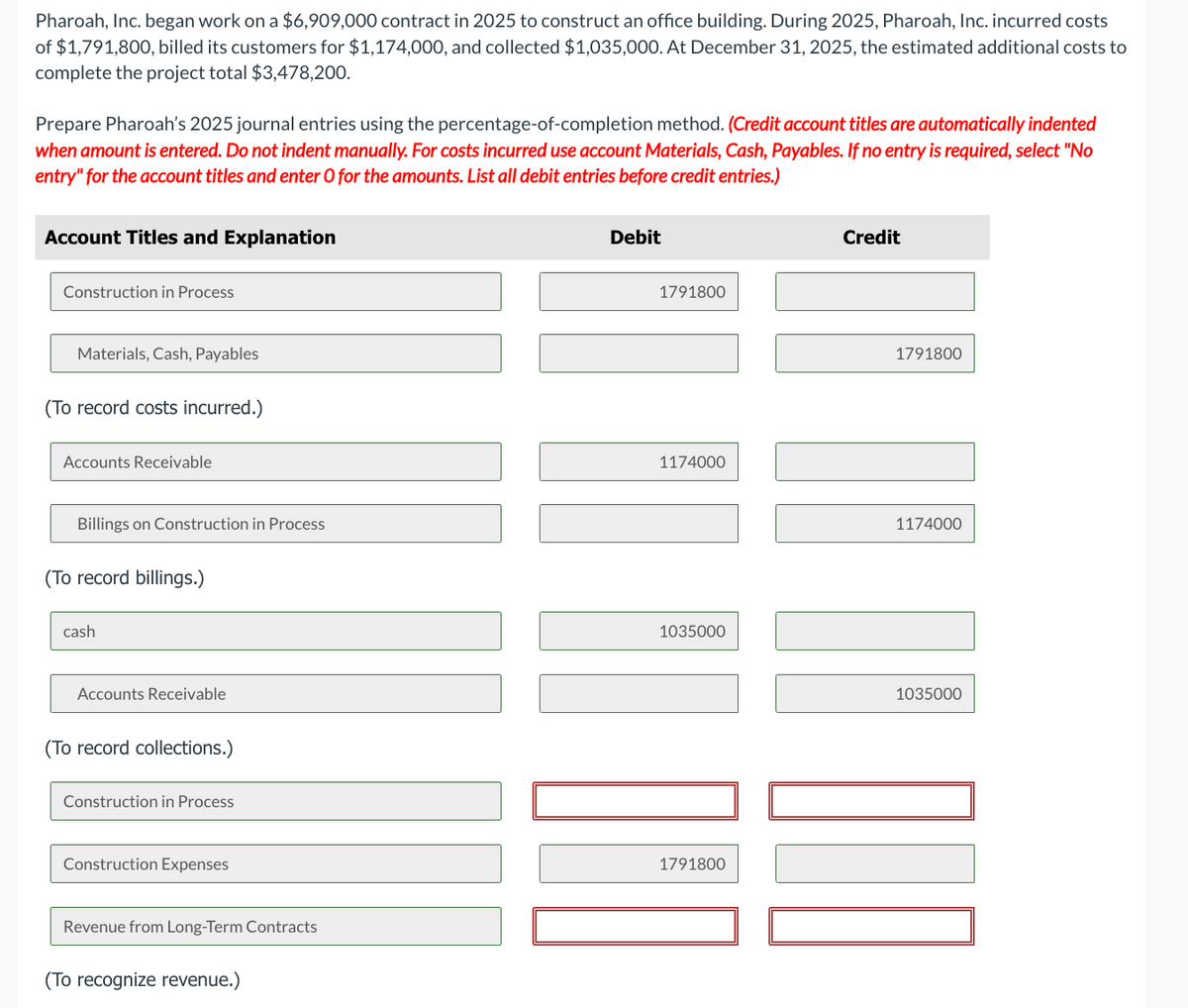

Pharoah, Inc. began work on a $6,909,000 contract in 2025 to construct an office building. During 2025, Pharoah, Inc. incurred costs of $1,791,800, billed its customers for $1,174,000, and collected $1,035,000. At December 31, 2025, the estimated additional costs to complete the project total $3,478,200. Prepare Pharoah's 2025 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Construction in Process Materials, Cash, Payables (To record costs incurred.) Accounts Receivable Billings on Construction in Process (To record billings.) cash Accounts Receivable (To record collections.) Construction in Process Construction Expenses Revenue from Long-Term Contracts (To recognize revenue.) Debit 1791800 1174000 1035000 1791800 Credit 1791800 ]]]] 1174000 1035000

Pharoah, Inc. began work on a $6,909,000 contract in 2025 to construct an office building. During 2025, Pharoah, Inc. incurred costs of $1,791,800, billed its customers for $1,174,000, and collected $1,035,000. At December 31, 2025, the estimated additional costs to complete the project total $3,478,200. Prepare Pharoah's 2025 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Construction in Process Materials, Cash, Payables (To record costs incurred.) Accounts Receivable Billings on Construction in Process (To record billings.) cash Accounts Receivable (To record collections.) Construction in Process Construction Expenses Revenue from Long-Term Contracts (To recognize revenue.) Debit 1791800 1174000 1035000 1791800 Credit 1791800 ]]]] 1174000 1035000

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Pharoah, Inc. began work on a $6,909,000 contract in 2025 to construct an office building. During 2025, Pharoah, Inc. incurred costs

of $1,791,800, billed its customers for $1,174,000, and collected $1,035,000. At December 31, 2025, the estimated additional costs to

complete the project total $3,478,200.

Prepare Pharoah's 2025 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented

when amount is entered. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select "No

entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Construction in Process

Materials, Cash, Payables

(To record costs incurred.)

Accounts Receivable

Billings on Construction in Process

(To record billings.)

cash

Accounts Receivable

(To record collections.)

Construction in Process

Construction Expenses

Revenue from Long-Term Contracts

(To recognize revenue.)

Debit

1791800

1111

1174000

1035000

1791800

Credit

1791800

OTO WW NO

1174000

1035000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT