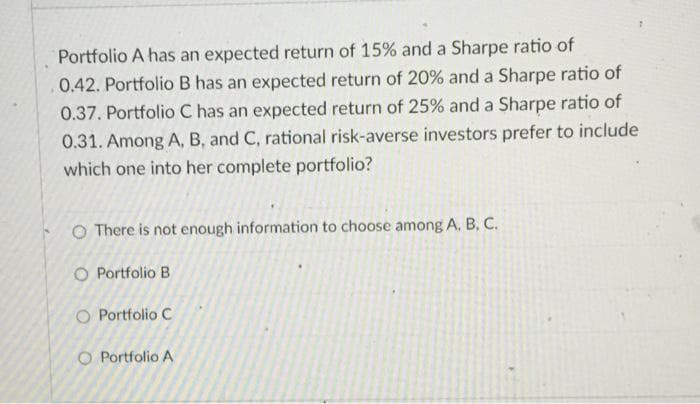

Portfolio A has an expected return of 15% and a Sharpe ratio of 0.42. Portfolio B has an expected return of 20% and a Sharpe ratio of 0.37. Portfolio C has an expected return of 25% and a Sharpe ratio of 0.31. Among A, B, and C, rational risk-averse investors prefer to include which one into her complete portfolio? O There is not enough information to choose among A, B, C. O Portfolio B O Portfolio C O Portfolio A

Q: Briefly explain the following life insurance contractual provisions. Suicide clause Grace period…

A: The objective of this question is to understand the meaning and implications of three specific…

Q: Find a country that has experienced more than two years of reported negative inflation in the last…

A: The objective of the question is to identify a country that has experienced more than two years of…

Q: Angelo purchased a 7% annual coupon bond one year ago for $987. At the time of purchase, the bond…

A: Therefore, the real rate of return that Angelo will realize on this investment if he sells the bond…

Q: You deposit $100 each month into an account earning 7% interest compounded monthly. a) How much will…

A: Given:P = $100 (monthly deposit)r=0.07 (7% annual interest rate, expressed as a decimal)n=12…

Q: A few years ago, you paid $10,000 to buy a corporate bond with a face value (maturity value) of…

A: Bond value = whereFV = Face value = $10,000C = periodic coupon = semi annual coupon = $10,000 x 4%…

Q: Klingon Widgets, Incorporated, purchased new cloaking machinery three years ago for $5.2 million.…

A: Net working capital(NWC) = Current assets - Current liabilities=>Current assets = Net working…

Q: Given the information below for HooYah! Corporation, compute the expected share price at the end of…

A: The stock price using the P/E ratio and EPS can be found by using the following formula:Similarly,…

Q: Assuming that the stock price follows a geometric Brownian motion, is it a Markov process when the…

A: The objective of the question is to determine whether a stock price, which follows a geometric…

Q: Suppose a five-year, $1,000 bond with annual coupons has a price of $901.55 and a yield to maturity…

A: The coupon rate can be computed by using goal seek feature of excel. Firstly enter the formulas as…

Q: Marlin Liquidators is considering the purchase of a new $175,000 crane. If Marlin expects the cash…

A: Net Present Value (NPV) represents the current value of a project, calculated by discounting the…

Q: suppose that you purchase a Baa rated $1,000 semi-annual coupon bond with a 7.4% coupon rate and a…

A: > Given data:> number of periods = 5*2 = 10> Yield to maturity per period = 4.618%/2 =…

Q: 4. Assume that you have two projects (A and B) the life of the two proposals with the respective net…

A: Capital budgeting is the process of evaluating various investment proposals on grounds of financial…

Q: Find the present value of the given annuity. $546 per month for 36 months at the rate of 3.9%…

A: Monthly payment = $546Number of months = 36Interest rate = 3.9%To find: Present value of the annuity

Q: The ABC Resort is redoing its golf course at a cost of $843,000. It expects to generate cash flows…

A: NPV or Net Present Value is a part of Capital Budgeting techniques. NPV is commonly used by business…

Q: What is the return on assets (ROA) of KwaZulu Limited if you use the DuPont model?

