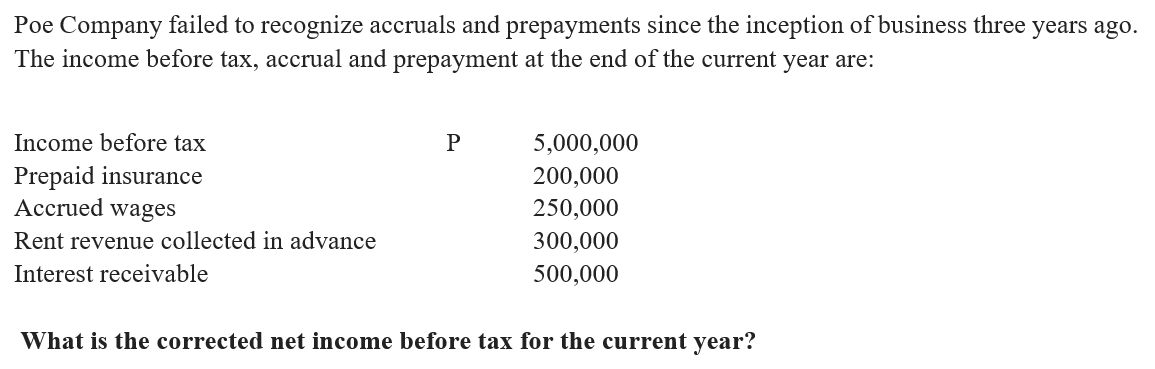

Poe Company failed to recognize accruals and prepayments since the inception of business three years ago. The income before tax, accrual and prepayment at the end of the current year are: Income before tax 5,000,000 Prepaid insurance Accrued wages 200,000 250,000 Rent revenue collected in advance 300,000 Interest receivable 500,000 What is the corrected net income before tax for the current year?

Poe Company failed to recognize accruals and prepayments since the inception of business three years ago. The income before tax, accrual and prepayment at the end of the current year are: Income before tax 5,000,000 Prepaid insurance Accrued wages 200,000 250,000 Rent revenue collected in advance 300,000 Interest receivable 500,000 What is the corrected net income before tax for the current year?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 19P: The Bookbinder Company had 500,000 cumulative operating losses prior to the beginning of last year....

Related questions

Question

Transcribed Image Text:Poe Company failed to recognize accruals and prepayments since the inception of business three years ago.

The income before tax, accrual and prepayment at the end of the current year are:

Income before tax

5,000,000

Prepaid insurance

Accrued wages

200,000

250,000

Rent revenue collected in advance

300,000

Interest receivable

500,000

What is the corrected net income before tax for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning