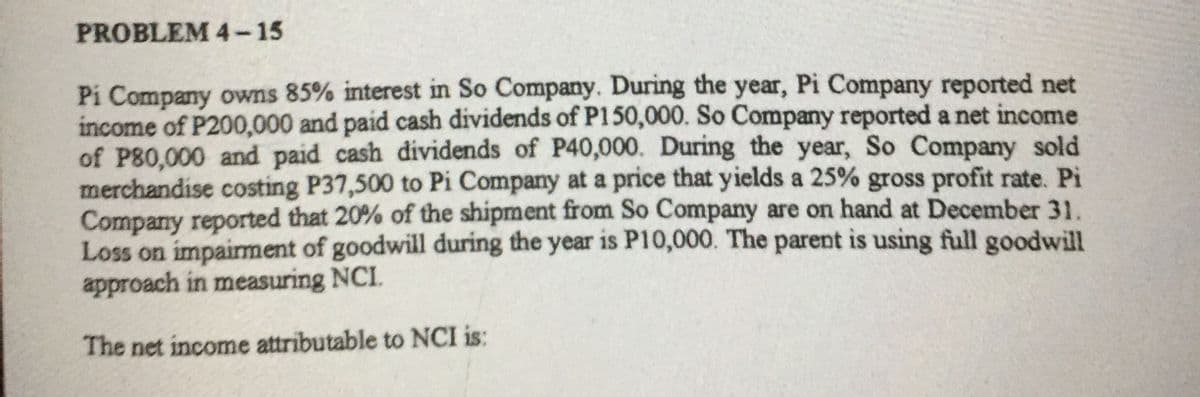

Pi Company owns 85% interest in So Company. During the year, Pi Company reported net income of P200,000 and paid cash dividends of P150,000. So Company reported a net income of P80,000 and paid cash dividends of P40,000. During the year, So Company sold merchandise costing P37,500 to Pi Company at a price that yields a 25% gross profit rate. Pi Company reported that 20% of the shipment from So Company are on hand at December 31. Loss on impairment of goodwill during the year is P10,000. The parent is using full goodwill approach in measuring NCI. The net income attributable to NCI is:

Q: On January 1, 2021, Alamar Corporation acquired a 41 percent interest in Burks, Inc., for $233,000.…

A: Given: % investment is 41% Amount = $233,000 Net income = $82,000 Cash dividend paid = $28,000

Q: Baba Plc has owned 100% of the issued share capital of Onua Plc for many years. Baba Plc sells goods…

A: The cost of goods sold represents the cost incurred in selling the goods and services to the…

Q: On April 1, year 1, Dart Co. paid $620,000 for all the issued and outstanding common stock of Wall…

A: Solution:- Calculation of goodwill as follows under:- Goodwill =purchase price - fair value of the…

Q: OI Corporation, a manufacturer, has a gross sales of P90,000,000.00 for CY 2021, its fifth year of…

A: Taxable income is the net income earned by an individual on which the tax is payable. It is…

Q: Pit Corporation owns 90% of Stop Company's outstanding common stock. On 07/01/20, Pit sold inventory…

A: Journal entry: A journal entry is used to record day-to-day transactions of the business by debiting…

Q: Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of…

A: given that, Shaun company reports net income = P280000 Shaun company pays annual cash dividend =…

Q: Frankie Corporation purchased 100% of Blake Company for P600,000. At that date, Blake Company had…

A: Given in the question: Particulars Book Value Market Value Cash and Receivables…

Q: On January 1, 2018, Alamar Corporation acquired a 42 percent interest in Burks, Inc., for $185,000.…

A: Equity method: Equity method is the method used for accounting equity investments which claims a…

Q: Peter Inc. purchases 30% of Sam Ltd for $50,000 with significant influence. At year-end, Peter Inc.…

A: Solution: Holding of peter Inc. in Sam ltd = 30% As Peter Inc holds more than 20% in Sam ltd,…

Q: JoeBlow Co. had revenue and expenses from ongoing business operations for the current year of…

A: Income statement refers to those financial statements which showcases the company's revenues and…

Q: Platek Enterprises purchases 100 percent of Smith Company for P600,000. At that date Smith Company…

A: At the time of acquisition of another business means acquisition of assets at book values on that…

Q: Nicolo manufacturing produced 10,000 Kitchen clocks in 2021 for P50 each and sold them to San Mig…

A: Consolidation In the consolidation parent company acquired the subsidiary company above the 50%…

Q: Khobar Company started its business in February 2001 producing and selling mix of pharmaceutical…

A:

Q: This year, Southern Coat Company had sales of £730,000. Cost of goods sold, administrative and…

A: Sales = 730,000 Cost of Goods Sold = 580,000 Admin and selling expenses = 105,000 Depreciation…

Q: Palm Company owns 100% of Soso Company. During year X1, Soso sold merchandise costing $50,000 to…

A: Soso sold merchandise cost =$ 50000 profit realised on it =$ 30000 But, 40% stock…

Q: ABC owns 30% of MELY, which it purchased on 1 January 20X7 for $5,000,000. At that date, MELY had…

A: The corporation which has substantial amount of investment in other corporation is called parent…

Q: Goddy Company owns 80% of the common stock of Morris, Inc. In the current year, Goddy reports sales…

A: Consolidated cost of goods which are sold comes after adding the cost of goods sold of subsidiary…

Q: What are the consolidated Accounts receivable balance at the end of the year?

A: Here, Rose company owns 100% of Hayley company. In such companies, accounts receivable in a company…

Q: Of the amount paid for the investment, how much is attributable to goodwill? How much is the…

A: Acquisition costs are the sum of the costs incurred by the business in acquiring a new client or…

Q: Rembrandt Paint Company had the following income statement items for the year ended December 31,…

A: Income Statement: It refers to a statement which shows how profitable a company was over a given…

Q: Tech Co. and Robotics Co. are joint venturers of Mecha Co., a producer of high tech machinery. Tech…

A: Joint venture is a form of agreement or arrangement between two or more than two persons, in which…

Q: On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000.…

A: As Mentioned question number 03 to answer so we are only answering that.

Q: rittney owns 30% of Orange Company, a C-Corporation. Orange Company has $600,000 in operating income…

A: Gross income refers to the total sum of money earned or gained by an individual or an entity in the…

Q: On January 1, 2018, Alamar Corporation acquired a 40 percent interest in Burks, Inc., for $210,000.…

A: Equity method: Equity method is the method used for accounting equity investments which claims a…

Q: Carlos Bakery owns 60 percent of the stocks of Zeus Products acquired several years ago at book…

A: Consolidated net income is the total income earned by the whole group of companies. Any unrealized…

Q: On January 1, 2015, P Company acquired a 90% interest in S Company. During 2016, S Company sold…

A: Consolidated Financial Statement In Simple consolidated financial statement which describes that the…

Q: During 2012 Logic Company purchased 4,000 shares of Midi, Inc. for P30 per share. The investment was…

A: In this question, Logic company has purchased 4000 shares at P30/share of Midi Inc during 2012 out…

Q: Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of…

A: The difference between Purchase Price and Book Value is either Goodwill or Capital Reserve. When…

Q: On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000.…

A: Dividend = Total dividend paid x 36% = $24000 x 36% = $8,640

Q: Paneer owns 30% of Lassi and has done so for many years. During the year ended 31 December 20X1,…

A: Lassi sold inventory of 1 million at 50% mark up out of which 40% is still in stock cost of…

Q: GG Co. had the following transactions with two subsidiaries, OO and RR during 2020: Sales of…

A: In consolidated Balance sheet any transaction which is happen between holding and subsidiary company…

Q: Toodles Inc. had sales of $1,840,000. Cost of goods sold, administrative and selling expenses, and…

A: The question is based on the concept of Financial Management.

Q: The Rollings Company had sales of $1,000 with cost of goods sold (COGS) equal to 30% of sales.…

A: Introduction: Net income refers to the after-tax income of an individual. Net income can also be…

Q: Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1, 2013, at…

A: Consolidation is a process of acquiring majority of shares (generally more than 50%) of one entity…

Q: OI Corporation, a manufacturer, has a gross sales of P90,000,000.00 for CY 2021, its fifth year of…

A: Solution: JOI Corporation, a manufacturer for CY 2021, Gross sales = P90000000 in its 5th year of…

Q: On January 1, 2021, Alamar Corporation acquired a 42 percent interest in Burks, Inc., for $185,000.…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: Lone Star Company is a calendar-year corporation, and this year Lone Star reported $122,000 in…

A: Captain Gain is a source of income gained from the profit from the sale of property or an…

Q: Acker Company bought 100% of Howell Company on 1/1/X1 for $1,440,000 and began applying the equity…

A: Expansion and growth are motives of business. Purchasing or acquiring other firms is one of the ways…

Q: Rose inc. had sales of $7 million during the past year. The cost of goods sold amounted to $4…

A: Cost of goods sold exhibits direct cost incurred by company for producing goods and services.

Q: On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000.…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Padlock Corp. owns 90 percent of Safeco, Inc. During the year, Padlock sold 3,000 locking mechanisms…

A: Determine the amount of intra-entity profit that remains in S company inventory at year-end.

Q: Brandy Corporation owns 60 percent of Downer's voting shares. During 20X3, Brandy produced 50,000…

A: Working Notes: 1. Sales = Number of desks sold to Downer's * selling Price = 20,000 desks * $94 =…

Q: On January 1, 2018, Spark Corp. acquired a 40% interest in Cranston Inc. for $250,000. On that date,…

A: Journal is the book of original entry in which all of the financial transactions of the business are…

Q: income of P160,000 and P180,000, respectively. During 20A, Vullaby sold merchandise to Braviary…

A: Minority interest is established when someone holds less than 50% share in the company. It is…

Q: P CO owns a 90% interest in S Co, purchased at a time when the book values of S recorded assets and…

A: Intercompany transactions are the transactions incur between the parent and subsidiary company…

Q: On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $218,000.…

A: Share in income = net income x holding % = 76000*36% = $27,360

Q: On January 1, 2021, Alamar Corporation acquired a 36 percent interest in Burks, Inc., for $198,000.…

A: Solution:- Preparation of journal entry for the 36 percent income earned by Alamar from this…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Problem 2: On Jan 1, 20X8, Banawe Company purchased 80% of the outstanding shares of Malate Company at a cost of P4,000,000. On that date, Malate had P2,500,000 of capital stock and P3,500,000 of retained earnings. For 20X8, Banawe had income of P1,400,000 form its separate operations and paid dividends of P750,000. Malate on the other hand reported income of P325,000 and paid dividends of P150,000 on December 1, 20X8. All the assets and liabilities of Malate have book values equal to their fair market values. Assume all income was earned evenly throughout the year except for an intercompany transaction on October 1, 20X8 when Banawe purchased a machinery from Malate for P500,000. The book value of the machinery on that date amounted to P600,000 and accumulated depreciation of P400,000 and is already reflected in the income of Malate indicated above. The machinery is expected to have a remaining useful life of 5 years from the date of sale. In the December 31, 20X8 consolidated…Exercise 4 – 7On January 1, 2020, Levesque Co. purchased 500,000 ordinary shares of Rowland Co. at ₱14 per share, representing a 25% ownership in Rowland. This allowed Levesque to exercise significant control over Rowland. Rowland declared and paid dividends of ₱1 and ₱2 in 2020 and 2021, respectively. At the end of 2020 and 2021, Rowland’s shares were trading at ₱15 and ₱17 per share. Rowland’s net income in 2020 and 2021 was ₱2,400,000 and ₱3,200,000, respectively.1. Determine the investment income recognized by Levesque in 2020 and 2021.2. Determine the carrying amount of Levesque’s investment on December 31, 2020, and December 31, 2021.Harvatin Group reported net income totaling $1,000,000 for the year 2006. The following is EXERCISE 6-4 additional information obtained from the Harvatin Group's financial reports: The Company purchased 100,000 shares of Micron Specialists for $10 per share during the fourth quarter of 2006. The investment is accounted for as "available for sale." The value of the shares is $9 at the end of 2006. The Company purchased 10,000 shares of Sunswept Properties for $20 per share during the fourth quarter of 2006. The investment is accounted for as "trading" securities. The value of the shares is $22 at the end of 2006. The company began operations in the Baltic region of Europe during the year and reports a foreign currency translation gain at the end of 2006 totaling $50,000. The decrease in the net pension assets for the year was $175,000. However, the periodic pension expense reported in the income statement was only $100,000. The company reported unrealized holding losses on…

- Situation 1Oriole Cosmetics acquired 10% of the 191,000 shares of common stock of Martinez Fashion at a total cost of $14 per share on March 18, 2020. On June 30, Martinez declared and paid $69,200 cash dividend to all stockholders. On December 31, Martinez reported net income of $116,000 for the year. At December 31, the market price of Martinez Fashion was $15 per share.Situation 2Waterway, Inc. obtained significant influence over Seles Corporation by buying 40% of Seles’s 28,500 outstanding shares of common stock at a total cost of $9 per share on January 1, 2020. On June 15, Seles declared and paid cash dividends of $38,100 to all stockholders. On December 31, Seles reported a net income of $78,200 for the year.Prepare all necessary journal entries in 2020 for both situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) PLEASE HELP.…Situation 1Waterway Cosmetics acquired 10% of the 189,000 shares of common stock of Martinez Fashion at a total cost of $12 per share on March 18, 2020. On June 30, Martinez declared and paid $77,300 cash dividend to all stockholders. On December 31, Martinez reported net income of $122,300 for the year. At December 31, the market price of Martinez Fashion was $13 per share.Situation 2Wildhorse, Inc. obtained significant influence over Seles Corporation by buying 30% of Seles’s 32,100 outstanding shares of common stock at a total cost of $9 per share on January 1, 2020. On June 15, Seles declared and paid cash dividends of $32,700 to all stockholders. On December 31, Seles reported a net income of $78,800 for the year.Prepare all necessary journal entries in 2020 for both situations.Question 32 On January 1, 2013, Pansy Company acquired a 10% interest in Sunflower Corporation for $80,000 when Sunflower's stockholders' equity consisted of $400,000 capital stock and $100,000 retained earnings. Book values of Sunflower's net assets equaled their fair values on this date. Sunflower's net income and dividends for 2013 through 2015 were as follows: 2013 2014 2015 Net income $ 8,000 $ 10,000 $15,000 Dividends paid 5,000 5,000 5,000 Assume that Pansy Incorporated used the cost method of accounting for its investment in Sunflower. The balance in the Investment in Sunflower account at December 31, 2015 was Answers: A. $76,700. B. $95,000. C. $80,000. D. $83,300. Question 33…

- 4. Pate Corp. owns 80% of Strange Inc.’s common stock. During 20X1, Pate sold inventory to Strange for $600,000 on the same terms as sales made to outside customers. Strange sold the entire inventory purchased from Pate by the end of 20X1. Pate and Strange report the following for 20X1. Pate Strange Sales $ 2,700,000 $ 1,600,000 Cost of sales 1,800,000 900,000 Gross profit $ 900,000 $ 700,000 Required: What amount should Pate report as sales revenue in its 20X1 consolidated income statement? What amount should Pate report as cost of sales in its 20X1 consolidated income statement? Amount a. Sales Revenue Amount $ b. Cost of sales amount $PROBLEM 28 (AICPA Adapted)Miraflores owned 10,000 shares in Maquiling Company acquired several years ago at P100 per share to be held as a long-term investment. Beginning in 2015, Miraflores received a dividend of P40 pershare. Maquiling Company notifies the investor that a portion of this amount represented earnings and the balance as liquidating dividends. The allocation to be made as follows: Earned Dividend Liquidating Dividend2015 - P402016 P10 P302017 P15 P252018 P20 P202019 P25 P15 Requirements:1. Prepare journal entries on the books of…JE 1 PizzaPan Inc. sold 1 million shares of their common stock for $1/share (par value of the common stock is $.10) JE 2 PizzaPan Inc. purchased $200,000 inventory from a culinary distributor. PizzaPan inc. had to pay at the point of purchase the full $200,000 (cash). JE 3 PizzaPan Inc. purchased a delivery truck for $40,000 (cash). JE 4 PizzaPan Inc. sold on account 10,000 pizza pans to Domino’s Corporation. They sold the pans for $5/each. The cost of each pan is $3 ($3/each). JE 5 PizzaPan Inc. sold on account 5,000 pizza cutters to PizzaHut Corporation. They sold the pizza cutters for $8/each. The cost of each pizza cutter is $4 ($4/each). JE 6 PizzaPan Inc. paid their employees as follows: Sales staff => $12,000 Administrative staff => $16,000 JE 7 PizzaPan Inc. received $50,000 payment from Domino’s Corporation. Prepare an Income Statement. Prepare a Retained Earnings Statement Prepare a Balance Sheet

- JE 1 PizzaPan Inc. sold 1 million shares of their common stock for $1/share (par value of the common stock is $.10) JE 2 PizzaPan Inc. purchased $200,000 inventory from a culinary distributor. PizzaPan inc. had to pay at the point of purchase the full $200,000 (cash). JE 3 PizzaPan Inc. purchased a delivery truck for $40,000 (cash). JE 4 PizzaPan Inc. sold on account 10,000 pizza pans to Domino’s Corporation. They sold the pans for $5/each. The cost of each pan is $3 ($3/each). JE 5 PizzaPan Inc. sold on account 5,000 pizza cutters to PizzaHut Corporation. They sold the pizza cutters for $8/each. The cost of each pizza cutter is $4 ($4/each). JE 6 PizzaPan Inc. paid their employees as follows: Sales staff => $12,000 Administrative staff => $16,000 JE 7 PizzaPan Inc. received $50,000 payment from Domino’s Corporation. I couldnt figure out the retained earnings in the T-account.JE 1 PizzaPan Inc. sold 1 million shares of their common stock for $1/share (par value of the common stock is $.10) JE 2 PizzaPan Inc. purchased $200,000 inventory from a culinary distributor. PizzaPan inc. had to pay at the point of purchase the full $200,000 (cash). JE 3 PizzaPan Inc. purchased a delivery truck for $40,000 (cash). JE 4 PizzaPan Inc. sold on account 10,000 pizza pans to Domino’s Corporation. They sold the pans for $5/each. The cost of each pan is $3 ($3/each). JE 5 PizzaPan Inc. sold on account 5,000 pizza cutters to PizzaHut Corporation. They sold the pizza cutters for $8/each. The cost of each pizza cutter is $4 ($4/each). JE 6 PizzaPan Inc. paid their employees as follows: Sales staff => $12,000 Administrative staff => $16,000 JE 7 PizzaPan Inc. received $50,000 payment from Domino’s Corporation. 1. Prepare closing entries. 2. Compare final closing entry to net income. Explain why the dollar amounts are…JE 1 PizzaPan Inc. sold 1 million shares of their common stock for $1/share (par value of the common stock is $.10) JE 2 PizzaPan Inc. purchased $200,000 inventory from a culinary distributor. PizzaPan inc. had to pay at the point of purchase the full $200,000 (cash). JE 3 PizzaPan Inc. purchased a delivery truck for $40,000 (cash). JE 4 PizzaPan Inc. sold on account 10,000 pizza pans to Domino’s Corporation. They sold the pans for $5/each. The cost of each pan is $3 ($3/each). JE 5 PizzaPan Inc. sold on account 5,000 pizza cutters to PizzaHut Corporation. They sold the pizza cutters for $8/each. The cost of each pizza cutter is $4 ($4/each). JE 6 PizzaPan Inc. paid their employees as follows: Sales staff => $12,000 Administrative staff => $16,000 JE 7 PizzaPan Inc. received $50,000 payment from Domino’s Corporation. Post the above journal entries to “T” accounts. Prepare a trial balance using the “T” account balances.