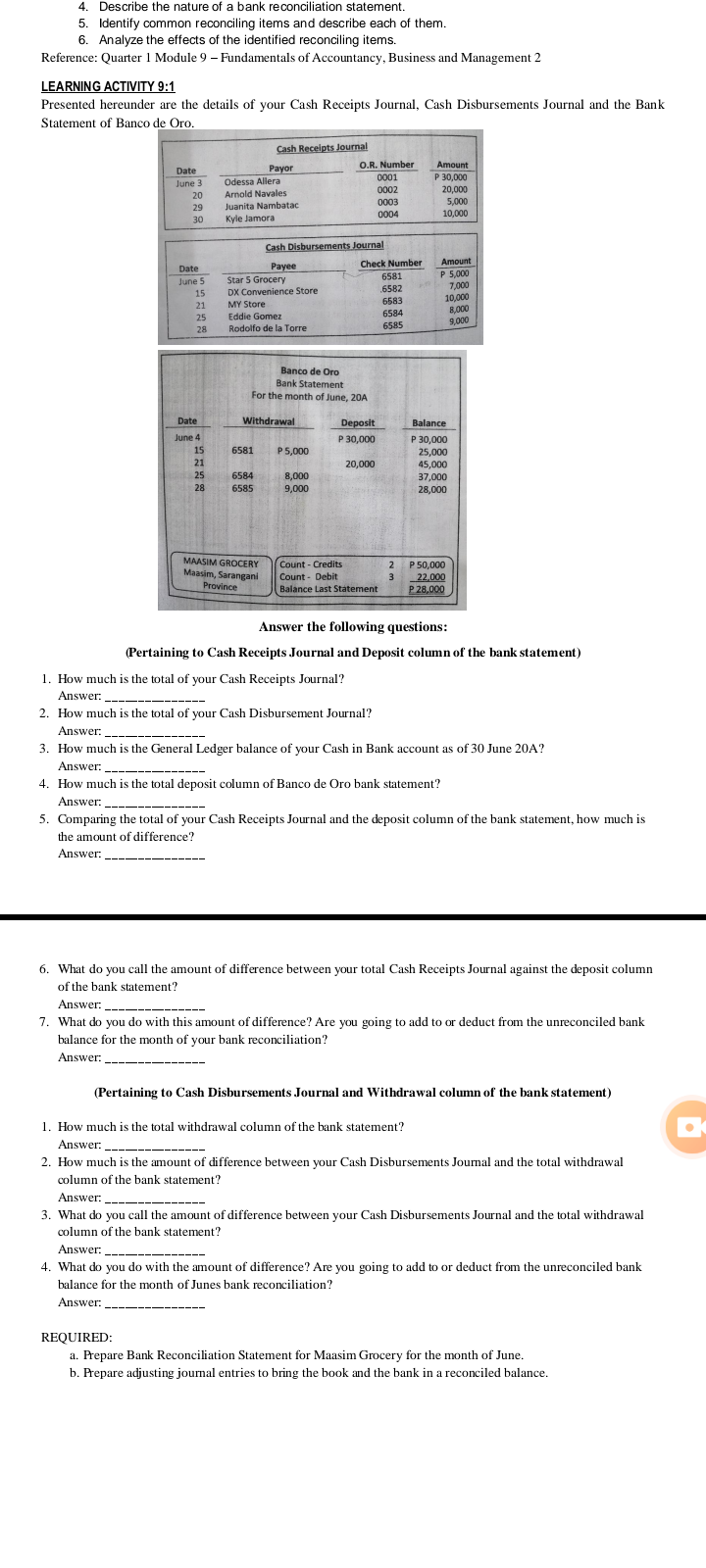

LEARNING ACTIVITY 9:1

Presented hereunder are the details of your Cash Receipts Journal, Cash Disbursements Journal and the Bank

Statement of Banco de Oro.

Cash Receipts Journal

O.R. Number

0001

0002

Amount

Date

Payor

P 30,000

June 3

Odessa Allera

20,000

5,000

10,000

20

Arnold Navales

0003

Juanita Nambatac

29

30

0004

Kyle Jamora

Cash Disbursements Journal

Check Number

6581

.6582

6583

6584

Amount

Date

Рayee

Star 5 Grocery

DX Convenience Store

MY Store

Eddie Gomez

P 5,000

7,000

10,000

June 5

15

21

8,000

9,000

25

28

Rodolfo de la Torre

6585

Banco de Oro

Bank Statement

For the month of June, 20A

Date

Withdrawal

Deposit

P 30,000

Balance

June 4

P 30,000

25,000

45,000

15

6581

P 5,000

21

20,000

25

6584

8,000

37,000

28

6585

9,000

28,000

MAASIM GROCERY

Maasim, Sarangani

Count - Credits

P 50,000

22,000

P 28,000

2

Count - Debit

3

Province

Balance Last Statement

Answer the following questions:

(Pertaining to Cash Receipts Journal and Deposit column of the bank statement)

1. How much is the total of your Cash Receipts Journal?

Answer:

2. How much is the total of your Cash Disbursement Journal?

Answer:

3. How much is the General Ledger balance of your Cash in Bank account as of 30 June 20A?

Answer:

4. How much is the total deposit column of Banco de Oro bank statement?

Answer:

5. Comparing the total of your Cash Receipts Journal and the deposit column of the bank statement, how much is

the amount of difference?

Answer:

6. What do you call the amount of difference between your total Cash Receipts Journal against the deposit column

of the bank statement?

Answer:

7. What do you do with this amount of difference? Are you going to add to or deduct from the unreconciled bank

balance for the month of your bank reconciliation?

Answer:

(Pertaining to Cash Disbursements Journal and Withdrawal column of the bank statement)

1. How much is the total withdrawal column of the bank statement?

Answer:

2. How much is the amount of difference between your Cash Disbursements Journal and the total withdrawal

column of the bank statement?

Answer:

3. What do you call the amount of difference between your Cash Disbursements Journal and the total withdrawal

column of the bank statement?

Answer:

4. What do you do with the amount of difference? Are you going to add to or deduct from the unreconciled bank

balance for the month of Junes bank reconciliation?

Answer:

REQUIRED:

a. Prepare Bank Reconciliation Statement for Maasim Grocery for the month of June.

b. Prepare adjusting journal entries to bring the book and the bank in a reconciled balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub