Please explain proper steps by Step and Do Not Give Solution In Image Format ? ? and fast answering please ?

Please explain proper steps by Step and Do Not Give Solution In Image Format ? ? and fast answering please ?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please explain proper steps by Step and Do Not Give Solution In Image Format ? ? and fast answering please ?

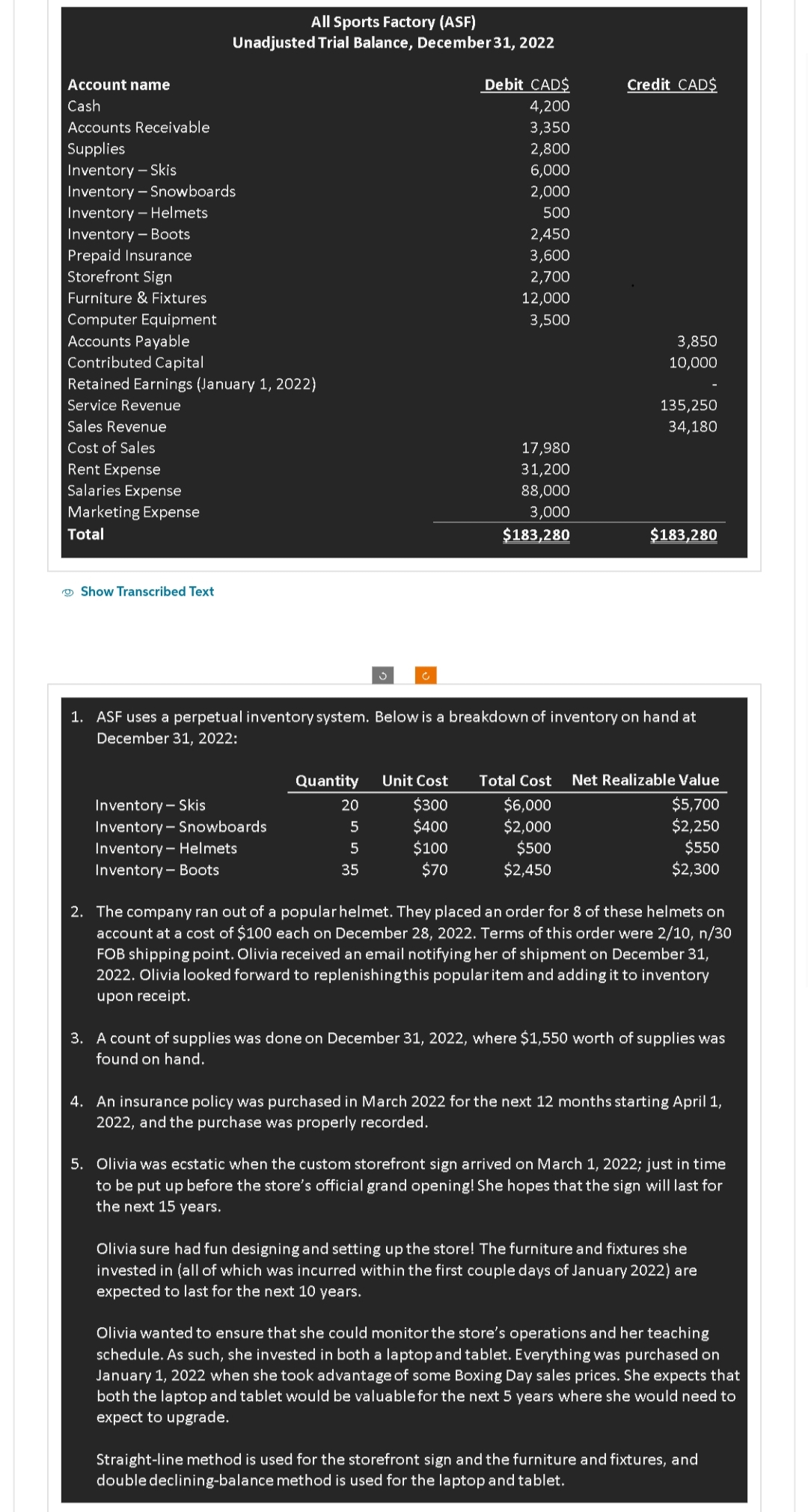

Transcribed Image Text:Account name

Cash

Accounts Receivable

Supplies

Inventory - Skis

Inventory - Snowboards

Inventory - Helmets

Inventory - Boots

Prepaid Insurance

Storefront Sign

Furniture & Fixtures

Computer Equipment

Accounts Payable

Contributed Capital

All Sports Factory (ASF)

