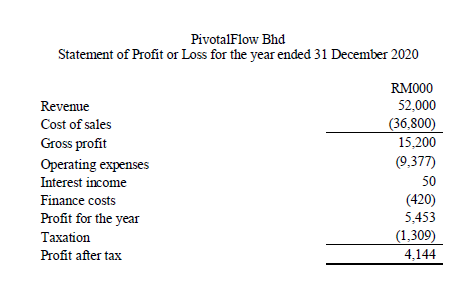

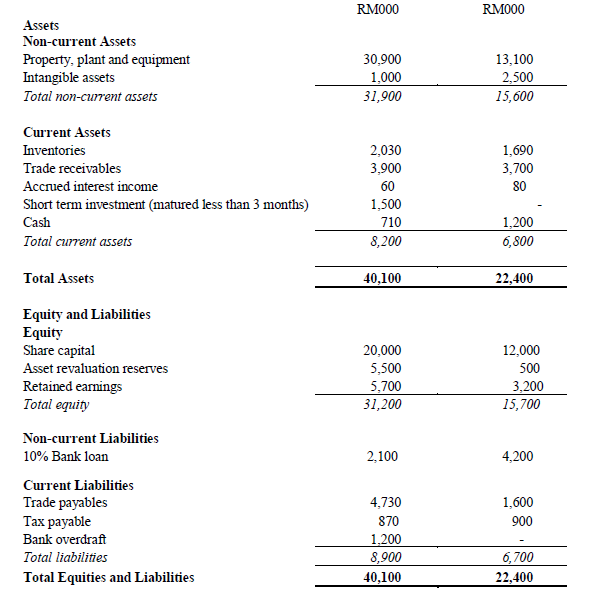

PivotalFlow Bhd is in the midst of preparing its financial statements for the year ending 31 December 2020. It has completed the comparative Statement of Financial Position and Statement of Profit or Loss as follows: The following information is available: 1. Plant, machinery and equipment (PPE) were purchased during the year at a cost of RM23 million. The assets revaluation reserves relate to revaluation of PPE. 2. An equipment with a carrying value of RM6.9 million was disposed at a loss of RM1.1 million. The buyer of the equipment will pay the balance of RM1.4 million in January 2021, which is included in the trade receivables. 3. Included in operating expenses was RM500,000 impairment loss of intangible assets charge for the year. Amortisation of intangible assets for the year was RM150,000 and gain on disposal of a patent was RM1.6 million. All these were included in operating expenses 4. In May 2020, a bonus issue of 1 for every 10 shares held, at RM1.60 each has utilised the retained earnings. The number of shares in issue at the beginning of the year was 10 million. Required: (a) Prepare a Statement of Cash Flows for the year ended 31 December 2020 for PivotalFlow Bhd in accordance with MFRS 107 Statement of Cash Flows using direct method of presenting cash flows from operating activities.

PivotalFlow Bhd is in the midst of preparing its financial statements for the year ending 31 December 2020. It has completed the comparative

The following information is available:

1. Plant, machinery and equipment (PPE) were purchased during the year at a cost of RM23 million. The assets revaluation reserves relate to revaluation of PPE.

2. An equipment with a carrying value of RM6.9 million was disposed at a loss of RM1.1 million. The buyer of the equipment will pay the balance of RM1.4 million in January 2021, which is included in the trade receivables.

3. Included in operating expenses was RM500,000 impairment loss of intangible assets charge for the year. Amortisation of intangible assets for the year was RM150,000 and gain on disposal of a patent was RM1.6 million. All these were included in operating expenses

4. In May 2020, a bonus issue of 1 for every 10 shares held, at RM1.60 each has utilised the

Required:

(a) Prepare a Statement of

Step by step

Solved in 2 steps with 1 images