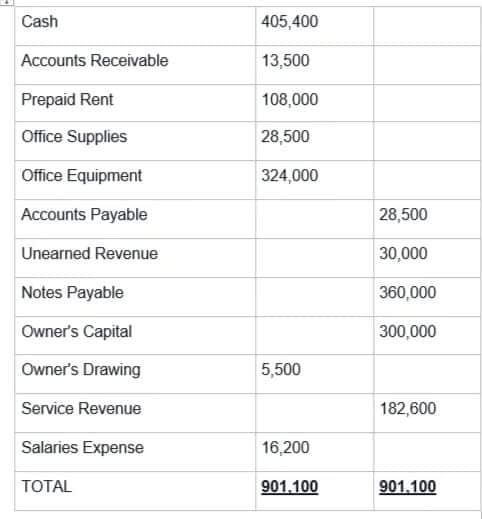

Please see the attached photo. Make the adjustments and adjusted trial balance. Additional information for adjustments: a. On December 31, a physical count of the office supplies reveals thatP15,300 worth of supplies are available at the end of the month. b. On December 31, one month of the prepaid rent of P18,000 has been usedup. c. The office equipment purchased by Mr. M for P324,000 on December 2,2020 is expected to last six years with no residual value. d. On December 5, Mr. M signed a four-month contract to perform work for P7,500 per month with the entire contract price of P30,000 received inadvance. e. At the close of business, December 30, 2020 the employee has worked oneweek during December for which salaries of P8,100 are not paid untilJanuary 2021. f. The two-year bank loan obtained by the company amounting to P360,000has a 10% annual interest rate payable every November 30. g. On December 2, 2020, Mr. M entered into a one-year contract with a local company. Mr. M agreed to maintain the company’s website inexchange for a monthly fee of P1,500, payable at the end of every threemonths.

Please see the attached photo.

Make the adjustments and adjusted

Additional information for adjustments:

a. On December 31, a physical count of the office supplies reveals thatP15,300 worth of supplies are available at the end of the month.

b. On December 31, one month of the prepaid rent of P18,000 has been usedup.

c. The office equipment purchased by Mr. M for P324,000 on December 2,2020 is expected to last six years with no residual value.

d. On December 5, Mr. M signed a four-month contract to perform work for P7,500 per month with the entire contract price of P30,000 received inadvance.

e. At the close of business, December 30, 2020 the employee has worked oneweek during December for which salaries of P8,100 are not paid untilJanuary 2021.

f. The two-year bank loan obtained by the company amounting to P360,000has a 10% annual interest rate payable every November 30.

g. On December 2, 2020, Mr. M entered into a one-year contract with a local company. Mr. M agreed to maintain the company’s website inexchange for a monthly fee of P1,500, payable at the end of every threemonths.

Step by step

Solved in 2 steps with 2 images