A: Return on Investment ( ROA ) is a financial ratio that measures a company's ability to generate…

Q: The price of a 20-year bond that has a coupon rate of 8% is $1100.The bond pays semiannual coupon.…

A: Calculate the semiannual coupon payment:Coupon rate = 8%Since payments are semiannual, divide the…

Q: Neveready Flashlights Inc. needs $340,000 to take a cash discount of 3/17, net 72. A banker will…

A: The first question is asking for the effective rate on the bank loan. The effective rate can be…

Q: Your firm has a WACC of 16.25%. The cost of equity is 20% and the firm's bonds yield 7.9%. The tax…

A: Debt equity ratio refers to the financial percentage where the ratio defines the amount of debt…

Q: name: cashflow6.dwg $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 0 B = ? F = ? 50…

A: The present value refers to the discounted future cash flow at the interest rate for the given…

Q: An investment has an installed cost of $574,380. The cash flows over the four-year life of the…

A: Here we will use the capital budgeting tools of NPV and IRR. NPV is the net present value. It is the…

Q: an investment in a coupon bond will provide the investor with a return equal to the bond's yield to…

A: The objective of the question is to understand the conditions under which an investment in a coupon…

Q: What is the difference between an investment - grade bond and a junk bond? 2 . What are the…

A: The primary difference between an investment grade bond and a junk bond lies in the credit quality…

Q: Please help with question #2. The based country is Trinidad and the countries trading to is…

A: Main Foreign Currencies and Foreign Exchange Risk MitigationMain Foreign Currencies:Australian…

Q: Trend-Line Incorporated has been growing at a rate of 8% per year and is expected to continue to do…

A: Growth rate = 8%Dividend next year = $3Market rate = 10%To find: Price of Trend-Line's share, part…

Q: The real risk-free rate, r*, is 1.4%. Inflation is expected to average 1.2% a year for the next 4…

A: The objective of the question is to calculate the default risk premium of an 8-year corporate bond.…

Q: Easy Slider recently sold a 15 year $1,000 face value bond at a discount for $800 that net the firm…

A: After tax cost of debt = Before tax cost of debt x (1-tax rate)Before tax cost of debt = Yield to…

Q: The following table shows the prices of a sample of Treasury bonds, all of which have coupon rates…

A: The objective of the question is to calculate the interest rates for different maturity periods and…

Q: Melynda and Andrés borrowed $60,000 at 7.25% compounded annually as a second mortgage loan against…

A: Second Mortgage LoanIt is a loan made in addition to the homeowner’s primary mortgage, which is made…

Q: Currency straddle - Short position - Seller of options Construct a short straddle Put and call…

A: The objective of the question is to construct a short straddle for currency straddle where we are…

Q: Am. 112.

A: The objective of the question is to estimate the overhead costs for Bowen plc if it handles…

Q: Tuas Limited (“Tuas”) is considering to replace its existing air-conditioning system with an energy…

A: Investment Recommendation for Tuas LimitedBased on the provided information, Tuas Limited should…

Q: What aspect of FHA loans made them particularly attractive to investment companies such as life…

A: FHA loans can be referred as the loans that are ussually required lesser financial obligations and…

Q: Consider the CAPM. The risk - free rate is 4%, and the expected return on the market is 15% .…

A: Risk-free Rate, Rf = 4%Beta = 1.2Expected return on market = 15%

Q: Cisco is considering the development of a wireless home networking appliance, called HomeNet. The…

A: In the NPV analysis, we compute the present value of all future cash inflows. The present value is…

Q: Why are the colored iron pills washed before they are ground up and weighed? So that they will be…

A: The objective of the question is to understand the reason behind washing colored iron pills before…

Q: Staton-Smith Software is a new start-up company and will not pay dividends for the first five years…

A: Dividend Discount Model refers to the process of discounting the dividends received over the period…

Q: Martin's Inc. is expected to pay annual dividends of $3.00, $3.50 and $4.00 a share over the next…

A: Dividend in year 1 = $3Dividend in year 2 = $3.50Dividend in year 3 = $4Growth rate = 3%Required…

Q: Zachary purchased a Ford Expedition (more than 6,000 lb) for $39,000 in March 2023. What is the…

A: b. $28,900.Explanation:Here's why:Section 179 Deduction:Under IRS code Section 179, businesses can…

Q: The figures below show plots of monthly excess returns for two stocks plotted against excess returns…

A: The difference between the market returns and the return on riskless assets such as T-bill…

Q: Summa Laude (Pty) Ltd ("Summa Laude") is an entity that owns various properties that the entity…

A: Cost of property = R1,637,000Cash available = R250,000Interest rate = 10.9%Number of years = 3To…

Q: If a person has ATM fees each month of $22 for 8 years, what would be the total cost of those…

A: Monthly fees: $22Number of years: 8

Q: As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.99 per…

A: Current spot rate=R$1.99/$Inflation Brazil=20%US inflation=2.7%Find out one year forward rate.

