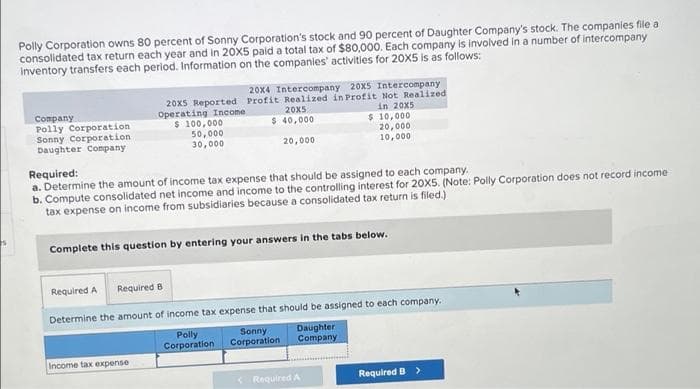

Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each year and in 20X5 paid a total tax of $80,000. Each company is involved in a number of intercompany Inventory transfers each period. Information on the companies' activities for 20X5 is as follows: Company Polly Corporation Sonny Corporation Daughter Company 20x4 Intercompany 20x5 Intercompany 20x5 Reported Profit Realized in Profit Not Realized Operating Income $ 100,000 in 20x5 10,000 20,000 10,000 50,000 30,000 Income tax expense 20x5 $ 40,000 20,000 Required: a. Determine the amount of income tax expense that should be assigned to each company. b. Compute consolidated net income and income to the controlling interest for 20X5. (Note: Polly Corporation does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.) Complete this question by entering your answers in the tabs below. $ Required A Required B Determine the amount of income tax expense that should be assigned to each company. Daughter Company Polly Sonny Corporation Corporation. Required B >

Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each year and in 20X5 paid a total tax of $80,000. Each company is involved in a number of intercompany Inventory transfers each period. Information on the companies' activities for 20X5 is as follows: Company Polly Corporation Sonny Corporation Daughter Company 20x4 Intercompany 20x5 Intercompany 20x5 Reported Profit Realized in Profit Not Realized Operating Income $ 100,000 in 20x5 10,000 20,000 10,000 50,000 30,000 Income tax expense 20x5 $ 40,000 20,000 Required: a. Determine the amount of income tax expense that should be assigned to each company. b. Compute consolidated net income and income to the controlling interest for 20X5. (Note: Polly Corporation does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.) Complete this question by entering your answers in the tabs below. $ Required A Required B Determine the amount of income tax expense that should be assigned to each company. Daughter Company Polly Sonny Corporation Corporation. Required B >

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 9P: Caloundra Corporation has book income of $ 40,000. Included in the book income is $3,000 of...

Related questions

Question

Transcribed Image Text:5

Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a

consolidated tax return each year and in 20X5 paid a total tax of $80,000. Each company is involved in a number of intercompany

Inventory transfers each period. Information on the companies' activities for 20X5 is as follows:

Company

Polly Corporation.

Sonny Corporation.

Daughter Company

20x4 Intercompany 20x5 Intercompany

20x5 Reported Profit Realized in Profit Not Realized

20x5

Operating Income

$ 100,000

in 20x5

$

40,000

50,000

30,000

20,000

Required:

a. Determine the amount of income tax expense that should be assigned to each company.

b. Compute consolidated net income and income to the controlling interest for 20X5. (Note: Polly Corporation does not record income

tax expense on income from subsidiaries because a consolidated tax return is filed.)

Complete this question by entering your answers in the tabs below.

Income tax expense

Required A

Required B

Determine the amount of income tax expense that should be assigned to each company.

Daughter

Company

Polly

Corporation

$ 10,000

20,000

10,000

Sonny

Corporation

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you