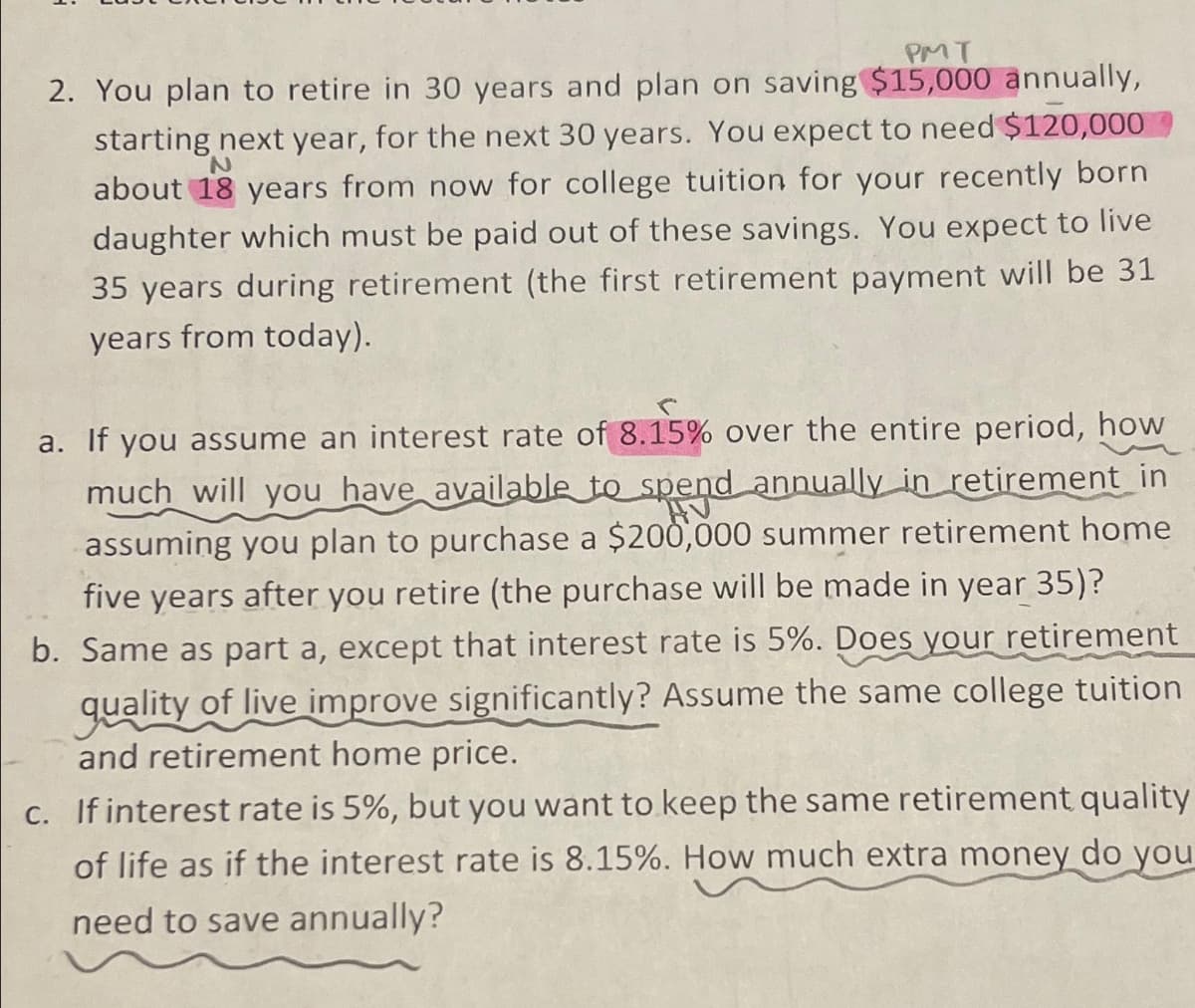

PMT 2. You plan to retire in 30 years and plan on saving $15,000 annually, N starting next year, for the next 30 years. You expect to need $120,000 about 18 years from now for college tuition for your recently born daughter which must be paid out of these savings. You expect to live 35 years during retirement (the first retirement payment will be 31 years from today). C a. If you assume an interest rate of 8.15% over the entire period, how much will you have available to spend annually in retirement in assuming you plan to purchase a $200,000 summer retirement home five years after you retire (the purchase will be made in year 35)? b. Same as part a, except that interest rate is 5%. Does your retirement quality of live improve significantly? Assume the same college tuition and retirement home price. c. If interest rate is 5%, but you want to keep the same retirement quality of life as if the interest rate is 8.15%. How much extra money do you need to save annually?

PMT 2. You plan to retire in 30 years and plan on saving $15,000 annually, N starting next year, for the next 30 years. You expect to need $120,000 about 18 years from now for college tuition for your recently born daughter which must be paid out of these savings. You expect to live 35 years during retirement (the first retirement payment will be 31 years from today). C a. If you assume an interest rate of 8.15% over the entire period, how much will you have available to spend annually in retirement in assuming you plan to purchase a $200,000 summer retirement home five years after you retire (the purchase will be made in year 35)? b. Same as part a, except that interest rate is 5%. Does your retirement quality of live improve significantly? Assume the same college tuition and retirement home price. c. If interest rate is 5%, but you want to keep the same retirement quality of life as if the interest rate is 8.15%. How much extra money do you need to save annually?

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Concept explainers

Question

Transcribed Image Text:PMT

2. You plan to retire in 30 years and plan on saving $15,000 annually,

N

starting next year, for the next 30 years. You expect to need $120,000

about 18 years from now for college tuition for your recently born

daughter which must be paid out of these savings. You expect to live

35 years during retirement (the first retirement payment will be 31

years from today).

a. If you assume an interest rate of 8.15% over the entire period, how

much will you have available to spend annually in retirement in

assuming you plan to purchase a $200,000 summer retirement home

five years after you retire (the purchase will be made in year 35)?

b. Same as part a, except that interest rate is 5%. Does your retirement

quality of live improve significantly? Assume the same college tuition

and retirement home price.

c. If interest rate is 5%, but you want to keep the same retirement quality

of life as if the interest rate is 8.15%. How much extra money do you

need to save annually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning