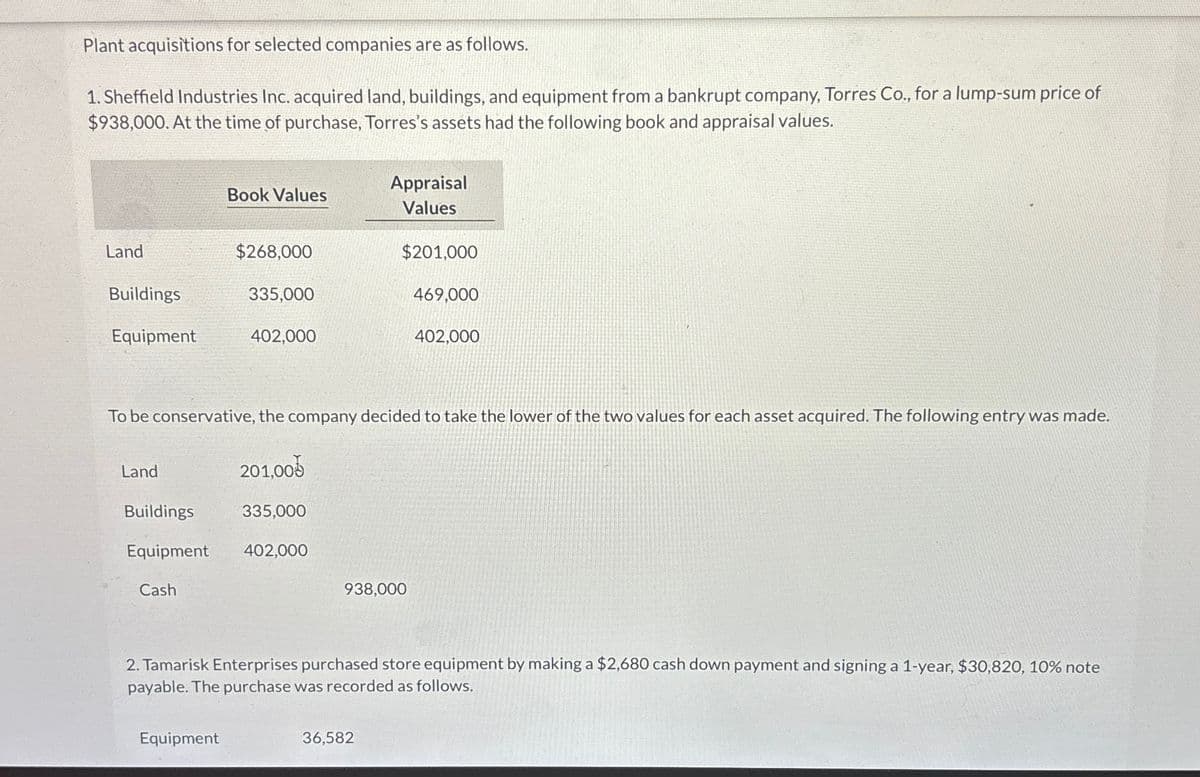

Plant acquisitions for selected companies are as follows. 1. Sheffield Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of $938,000. At the time of purchase, Torres's assets had the following book and appraisal values. Book Values Appraisal Values Land $268,000 $201,000 Buildings 335,000 469,000 Equipment 402,000 402,000 To be conservative, the company decided to take the lower of the two values for each asset acquired. The following entry was made. Land 201,000 Buildings 335,000 Equipment 402,000 Cash 938,000 2. Tamarisk Enterprises purchased store equipment by making a $2,680 cash down payment and signing a 1-year, $30,820, 10% note payable. The purchase was recorded as follows. Equipment 36,582

Plant acquisitions for selected companies are as follows. 1. Sheffield Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of $938,000. At the time of purchase, Torres's assets had the following book and appraisal values. Book Values Appraisal Values Land $268,000 $201,000 Buildings 335,000 469,000 Equipment 402,000 402,000 To be conservative, the company decided to take the lower of the two values for each asset acquired. The following entry was made. Land 201,000 Buildings 335,000 Equipment 402,000 Cash 938,000 2. Tamarisk Enterprises purchased store equipment by making a $2,680 cash down payment and signing a 1-year, $30,820, 10% note payable. The purchase was recorded as follows. Equipment 36,582

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

Transcribed Image Text:Plant acquisitions for selected companies are as follows.

1. Sheffield Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of

$938,000. At the time of purchase, Torres's assets had the following book and appraisal values.

Book Values

Appraisal

Values

Land

$268,000

$201,000

Buildings

335,000

469,000

Equipment

402,000

402,000

To be conservative, the company decided to take the lower of the two values for each asset acquired. The following entry was made.

Land

201,000

Buildings

335,000

Equipment

402,000

Cash

938,000

2. Tamarisk Enterprises purchased store equipment by making a $2,680 cash down payment and signing a 1-year, $30,820, 10% note

payable. The purchase was recorded as follows.

Equipment

36,582

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College