Unadjusted Trial Balance, December 31, 2022

Retained Earnings (January 1, 2022)

Service Revenue

Sales Revenue

Cost of Sales

Rent Expense

Salaries Expense

Marketing Expense

Total

Show Transcribed Text

Inventory - Skis

Inventory - Snowboards

Inventory - Helmets

Inventory - Boots

3

Quantity Unit Cost

$300

$400

$100

$70

20

5

5

35

Debit CAD$

4,200

3,350

2,800

6,000

2,000

500

2,450

3,600

2,700

12,000

3,500

17,980

31,200

88,000

3,000

$183,280

Credit CAD$

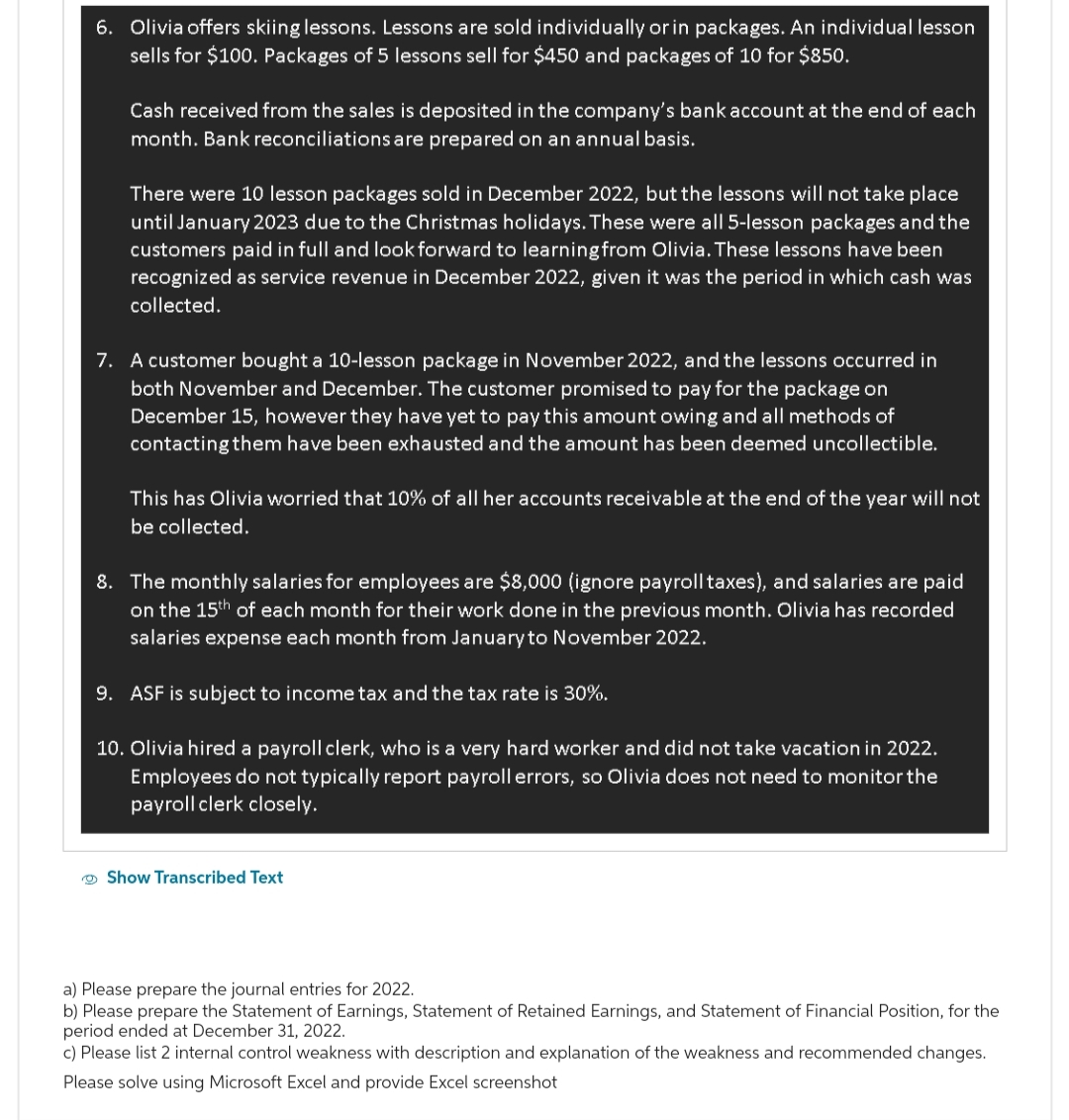

1. ASF uses a perpetual inventory system. Below is a breakdown of inventory on hand at

December 31, 2022:

3,850

10,000

$6,000

$2,000

$500

$2,450

135,250

34,180

$183,280

Total Cost Net Realizable Value

$5,700

$2,250

$550

$2,300

2. The company ran out of a popular helmet. They placed an order for 8 of these helmets on

account at a cost of $100 each on December 28, 2022. Terms of this order were 2/10, n/30

FOB shipping point. Olivia received an email notifying her of shipment on December 31,

2022. Olivia looked forward to replenishing this popular item and adding it to inventory

upon receipt.

3. A count of supplies was done on December 31, 2022, where $1,550 worth of supplies was

found on hand.

4. An insurance policy was purchased in March 2022 for the next 12 months starting April 1,

2022, and the purchase was properly recorded.

5. Olivia was ecstatic when the custom storefront sign arrived on March 1, 2022; just in time

to be put up before the store's official grand opening! She hopes that the sign will last for

the next 15 years.

Olivia sure had fun designing and setting up the store! The furniture and fixtures she

invested in (all of which was incurred within the first couple days of Janu 2022) are

expected to last for the next 10 years.

Olivia wanted to ensure that she could monitor the store's operations and her teaching

schedule. As such, she invested in both a laptop and tablet. Everything was purchased on

January 1, 2022 when she took advantage of some Boxing Day sales prices. She expects that

both the laptop and tablet would be valuable for the next 5 years where she would need to

expect to upgrade.

Straight-line method is used for the storefront sign and the furniture and fixtures, and

double declining-balance method is used for the laptop and tablet.

Transcribed Image Text:6. Olivia offers skiing lessons. Lessons are sold individually or in packages. An individual lesson

sells for $100. Packages of 5 lessons sell for $450 and packages of 10 for $850.

Cash received from the sales is deposited in the company's bank account at the end of each

month. Bank reconciliations are prepared on an annual basis.

There were 10 lesson packages sold in December 2022, but the lessons will not take place

until January 2023 due to the Christmas holidays. These were all 5-lesson packages and the

customers paid in full and look forward to learning from Olivia. These lessons have been

recognized as service revenue in December 2022, given it was the period in which cash was

collected.

7. A customer bought a 10-lesson package in November 2022, and the lessons occurred in

both November and December. The customer promised to pay for the package on

December 15, however they have yet to pay this amount owing and all methods of

contacting them have been exhausted and the amount has been deemed uncollectible.

This has Olivia worried that 10% of all her accounts receivable at the end of the year will not

be collected.

8. The monthly salaries for employees are $8,000 (ignore payroll taxes), and salaries are paid

on the 15th of each month for their work done in the previous month. Olivia has recorded

salaries expense each month from January to November 2022.

9. ASF is subject to income tax and the tax rate is 30%.

10. Olivia hired a payroll clerk, who is a very hard worker and did not take vacation in 2022.

Employees do not typically report payroll errors, so Olivia does not need to monitor the

payroll clerk closely.

Show Transcribed Text

a) Please prepare the journal entries for 2022.

b) Please prepare the Statement of Earnings, Statement of Retained Earnings, and Statement of Financial Position, for the

period ended at December 31, 2022.

c) Please list 2 internal control weakness with description and explanation of the weakness and recommended changes.

Please solve using Microsoft Excel and provide Excel screenshot

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Explain adjustment journal entry

VIEWStep 2: Required Journal Entry

VIEWStep 3: Preparation of Statement of Earnings

VIEWStep 4: Preparation of Statement of Retained Earnings

VIEWStep 5: Preparation of Statement of Financial Position

VIEWStep 6: Describe about internal Control Weakness

VIEWSolution

VIEWStep by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education