Q: Your firm is analyzing a project that will result in aftertax cash savings of $250,000 per year,…

A: The maximum cost of project can be determined by discounting the future perpetual earnings with the…

Q: igital Organics (DO) has the opportunity to invest $1.03 million now (t = 0) and expects after - tax…

A: Adjusted Present Value (APV) refers to a valuation approach that takes into account how financing…

Q: Interest rates on 3-year Treasury securities and 5-year Treasury securities are currently 4.5% and…

A: Treasury securities refer to the obligations of debt which are issued by the US Treasury department…

Q: a constant 15 percent growth rate thereafter. What is the dividend yield and capital gains yield for…

A: The dividend yield is similar to the interest you receive on savings accounts, but you invest in…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: The Sharpe Ratio is a financial measure that analyzes the risk-adjusted performance of an investment…

Q: Lars acquired a new network system on June 5, 2023 (five-year class property), for $69,000. She…

A: To determine Lars's maximum cost recovery deduction for the purchases made in 2023, we will…

Q: A fin-tech firm is considering devising a new payment system. The initial cost for developing this…

A: Net present value (NPV):NPV involves discounting future cash inflows and outflows to their present…

Q: A 6.5 percent coupon bond with 14 years left to maturity is priced to offer a yield to maturity of…

A: Bonds refer to the financial instrument issued by the bank or financial institutions at a specified…

Step by step

Solved in 3 steps

- If your portfolio includes 35 percent of X, 40 percent of Y and 25 percent of Z, answer the following questions: (a) Calculate the portfolio expected return. (b) Calculate the variance and the standard deviation of the portfolio. (c) If the expected T-bill rate is 3.80 percent, calculate the expected risk premium on the portfolio. (d) If the market index fund has the same expected return as your portfolio, without considering any transaction cost, would you consider selling your portfolio and investing the market index fund instead? Explain your thoughts.A portfolio that combines the risk-free asset and the market portfolio has an expected return of 6.4 percent and a standard deviation of 9.4 percent. The risk-free rate is 3.4 percent, and the expected return on the market portfolio is 11.4 percent. Assume the capital asset pricing model holds. What expected rate of return would a security earn if it had a .39 correlation with the market portfolio and a standard deviation of 54.4 percent? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 17% and a standard deviation of return of 28%. Stock B has an expected return of 15% and a standard deviation of return of 15%. The correlation coefficient between the returns of A and B is 0.8. The risk-free rate of return is 3.2%. What is the expected return on the optimal risky portfolio? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.

- An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The expected return on the optimal risky portfolio is approximately ____?____. Using the risk and return profile calculated in Q10 and Q11 (standard deviation of the optimal risky portfolio is 21.4%), what is the percentage weight that you need to invest in the optimal risky portfolio if you want your complete portfolio to achieve 12% return? ___?___Helen's portfolio consists solely of an investment in Tombland stock. Tombland has an expected return of 15% and a volatility of 25%. The market portfolio has an expected return of 12% and a volatility of 18%. The risk-free rate is 4%. Assume that the CAPM assumptions hold in the market. Assuming that Helen wants to maintain the current expected return on his portfolio, then the minimum volatility that Helen could achieve by investing in the market portfolio and risk-free investment is closest to: 24.75% 27.5% 12.5% 15%Drew can design a risky portfolio based on two risky assets, Origami and Gamiori. Origami has an expected return of 13% and a standard deviation of 20%. Gamiori has an expected return of 6% and a standard deviation of 10%. The correlation coefficient between the returns of Origami and Gamiori is 0.30. The risk-free rate of return is 2%. What is the Sharpe ratio of the optimal risky portfolio? A. 60.26% B. 12.19% C. 9.34% D. 47.78%

- Consider a risky portfolio, A, with an expected rate of return of 0.15 and a standard deviation of 0.15, that lies on a given indifference curve. Which one of the following portfolios might lie on the same indifference curve? A. E(r) = 0.15; Standard deviation = 0.20 B. E(r) = 0.20; Standard deviation = 0.15 C. E(r) = 0.10; Standard deviation = 0.10 D. E(r) = 0.10; Standard deviation = 0.20 E. E(r) = 0.15; Standard deviation = 0.10An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. what is the standard deviation of returns on the optimal risky portfolio is ____?An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 15% and a standard deviation of return of 16.0%. Stock B has an expected return of 11% and a standard deviation of return of 4%. The correlation coefficient between the returns of A and B is 0.50. The risk-free rate of return is 7%. The proportion of the optimal risky portfolio that should be invested in stock A is __________.

- You manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 31%. The T-bill rate is 5%. Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio’s standard deviation will not exceed 19%. a. What is the investment proportion, y? (Round your answer to 2 decimal places.) b. What is the expected rate of return on the complete portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)a) Calculate the expected return and standard deviation for the following portfolios: i) All in Zii) 0.75inZand0.25inY iii) 0.5 in Z and 0.5 in Y iv) 0.25 in Z and 0.75 in Y v) All in Y b) Draw the mean-standard deviation frontier. c) Which portfolios might not be held by an investor who likes high expected return and low standard deviation?You manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 30%. The T-bill rate is 4%. Your client chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund. What is the reward-to-volatility (Sharpe) ratio (S) of your risky portfolio? Your client’s? (Do not round intermediate calculations. Round your answers to 4 decimal places.)