- Philippines of AL

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Please answer number 8 only with a complete solution. Thank you

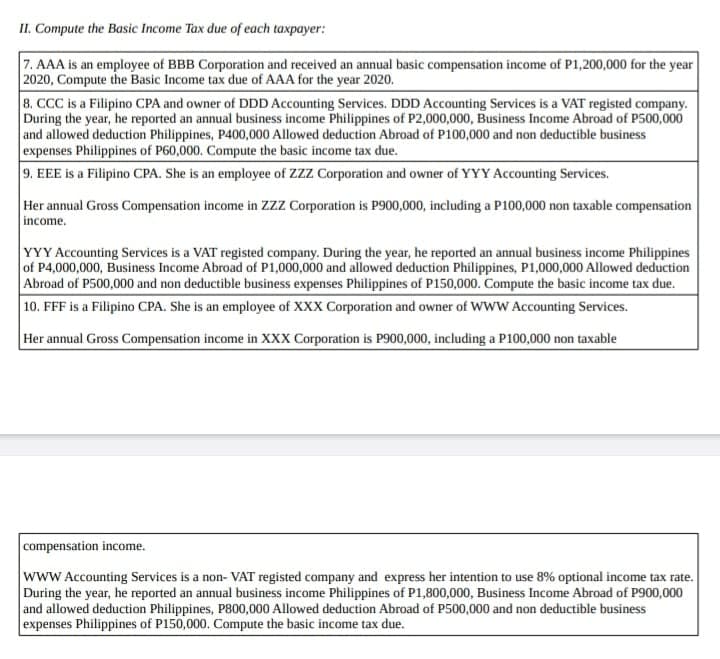

Transcribed Image Text:II. Compute the Basic Income Tax due of each taxpayer:

7. AAA is an employee of BBB Corporation and received an annual basic compensation income of P1,200,000 for the year

2020, Compute the Basic Income tax due of AAA for the year 2020.

8. CCC is a Filipino CPA and owner of DDD Accounting Services. DDD Accounting Services is a VAT registed company.

During the year, he reported an annual business income Philippines of P2,000,000, Business Income Abroad of P500,000

and allowed deduction Philippines, P400,000 Allowed deduction Abroad of P100,000 and non deductible business

expenses Philippines of P60,000. Compute the basic income tax due.

9. EEE is a Filipino CPA. She is an employee of ZZZ Corporation and owner of YYY Accounting Services.

Her annual Gross Compensation income in ZZZ Corporation is P900,000, including a P100,000 non taxable compensation

income.

YYY Accounting Services is a VAT registed company. During the year, he reported an annual business income Philippines

of P4,000,000, Business Income Abroad of P1,000,000 and allowed deduction Philippines, P1,000,000 Allowed deduction

Abroad of P500,000 and non deductible business expenses Philippines of P150,000. Compute the basic income tax due.

10. FFF is a Filipino CPA. She is an employee of XXX Corporation and owner of WwW Accounting Services.

Her annual Gross Compensation income in XXX Corporation is P900,000, including a P100,000 non taxable

compensation income.

www Accounting Services is a non- VAT registed company and express her intention to use 8% optional income tax rate.

During the year, he reported an annual business income Philippines of P1,800,000, Business Income Abroad of P900,000

and allowed deduction Philippines, P800,000 Allowed deduction Abroad of P500,000 and non deductible business

expenses Philippines of P150,000. Compute the basic income tax due.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT